Question: Required information Comprehensive Problem 13-83 (LO 13-1, LO 13-2, LO 13-3, LO 13-4) (Algo) [The following information applies to the questions displayed below.] XYZ

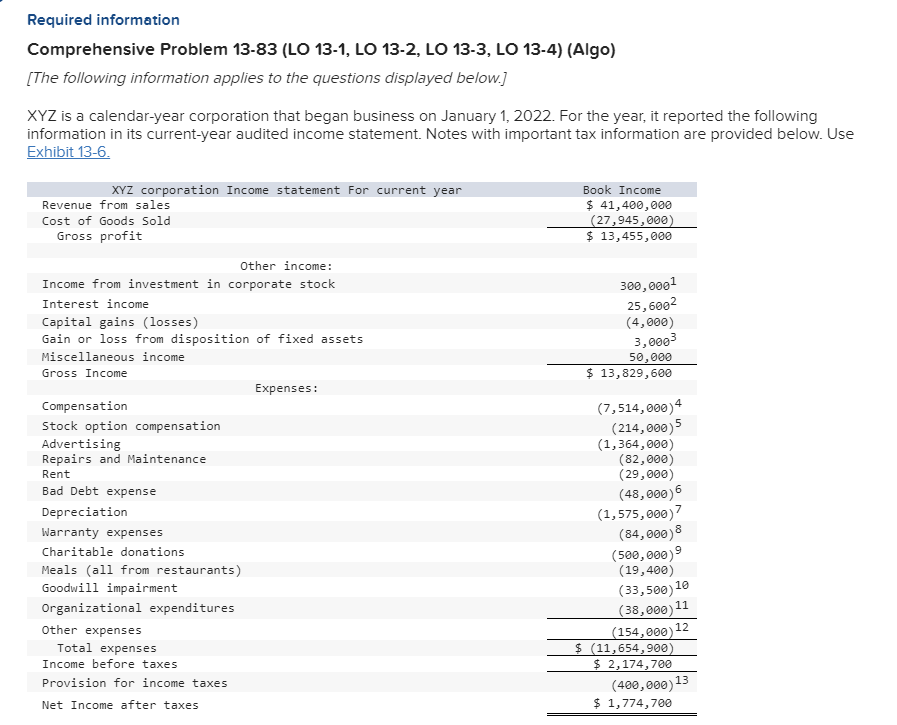

Required information Comprehensive Problem 13-83 (LO 13-1, LO 13-2, LO 13-3, LO 13-4) (Algo) [The following information applies to the questions displayed below.] XYZ is a calendar-year corporation that began business on January 1, 2022. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. Use Exhibit 13-6. XYZ corporation Income statement For current year Revenue from sales Book Income Cost of Goods Sold Gross profit Other income: $ 41,400,000 (27,945,000) $ 13,455,000 Income from investment in corporate stock Interest income Capital gains (losses) Gain or loss from disposition of fixed assets Miscellaneous income Gross Income Compensation Stock option compensation Advertising Repairs and Maintenance Rent Bad Debt expense Depreciation Warranty expenses Charitable donations Meals (all from restaurants) Goodwill impairment Organizational expenditures Other expenses Total expenses Income before taxes Provision for income taxes Net Income after taxes Expenses: 300,0001 25,6002 (4,000) 3,000 50,000 $ 13,829,600 (7,514,000) 4 (214,000)5 (1,364,000) (82,000) (29,000) (48,000) 6 (1,575,000)7 (84,000)8 (500,000)9 (19,400) (33,500) 10 (38,000) 11 (154,000) 12 $ (11,654,900) $ 2,174,700 (400,000) 13 $ 1,774,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts