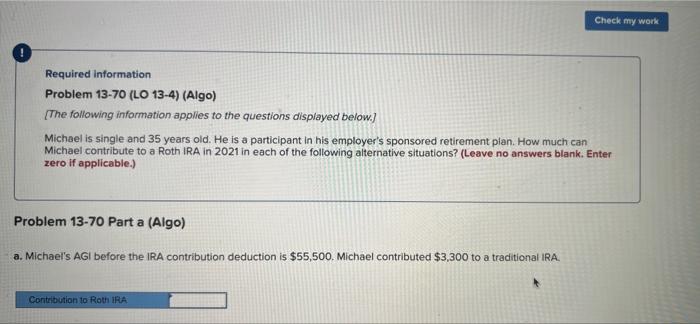

Question: Required information Check my work Problem 13-70 (LO 13-4) (Algo) [The following information applies to the questions displayed below.] Michael is single and 35

![information applies to the questions displayed below.] Michael is single and 35](https://s3.amazonaws.com/si.experts.images/answers/2024/05/6659e84e1a6a5_2056659e84daba19.jpg)

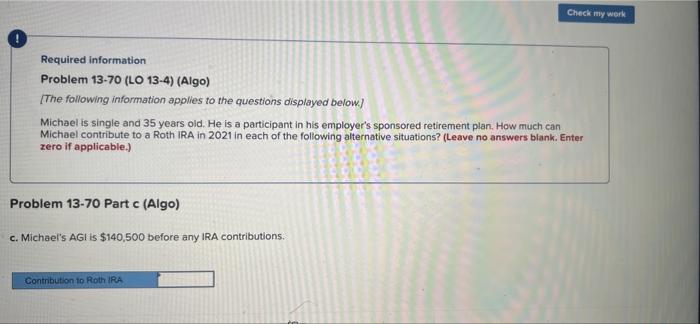

Required information Check my work Problem 13-70 (LO 13-4) (Algo) [The following information applies to the questions displayed below.] Michael is single and 35 years old. He is a participant in his employer's sponsored retirement plan. How much can Michael contribute to a Roth IRA in 2021 in each of the following alternative situations? (Leave no answers blank. Enter zero if applicable.) Problem 13-70 Part a (Algo) a. Michael's AGI before the IRA contribution deduction is $55,500. Michael contributed $3,300 to a traditional IRA Contribution to Roth IRA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock