Question: Required information Does return on assets seem satisfactory for Kyzera given that its competitors average a 1 1 % return on assets? Does return on

Required information Does return on assets seem satisfactory for Kyzera given that its competitors average a return on assets?

Does return on assets seem satisfactory for Kyzera given that its competitors average a return on assets? What are total expenses for Kyzera in its most recent year?

Total expenses What is the average total amount of liabilities plus equity for Kyzera?

Average total financing liabilities plus equity

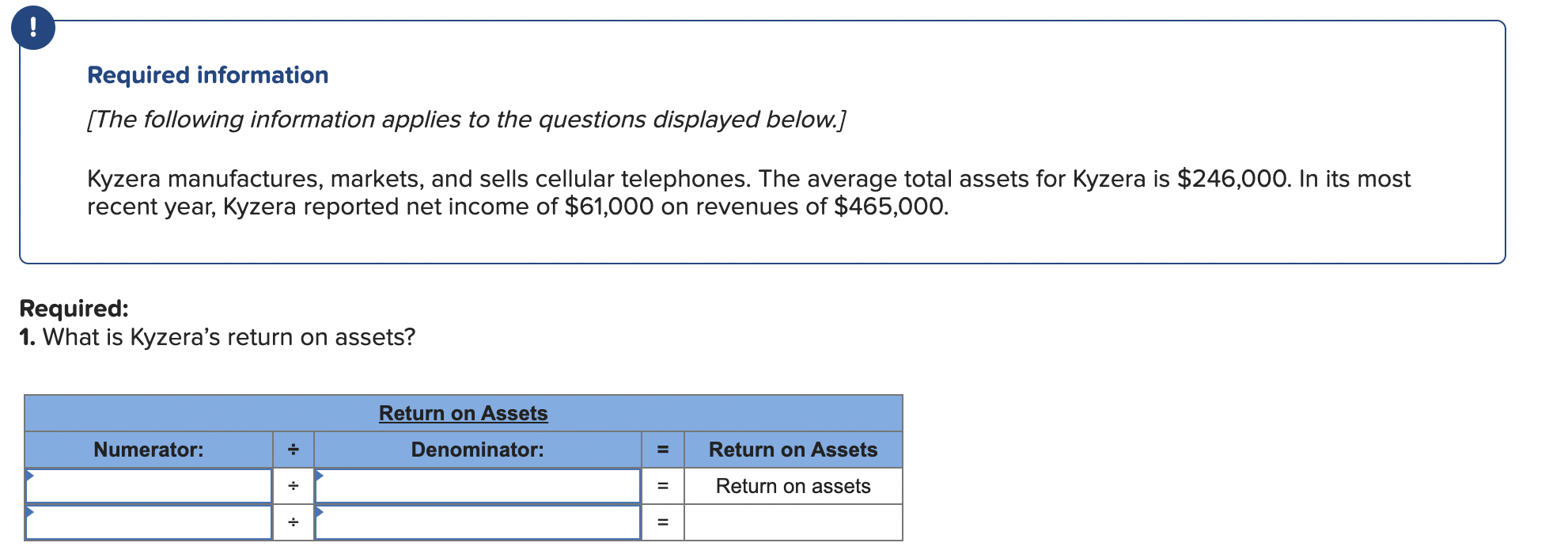

The following information applies to the questions displayed below.

Kyzera manufactures, markets, and sells cellular telephones. The average total assets for Kyzera is $ In its most

recent year, Kyzera reported net income of $ on revenues of $

Required:

What is Kyzera's return on assets?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock