Question: Required information Comprehensive Problem 4.58 (LO 4-1, LO 4-2, LO 4-3) (Algo) [The following information applies to the questions displayed below] Camille Sikorski was divorced

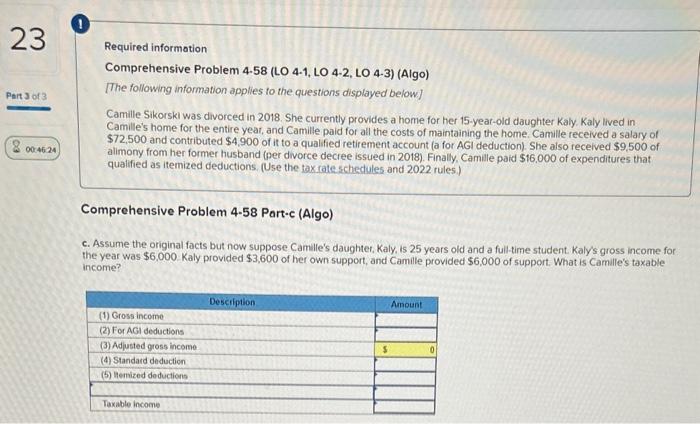

Required information Comprehensive Problem 4.58 (LO 4-1, LO 4-2, LO 4-3) (Algo) [The following information applies to the questions displayed below] Camille Sikorski was divorced in 2018. She currently provides a home for her 15-yeat-old daughter Kaly. Kaly lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of $72,500 and contributed $4,900 of it to a qualfied retirement account (a for AGI deduction). She also recelved $9,500 of alimony from her former husband (per divorce decree issued in 2018). Finally. Camille paid $16,000 of expenditures that qualified as itemized deductions. (Use the tax rateschedules and 2022 rules.) Comprehensive Problem 4.58 Part-c (Algo) c. Assume the original facts but now suppose Camille's daughter, Kaly. is 25 years old and a full-time student. Kaly's gross income for the year was $6,000 Kaly provided $3,600 of her own support, and Camile provided $6,000 of support. What is Camille's taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts