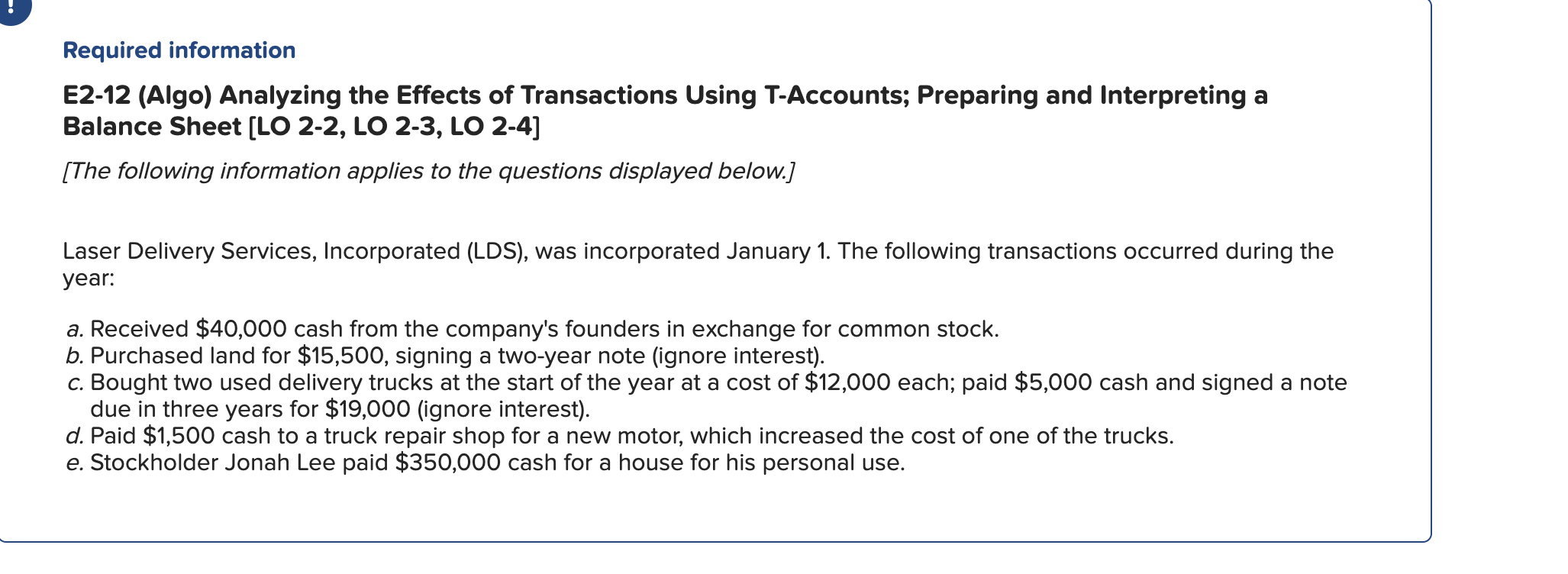

Question: Required information E2-12 (Algo) Analyzing the Effects of Transactions Using T-Accounts; Preparing and Interpreting a Balance Sheet [LO 2-2, LO 2-3, LO 2-4] [The following

![Preparing and Interpreting a Balance Sheet [LO 2-2, LO 2-3, LO 2-4]](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66a4ba3dcdf73_61366a4ba3d2fae1.jpg)

Required information E2-12 (Algo) Analyzing the Effects of Transactions Using T-Accounts; Preparing and Interpreting a Balance Sheet [LO 2-2, LO 2-3, LO 2-4] [The following information applies to the questions displayed below.] Laser Delivery Services, Incorporated (LDS), was incorporated January 1. The following transactions occurred during the year: a. Received $40,000 cash from the company's founders in exchange for common stock. b. Purchased land for $15,500, signing a two-year note (ignore interest). c. Bought two used delivery trucks at the start of the year at a cost of $12,000 each; paid $5,000 cash and signed a note due in three years for $19,000 (ignore interest). d. Paid $1,500 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. e. Stockholder Jonah Lee paid \$350,000 cash for a house for his personal use. Record the effects of each item using a journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts