Question: Required information E10-9 (Static) (Chapter Supplement) Recording and Reporting a Bond Issued at a Discount (without Discount Account) LO10-4 Skip to question [The following information

Required information

E10-9 (Static) (Chapter Supplement) Recording and Reporting a Bond Issued at a Discount (without Discount Account) LO10-4

Skip to question

[The following information applies to the questions displayed below.]

Park Corporation is planning to issue bonds with a face value of $600,000 and a coupon rate of 7.5 percent. The bonds mature in four years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Park uses the effective-interest amortization method and does not use a discount account. Assume an annual market rate of interest of 8.5 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.)

Note; I have used "discount bonds payable and premium bond's payable" both answers were considered wrong including the figures

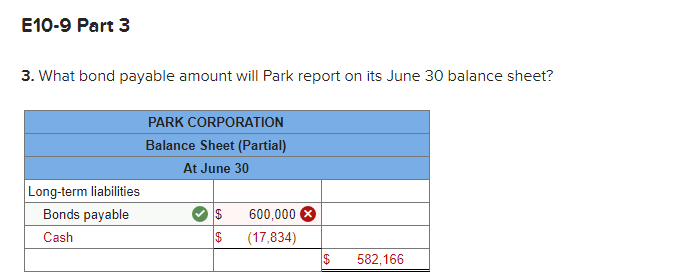

E10-9 Part 3 3. What bond payable amount will Park report on its June 30 balance sheet? PARK CORPORATION Balance Sheet (Partial) At June 30 Long-term liabilities Bonds payable Cash $ $ 600,000 X (17,834) $ 582,166

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts