Question: Required information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (Algo) [The following information applies to the questions displayed below.]

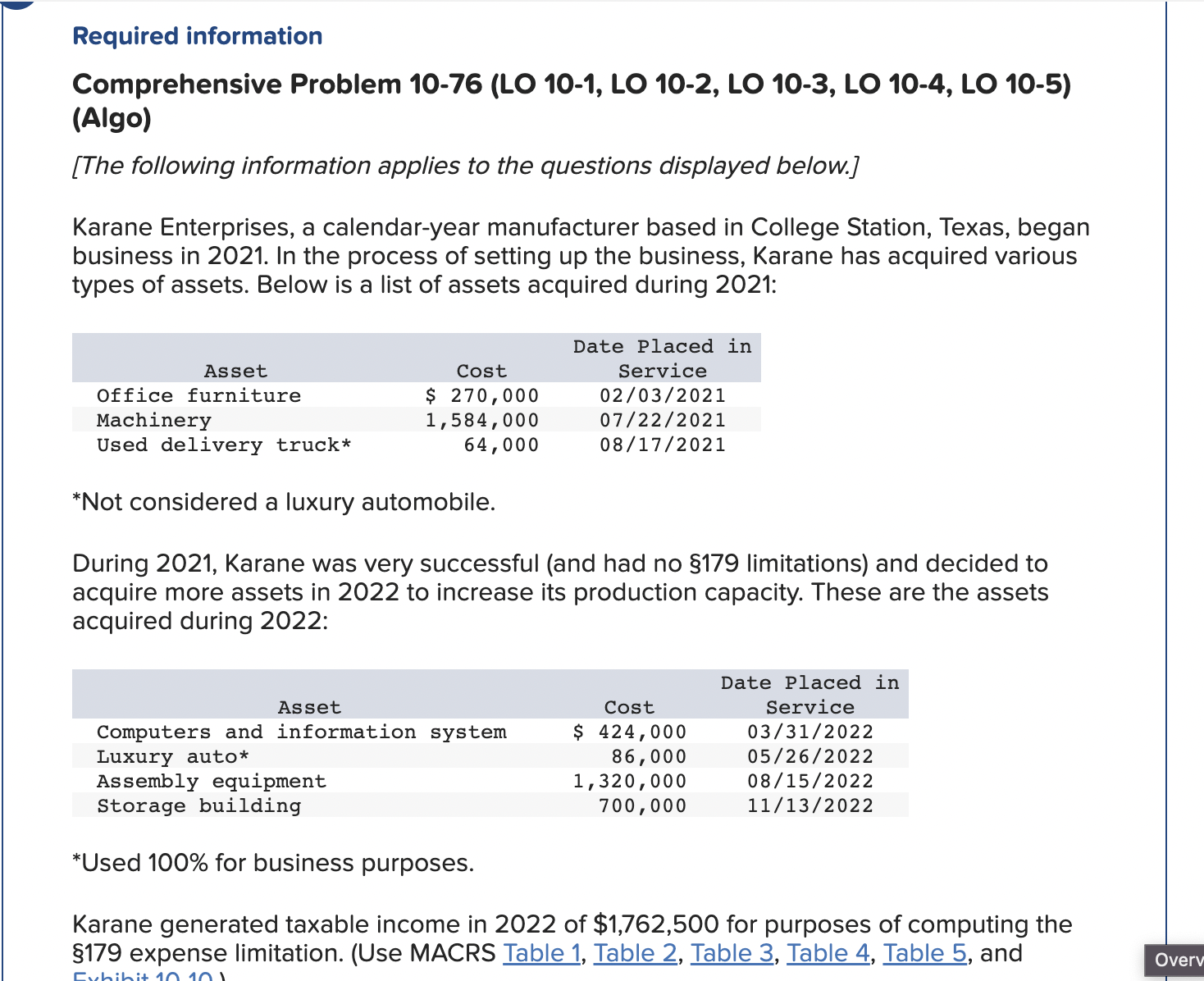

Required information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (Algo) [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021: *Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022: *Used 100% for business purposes. Karane generated taxable income in 2022 of $1,762,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Comprehensive Problem 10-76 Part e [MUST MANUALLY GRADE] (Algo) e. Complete Part I of Form 4562 for part (b) (use the most current form available). Visit the IRS website and download Form 4562. Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." Required information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (Algo) [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021: *Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022: *Used 100% for business purposes. Karane generated taxable income in 2022 of $1,762,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Comprehensive Problem 10-76 Part e [MUST MANUALLY GRADE] (Algo) e. Complete Part I of Form 4562 for part (b) (use the most current form available). Visit the IRS website and download Form 4562. Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts