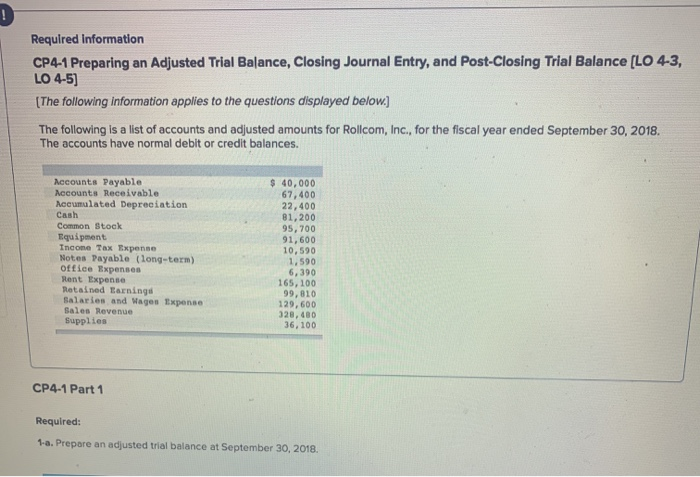

Question: Required information CP4-1 Preparing an Adjusted Trial Balance, Closing Journal Entry, and Post-Closing Trial Balance (LO 4-3, LO 4-5] (The following information applies to the

![and Post-Closing Trial Balance (LO 4-3, LO 4-5] (The following information applies](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66c8c40dd27a7_42166c8c40d1dff8.jpg)

Required information CP4-1 Preparing an Adjusted Trial Balance, Closing Journal Entry, and Post-Closing Trial Balance (LO 4-3, LO 4-5] (The following information applies to the questions displayed below.) The following is a list of accounts and adjusted amounts for Rollcom, Inc., for the fiscal year ended September 30, 2018. The accounts have normal debit or credit balances. Accounts Payable Accounts Receivable Accumulated Depreciation Cash Common Stock Equipment Income Tax Expense Notes Payable (long-term) office Expenses Rent Expense Retained Earnings Salaries and Wages Expense Sales Revenue Supplies $ 40,000 67,400 22,400 81,200 95,700 91,600 10,590 1,590 6,390 165, 100 99,810 129,600 328,480 36,100 CP4-1 Part 1 Required: 1-a. Prepare an adjusted trial balance at September 30, 2018. CP4-1 Part 1 3 Required: 1-a. Prepare an adjusted trial balance at September 30, 2018. ed ROLLCOM, INC. Adjusted Trial Balance Account Titles Debit Credit nces Totals 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts