Question: Required information Comprehensive Problem 8 - 8 4 ( LO 8 - 1 , LO 8 - 2 , LO 8 - 3 , LO

Required information

Comprehensive Problem LO LO LO LO LO Algo

The following information applies to the questions displayed below.

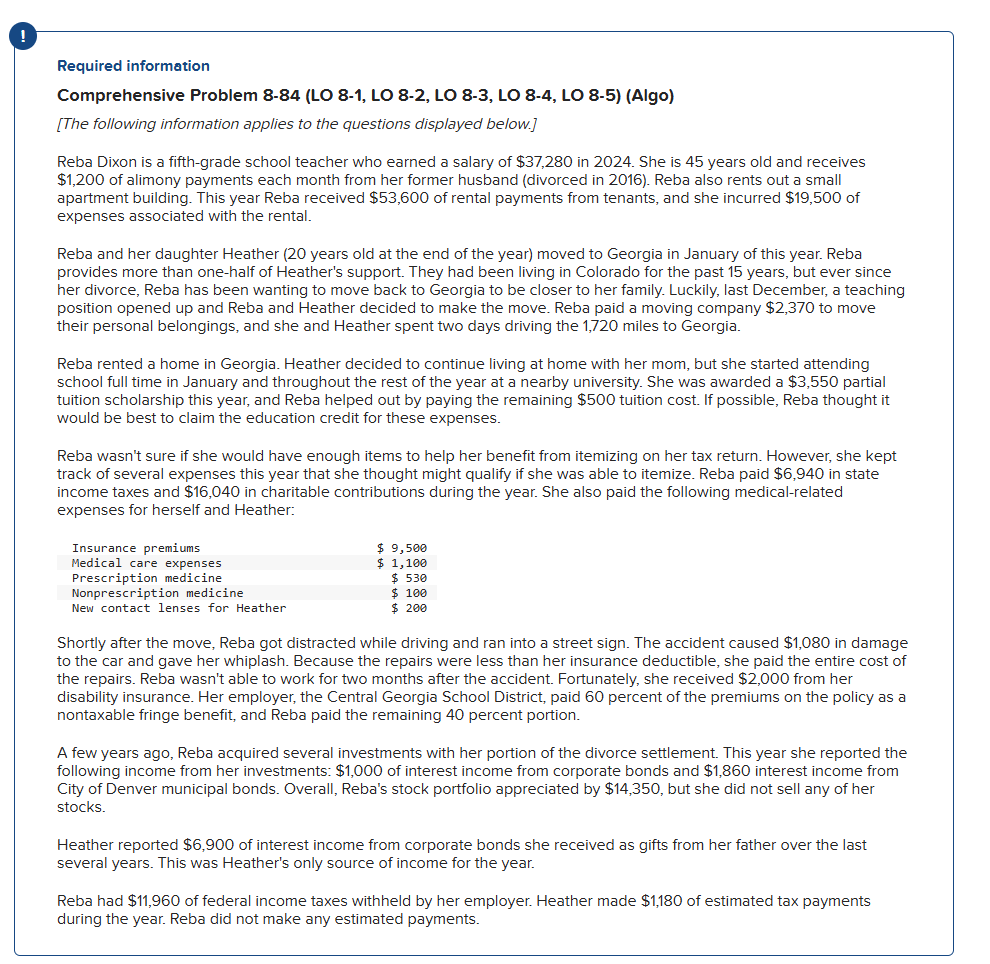

Reba Dixon is a fifthgrade school teacher who earned a salary of $ in She is years old and receives $ of alimony payments each month from her former husband divorced in Reba also rents out a small apartment building. This year Reba received $ of rental payments from tenants, and she incurred $ of expenses associated with the rental.

Reba and her daughter Heather years old at the end of the year moved to Georgia in January of this year. Reba provides more than onehalf of Heather's support. They had been living in Colorado for the past years, but ever since her divorce, Reba has been wanting to move back to Georgia to be closer to her family. Luckily, last December, a teaching position opened up and Reba and Heather decided to make the move. Reba paid a moving company $ to move their personal belongings, and she and Heather spent two days driving the miles to Georgia.

Reba rented a home in Georgia. Heather decided to continue living at home with her mom, but she started attending school full time in January and throughout the rest of the year at a nearby university. She was awarded a $ partial tuition scholarship this year, and Reba helped out by paying the remaining $ tuition cost. If possible, Reba thought it would be best to claim the education credit for these expenses.

Reba wasn't sure if she would have enough items to help her benefit from itemizing on her tax return. However, she kept track of several expenses this year that she thought might qualify if she was able to itemize. Reba paid $ in state income taxes and $ in charitable contributions during the year. She also paid the following medicalrelated expenses for herself and Heather:

Shortly after the move, Reba got distracted while driving and ran into a street sign. The accident caused $ in damage to the car and gave her whiplash. Because the repairs were less than her insurance deductible, she paid the entire cost of the repairs. Reba wasn't able to work for two months after the accident. Fortunately, she received $ from her disability insurance. Her employer, the Central Georgia School District, paid percent of the premiums on the policy as a nontaxable fringe benefit, and Reba paid the remaining percent portion.

A few years ago, Reba acquired several investments with her portion of the divorce settlement. This year she reported the following income from her investments: $ of interest income from corporate bonds and $ interest income from City of Denver municipal bonds. Overall, Reba's stock portfolio appreciated by $ but she did not sell any of her stocks.

Heather reported $ of interest income from corporate bonds she received as gifts from her father over the last several years. This was Heather's only source of income for the year.

Reba had $ of federal income taxes withheld by her employer. Heather made $ of estimated tax payments during the year. Reba did not make any estimated payments. Comprehensive Problem Part aAlgo

Using the information from part a Complete pages and Schedule and Schedule of Form for Reba.

Reba Dixon's address is NWth Street, Lawrenceville, GA

Social security numbers:

Reba Dixon:

Heather Dixon:

Note: Assume all taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Input all the values as positive numbers. Use tax rules regardless of year on tax form. Round your intermediate computations and final answers to the nearest whole dollar amount.

for a Head of household with one dependent.

Form Page Required information

Form Page

Tax see instructions

Check if any from Forms:

Amount from Schedule line

Add lines and

Child tax credit or credit for other dependents from Schedule

Amount from Schedule line

Add lines and

Subtract line from line If zero or less, enter

Other taxes, including selfemployment tax, from Schedule line

Add lines and This is your total tax

Federal income tax withheld from:

a Forms W

b Forms

c Other forms see instructions

d Add lines a through c

estimated tax payments and amount applied from return

If you have a qualifying child, attach Sch EIC Go to wwwirs.govForm for instructions and the latest information.

THIS FORM IS A SIMULATION OF AN OFFICIAL US TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. Source: irs.gov

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock