Question: Required information E 2 - 1 6 ( Static ) Analyzing the Effects of Transactions Using TAccounts, Preparing a Balance Sheet, and Evaluating the Current

Required information

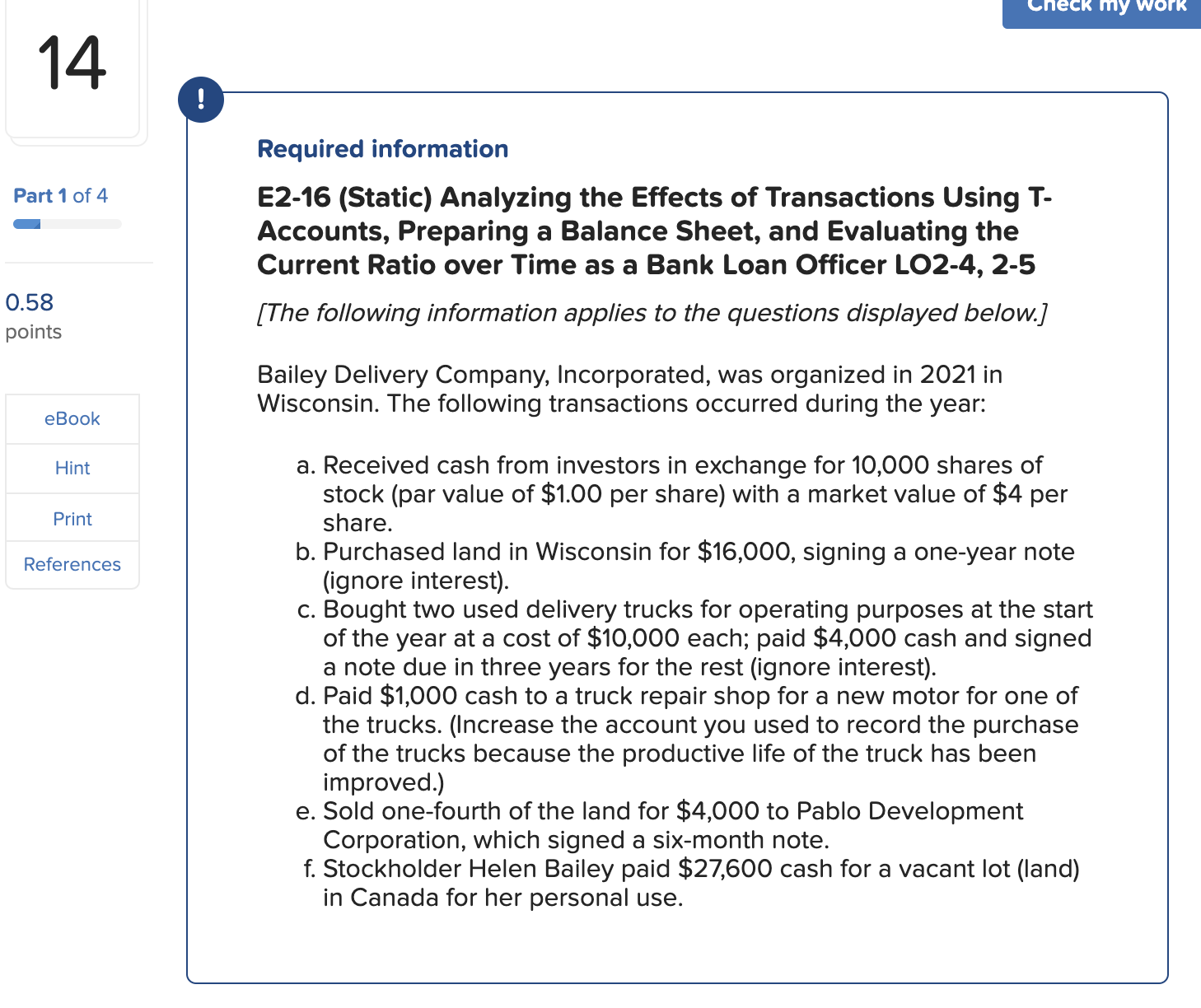

EStatic Analyzing the Effects of Transactions Using TAccounts, Preparing a Balance Sheet, and Evaluating the Current Ratio over Time as a Bank Loan Officer LO

The following information applies to the questions displayed below.

Bailey Delivery Company, Incorporated, was organized in in Wisconsin. The following transactions occurred during the year:

a Received cash from investors in exchange for shares of stock par value of $ per share with a market value of $ per share.

b Purchased land in Wisconsin for $ signing a oneyear note ignore interest

c Bought two used delivery trucks for operating purposes at the start of the year at a cost of $ each; paid $ cash and signed a note due in three years for the rest ignore interest

d Paid $ cash to a truck repair shop for a new motor for one of the trucks. Increase the account you used to record the purchase of the trucks because the productive life of the truck has been improved.

e Sold onefourth of the land for $ to Pablo Development Corporation, which signed a sixmonth note.

f Stockholder Helen Bailey paid $ cash for a vacant lot land in Canada for her personal use. Required:

Using the Taccounts, record the effects of these transactions by Bailey Delivery Company.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock