Question: Required information Comprehensive Problem 9 - 8 1 ( LO 9 - 1 , LO 9 - 2 , LO 9 - 3 , LO

Required information

Comprehensive Problem LO LO LO LO LO LO Algo

The following information applies to the questions displayed below.

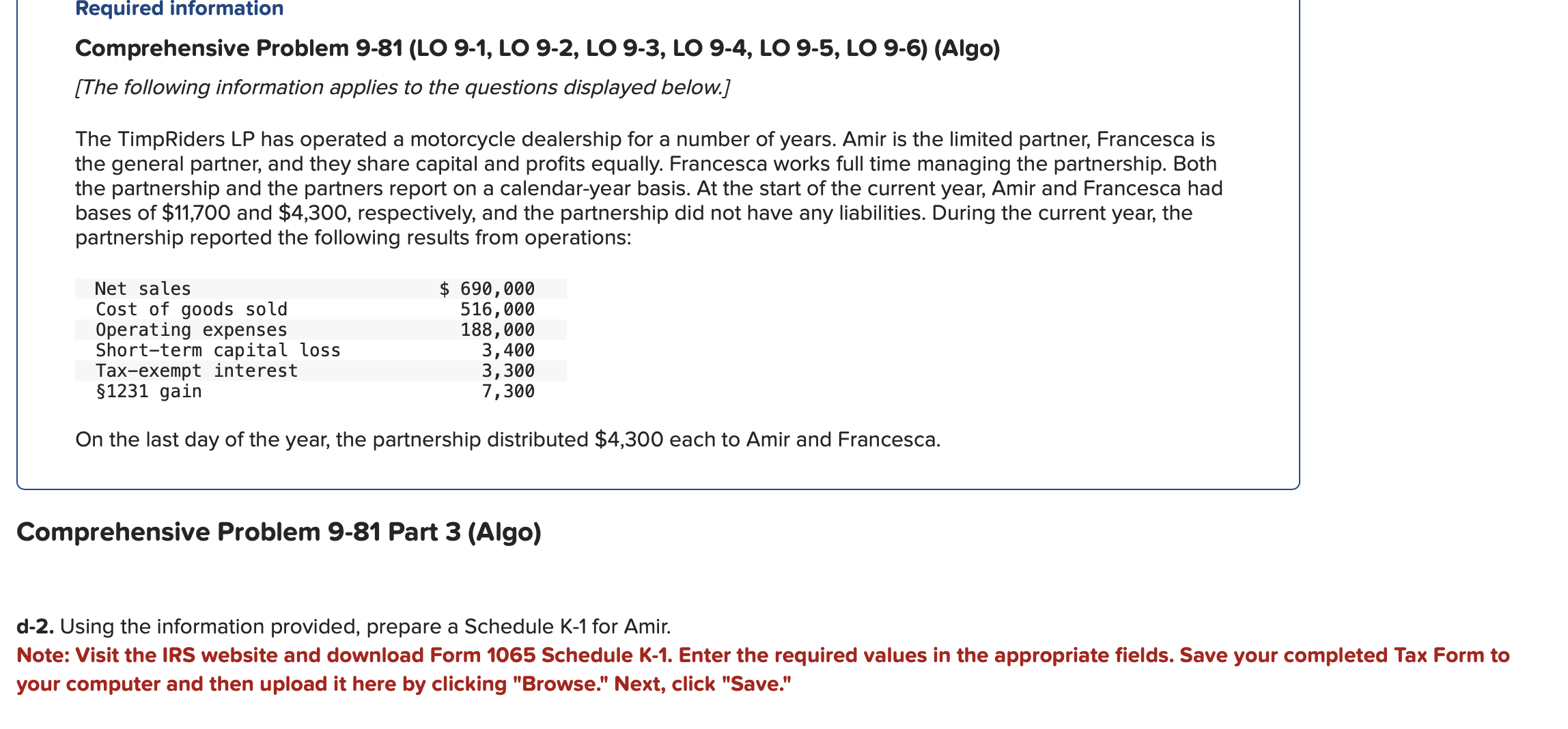

The TimpRiders LP has operated a motorcycle dealership for a number of years. Amir is the limited partner, Francesca is the general partner, and they share capital and profits equally. Francesca works full time managing the partnership. Both the partnership and the partners report on a calendaryear basis. At the start of the current year, Amir and Francesca had bases of $ and $ respectively, and the partnership did not have any liabilities. During the current year, the partnership reported the following results from operations:

On the last day of the year, the partnership distributed $ each to Amir and Francesca.

Comprehensive Problem Part Algo

d Using the information provided, prepare a Schedule K for Amir.

Note: Visit the IRS website and download Form Schedule K Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save."

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock