Question: Required information Comprehensive Problem 4-56 (LO 4-1, LO 4-2, LO 4-3) (The following information applies to the questions displayed below.) Demarco and Janine Jackson have

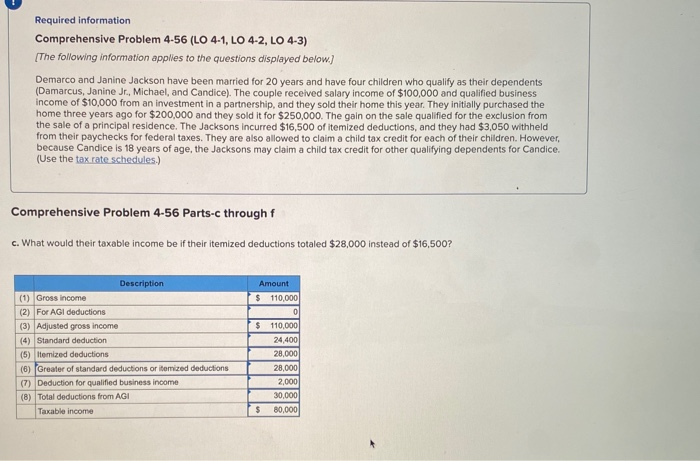

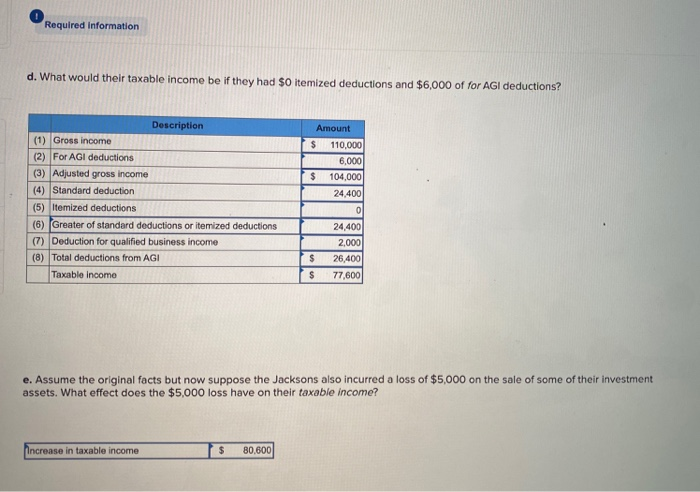

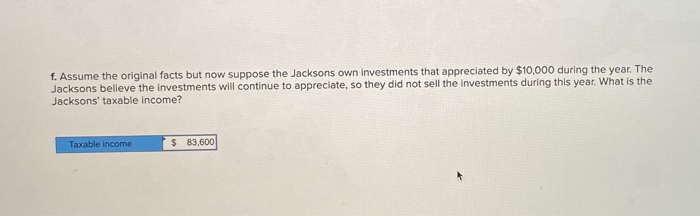

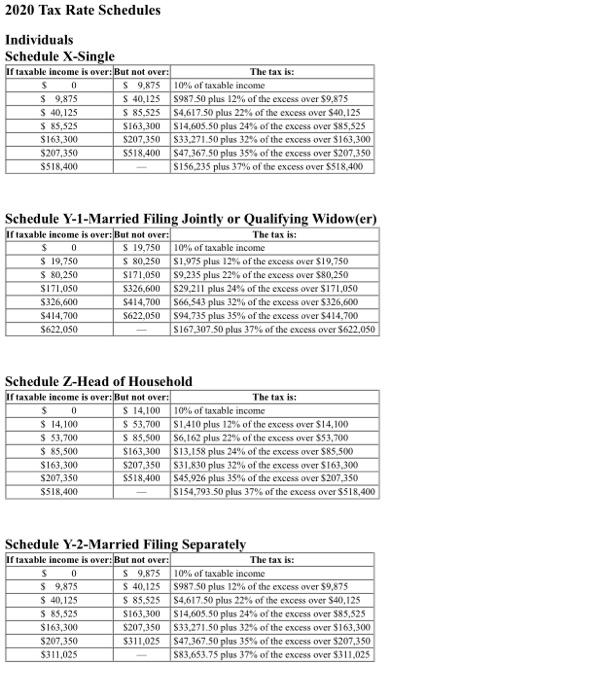

Required information Comprehensive Problem 4-56 (LO 4-1, LO 4-2, LO 4-3) (The following information applies to the questions displayed below.) Demarco and Janine Jackson have been married for 20 years and have four children who qualify as their dependents (Damarcus, Janine Jr., Michael, and Candice). The couple received salary income of $100,000 and qualified business income of $10,000 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $200,000 and they sold it for $250,000. The gain on the sole qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $16,500 of itemized deductions, and they had $3,050 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice is 18 years of age, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. (Use the tax rate schedules.) Comprehensive Problem 4-56 Parts-c through f c. What would their taxable income be if their itemized deductions totaled $28,000 instead of $16,500? Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itomized deductions (6) Greater of standard deductions or itemized deductions (7) Deduction for qualified business income (8) Total deductions from AGI Amount $ 110,000 0 $ 110,000 24,400 28,000 28,000 2.000 30,000 $ 80,000 Taxable income Required information d. What would their taxable income be if they had $0 itemized deductions and $6,000 of for AGI deductions? Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard deductions or itemized deductions (7) Deduction for qualified business income (8) Total deductions from AGI Taxable income Amount $ 110,000 6.000 $ 104,000 24,400 0 24,400 2,000 $ 26,400 $ 77,600 e. Assume the original facts but now suppose the Jacksons also incurred a loss of $5,000 on the sale of some of their investment assets. What effect does the $5,000 loss have on their taxable income? Increase in taxable income $ 80,600 f. Assume the original facts but now suppose the Jacksons own investments that appreciated by $10,000 during the year. The Jacksons believe the investments will continue to appreciate, so they did not sell the investments during this year. What is the Jacksons' taxable income? Taxable income $ 83,600 0 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: s S 9,875 10% of taxable income $ 9,875 S 40,125 598750 plus 12% of the excess over $9,875 $ 40,125 S 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 S163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33.271.50 plus 32% of the excess over $163,300 $207,350 $518,400 S47,367.50 plus 35% of the excess over $207,350 $518,400 S156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 S 80,250 $1,975 plus 12% of the excess over $19,750 S 80,250 S171,050 $9,235 plus 22% of the excess over $80,250 $171,050 S326,600 S29.211 plus 24% of the excess over $171,050 $326,600 $414,700 566,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 S167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 S 53.700 51.410 plus 12% of the excess over $14,100 $ 53,700 S 85.500 S6,162 plus 22% of the excess over $53,700 $ 85,500 S163,300 $13,158 plus 24% of the excess over $85,500 $ 163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 S45,926 plus 35% of the excess over $207,350 $518,400 S154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: s 0 S 9,875 10% of taxable income $ 9,875 $ 40,125 5987 50 plus 12% of the excess over $9,875 $ 40,125 S 85,525 $4.617.50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,005,50 plus 24% of the excess over $85,525 $163,300 $207,350 $33.271.50 plus 32% of the excess over $163,300 $207,350 $311,025 S47.367.50 plus 35% of the excess over $207,350 $311,025 $83.653.75 plus 37% of the excess over $311,025

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts