Question: Required information CC7-1 (Static) Accounting for Changing Inventory Costs [LO 7.3, LO 7-5] In October, Nicole eliminated all existing inventory of cosmetic items. The trouble

![LO 7-5] In October, Nicole eliminated all existing inventory of cosmetic items.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e315571ed61_16666e31556a85a0.jpg)

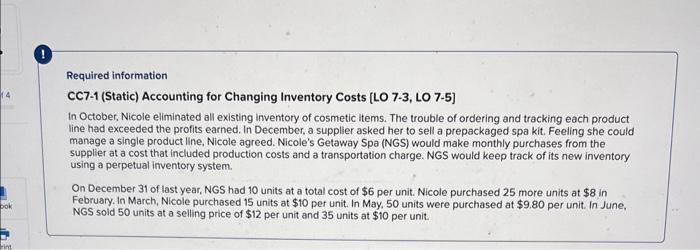

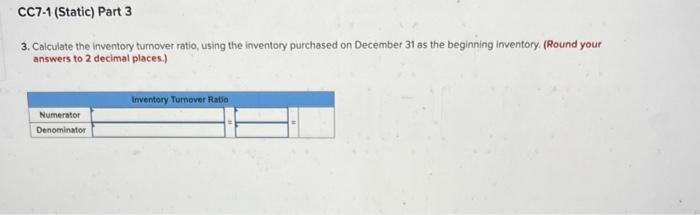

Required information CC7-1 (Static) Accounting for Changing Inventory Costs [LO 7.3, LO 7-5] In October, Nicole eliminated all existing inventory of cosmetic items. The trouble of ordering and tracking each product line had exceeded the profits earned. In December, a supplier asked her to sell a prepackaged spa kit. Feeling she could manage a single product line, Nicole agreed. Nicole's Getaway Spa (NGS) would make monthly purchases from the supplier at a cost that included production costs and a transportation charge. NGS would keep track of its new inventory using a perpetual inventory system. On December 31 of last year, NGS had 10 units at a total cost of $6 per unit. Nicole purchased 25 more units at $8 in February. In March, Nicole purchased 15 units at $10 per unit. In May, 50 units were purchased at $9.80 per unit. In June, NGS sold 50 units at a selling price of $12 per unit and 35 units at $10 per unit. 2. Compute the Cost of Goods Available for Sale, Cost of Goods Sold, and Cost of Ending Inventory using the first-in, first-out (FIFO) method. (Round "Cost per Unit" to 2 decimal places.) 3. Calculate the inventory turnover ratio, using the inventory purchased on December 31 as the beginning inventory. (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts