Question: Required information Comprehensive Problem 4 - 5 8 ( LO 4 - 1 , LO 4 - 2 , LO 4 - 3 ) (

Required information

Comprehensive Problem LO LO LO Algo

The following information applies to the questions displayed below.

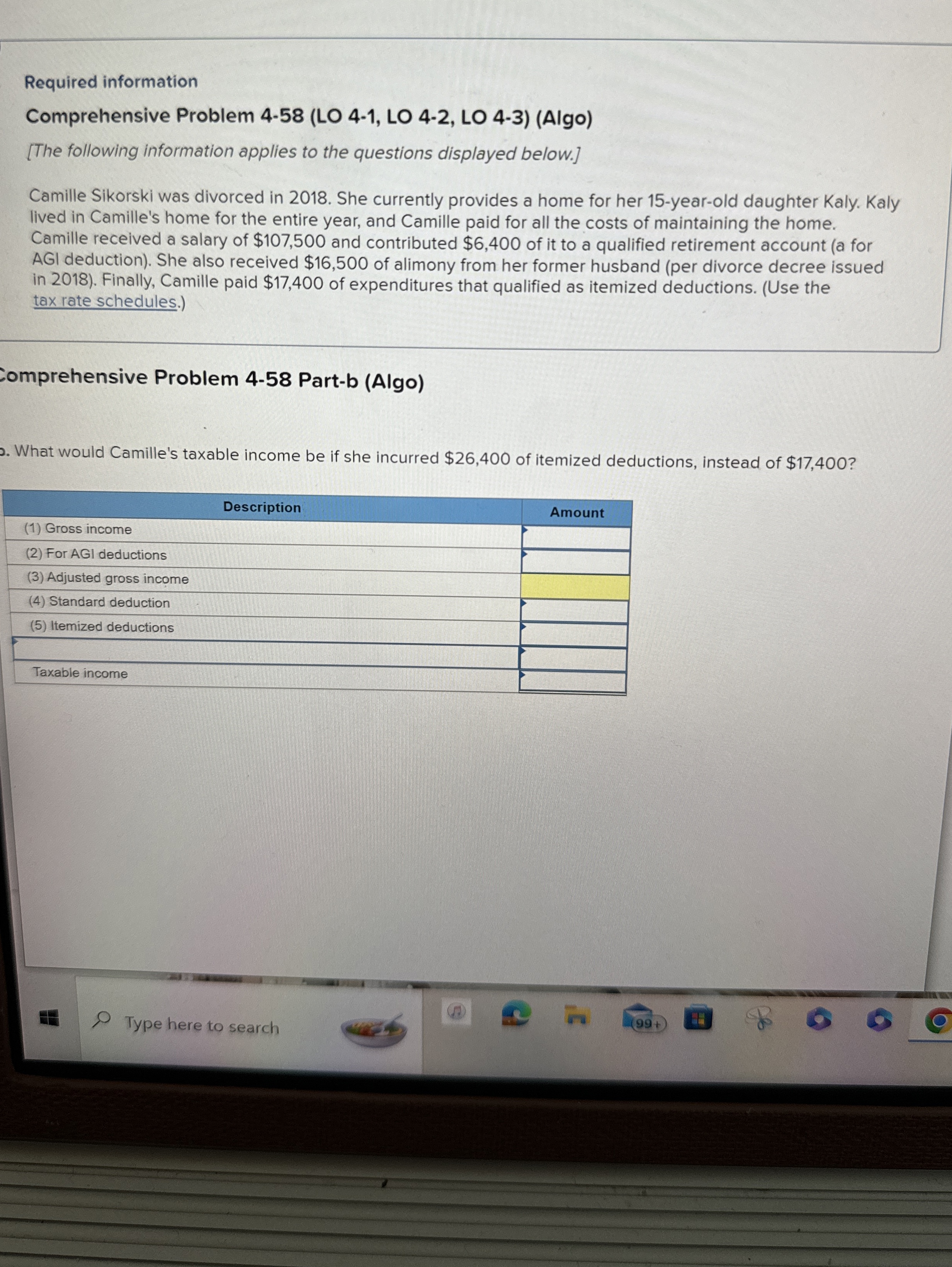

Camille Sikorski was divorced in She currently provides a home for her yearold daughter Kaly. Kaly

lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home.

Camille received a salary of $ and contributed $ of it to a qualified retirement account a for

AGI deduction She also received $ of alimony from her former husband per divorce decree issued

in Finally, Camille paid $ of expenditures that qualified as itemized deductions. Use the

tax rate schedules.

Zomprehensive Problem Partb Algo

What would Camille's taxable income be if she incurred $ of itemized deductions, instead of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock