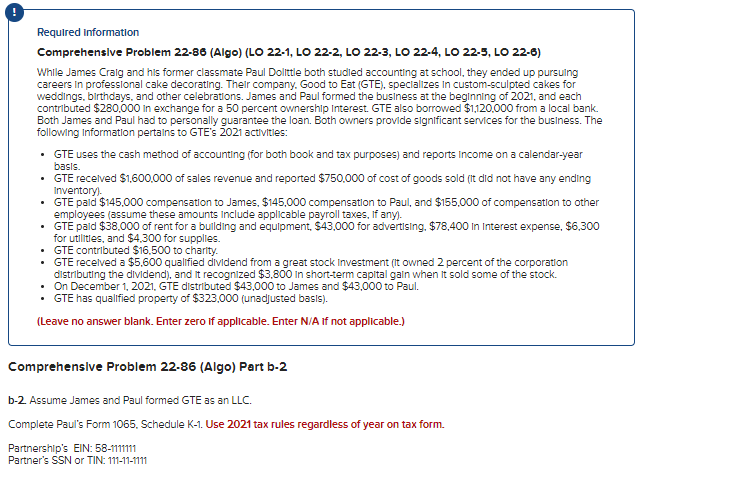

Question: Required Information Comprehensive Problem 22-88 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate

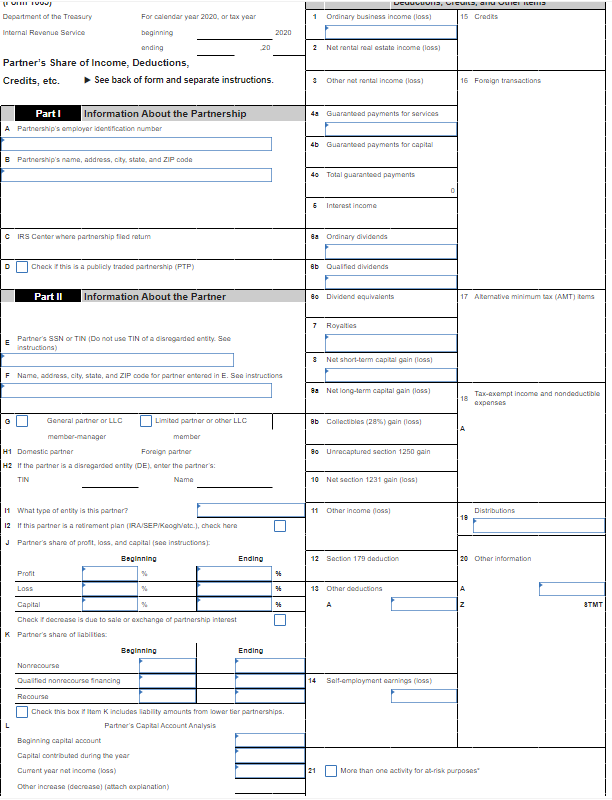

Required Information Comprehensive Problem 22-88 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolitle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company. Good to Eat (GTE). specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contributed $280.000 in exchange for a 50 percent ownership Interest GTE also borrowed $1,120.000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following Information pertains to GTE's 2021 activities: GTE uses the cash method of accounting (for both book and tax purposes) and reports Income on a calendar-year basis. GTE received $1.600.000 of sales revenue and reported $750.000 of cost of goods sold (It did not have any ending Inventory GTE paid $145.000 compensation to James, $145,000 compensation to Paul, and $155.000 of compensation to other employees (assume these amounts Include applicable payroll taxes, if any). GTE paid $38.000 of rent for a building and equipment. $43.000 for advertising, $78,400 in Interest expense, $6,300 for utilities, and $4,300 for supplies. GTE contributed $16.500 to charity GTE received a $5.600 qualified dividend from a great stock Investment (t owned 2 percent of the corporation distributing the dividend), and it recognized $3.800 in short-term capital gain when it sold some of the stock. On December 1, 2021, GTE distributed $43,000 to James and $43,000 to Paul. GTE has qualified property of $323.000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A if not applicable.) Comprehensive Problem 22-86 (Algo) Part b-2 b-2 Assume James and Paul formed GTE as an LLC. Complete Paul's Form 1065. Schedule K-1. Use 2021 tax rules regardless of year on tax form. Partnership's EIN: 58-1111111 Partner's SSN or TIN: 111-11-1111 UCUVUUS, VISVIES, GUICI ICHIS Ordinary business income foss) 15 Credits 1 beginning 2020 20 Department of the Treasury For calendar year 2020, or tax year Internal Revenue Service anding Partner's Share of Income, Deductions, Credits, etc. See back of form and separate instructions. 2 Not rental real estate income foss) 3 Other not rental income (loss 16 Foreign transactions 4a Guaranteed payments for services Parti Information About the Partnership A Partnership's employer identification number 4b Guaranteed payments for capital B Partnership's name, address, city, state and ZIP code 40 Total guaranteed payments 6 Interest income CIRS Center where partnership flodratum ea Ordinary dividends Check this a publicly traded partnership (PTP) Bb Qualified dividends Part II Information About the Partner Bo Dividend equivalents 17 Alterative minimum tax (AMT) toms 7 Royalties E Partner's SSN OTIN (Do not use TIN of a disregarded entity. See instructions) 3 Net short term capital gain los F Name, address, city, stato, and ZIP code for partner entered in E. See instructions a Not long-term capital gain loss 18 Tax-exempt Income and nondeductible expenses General partner or LLC Limited partner or other LLC ab Collectibles (28%) gen 0 A So Unrecaptured Section 1250 gain member manager member H1 Domestic partner Foreign partner H2 If the partner is a disregarded entity (DE) enter the partners: TIN Name 10 Net section 1231 gain loss 11 Other income dos Distributions 19 11 What type of entity is this partner? 12 If this partner is a retirement plan (RAISEP Keoghetc.), check here J Partner's share of profit, loss, and capital se instructions): Beginning Ending 12 Section 179 deduction 20 Other information Pront % % Loss % 13 Other deductions A Capital % A z TMT Check I decrease is due to sale or exchange of partnership interest K Partner's share of liabilities: 14 Self-employment earnings (loss) Beginning Ending Nonrecourse Qualified nonrecourse financing Recourse Check this box item k includes lability amounts from lower tier partnerships Partner's Capital Account Analysis Beginning capital account Capital contributed during the year Current year net income (los) Other increase (decrease] (attach explanation) L 21 More than one activity for at risk purposes Required Information Comprehensive Problem 22-88 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolitle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company. Good to Eat (GTE). specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contributed $280.000 in exchange for a 50 percent ownership Interest GTE also borrowed $1,120.000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following Information pertains to GTE's 2021 activities: GTE uses the cash method of accounting (for both book and tax purposes) and reports Income on a calendar-year basis. GTE received $1.600.000 of sales revenue and reported $750.000 of cost of goods sold (It did not have any ending Inventory GTE paid $145.000 compensation to James, $145,000 compensation to Paul, and $155.000 of compensation to other employees (assume these amounts Include applicable payroll taxes, if any). GTE paid $38.000 of rent for a building and equipment. $43.000 for advertising, $78,400 in Interest expense, $6,300 for utilities, and $4,300 for supplies. GTE contributed $16.500 to charity GTE received a $5.600 qualified dividend from a great stock Investment (t owned 2 percent of the corporation distributing the dividend), and it recognized $3.800 in short-term capital gain when it sold some of the stock. On December 1, 2021, GTE distributed $43,000 to James and $43,000 to Paul. GTE has qualified property of $323.000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A if not applicable.) Comprehensive Problem 22-86 (Algo) Part b-2 b-2 Assume James and Paul formed GTE as an LLC. Complete Paul's Form 1065. Schedule K-1. Use 2021 tax rules regardless of year on tax form. Partnership's EIN: 58-1111111 Partner's SSN or TIN: 111-11-1111 UCUVUUS, VISVIES, GUICI ICHIS Ordinary business income foss) 15 Credits 1 beginning 2020 20 Department of the Treasury For calendar year 2020, or tax year Internal Revenue Service anding Partner's Share of Income, Deductions, Credits, etc. See back of form and separate instructions. 2 Not rental real estate income foss) 3 Other not rental income (loss 16 Foreign transactions 4a Guaranteed payments for services Parti Information About the Partnership A Partnership's employer identification number 4b Guaranteed payments for capital B Partnership's name, address, city, state and ZIP code 40 Total guaranteed payments 6 Interest income CIRS Center where partnership flodratum ea Ordinary dividends Check this a publicly traded partnership (PTP) Bb Qualified dividends Part II Information About the Partner Bo Dividend equivalents 17 Alterative minimum tax (AMT) toms 7 Royalties E Partner's SSN OTIN (Do not use TIN of a disregarded entity. See instructions) 3 Net short term capital gain los F Name, address, city, stato, and ZIP code for partner entered in E. See instructions a Not long-term capital gain loss 18 Tax-exempt Income and nondeductible expenses General partner or LLC Limited partner or other LLC ab Collectibles (28%) gen 0 A So Unrecaptured Section 1250 gain member manager member H1 Domestic partner Foreign partner H2 If the partner is a disregarded entity (DE) enter the partners: TIN Name 10 Net section 1231 gain loss 11 Other income dos Distributions 19 11 What type of entity is this partner? 12 If this partner is a retirement plan (RAISEP Keoghetc.), check here J Partner's share of profit, loss, and capital se instructions): Beginning Ending 12 Section 179 deduction 20 Other information Pront % % Loss % 13 Other deductions A Capital % A z TMT Check I decrease is due to sale or exchange of partnership interest K Partner's share of liabilities: 14 Self-employment earnings (loss) Beginning Ending Nonrecourse Qualified nonrecourse financing Recourse Check this box item k includes lability amounts from lower tier partnerships Partner's Capital Account Analysis Beginning capital account Capital contributed during the year Current year net income (los) Other increase (decrease] (attach explanation) L 21 More than one activity for at risk purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts