Question: Required information E2-16 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing a Balance Sheet, and Evaluating the Current Ratio over Time as a Bank

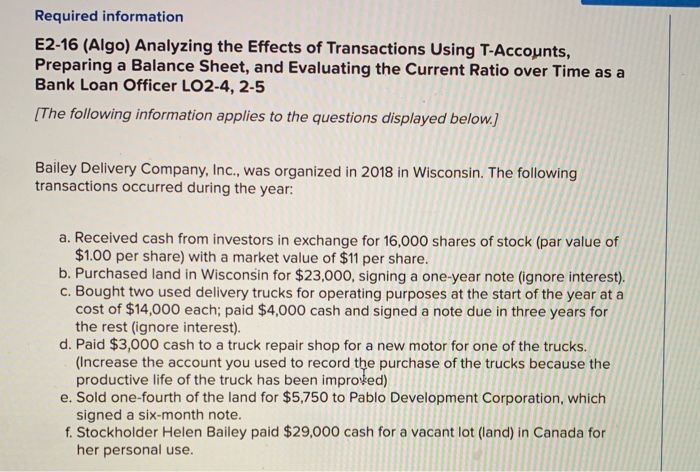

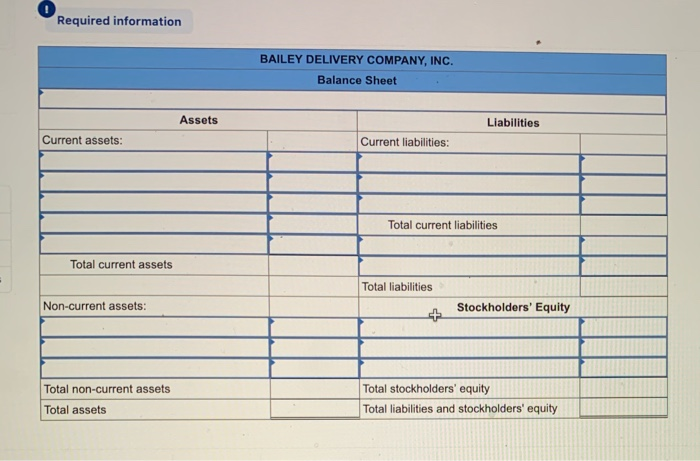

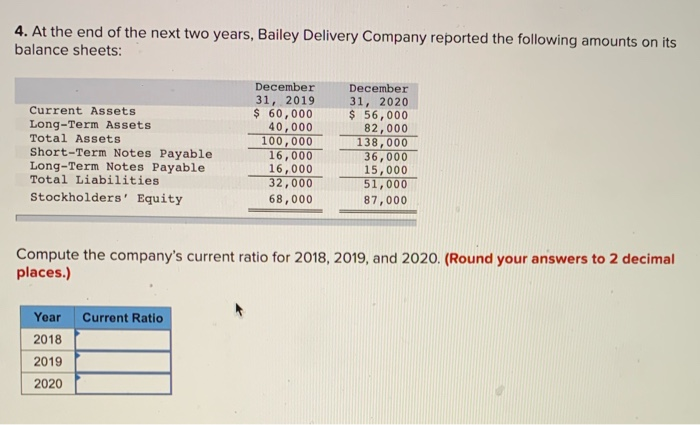

Required information E2-16 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing a Balance Sheet, and Evaluating the Current Ratio over Time as a Bank Loan Officer LO2-4, 2-5 [The following information applies to the questions displayed below.) Bailey Delivery Company, Inc., was organized in 2018 in Wisconsin. The following transactions occurred during the year: a. Received cash from investors in exchange for 16,000 shares of stock (par value of $1.00 per share) with a market value of $11 per share. b. Purchased land in Wisconsin for $23,000, signing a one-year note (ignore interest). c. Bought two used delivery trucks for operating purposes at the start of the year at a cost of $14,000 each; paid $4,000 cash and signed a note due in three years for the rest (ignore interest). d. Paid $3,000 cash to a truck repair shop for a new motor for one of the trucks. (Increase the account you used to record the purchase of the trucks because the productive life of the truck has been improved) e. Sold one-fourth of the land for $5,750 to Pablo Development Corporation, which signed a six-month note. f. Stockholder Helen Bailey paid $29,000 cash for a vacant lot (land) in Canada for her personal use. Required information BAILEY DELIVERY COMPANY, INC. Balance Sheet Assets Liabilities Current assets: Current liabilities: Total current liabilities Total current assets Total liabilities Non-current assets: Stockholders' Equity Total non-current assets Total stockholders' equity Total liabilities and stockholders' equity Total assets 4. At the end of the next two years, Bailey Delivery Company reported the following amounts on its balance sheets: Current Assets Long-Term Assets Total Assets Short-Term Notes Payable Long-Term Notes Payable Total Liabilities Stockholders' Equity December 31, 2019 $ 60,000 40,000 100,000 16,000 16,000 32,000 68,000 December 31, 2020 $ 56,000 82,000 138,000 36,000 15,000 51,000 87,000 Compute the company's current ratio for 2018, 2019, and 2020. (Round your answers to 2 decimal places.) Current Ratio Year 2018 2019 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts