Question: Required information E3-18 and E3-19 Posting to T-Accounts and Creating an Unadjusted Trial Balance (LO 3. 3, LO 3-4) (The following information applies to the

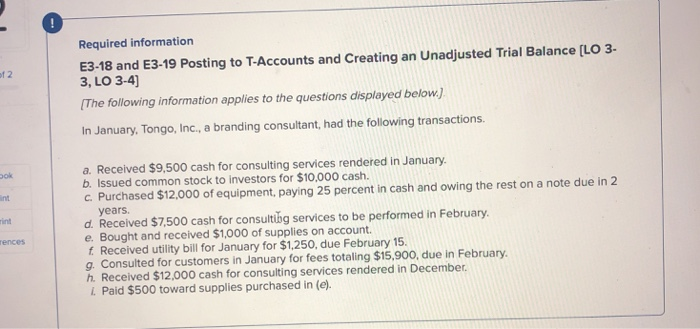

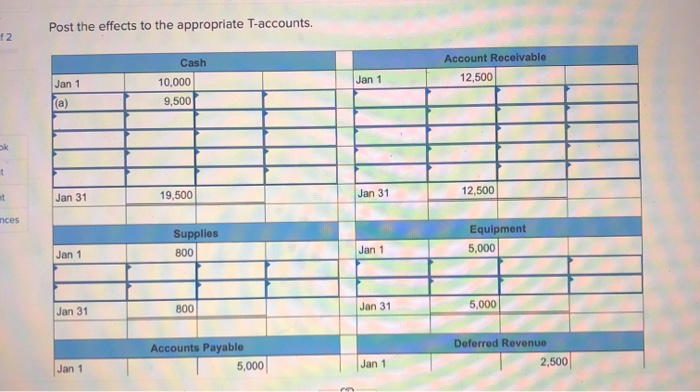

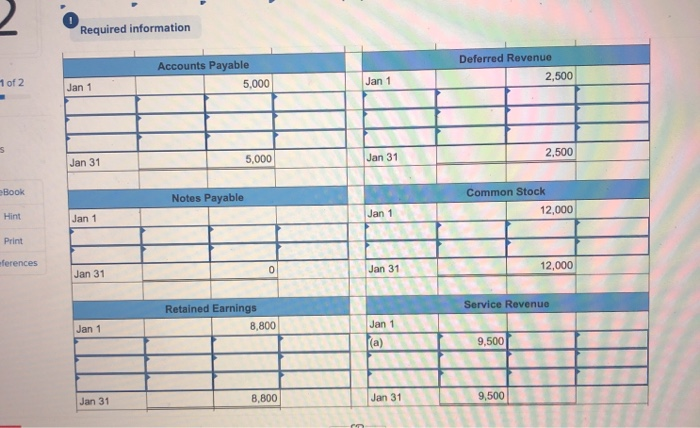

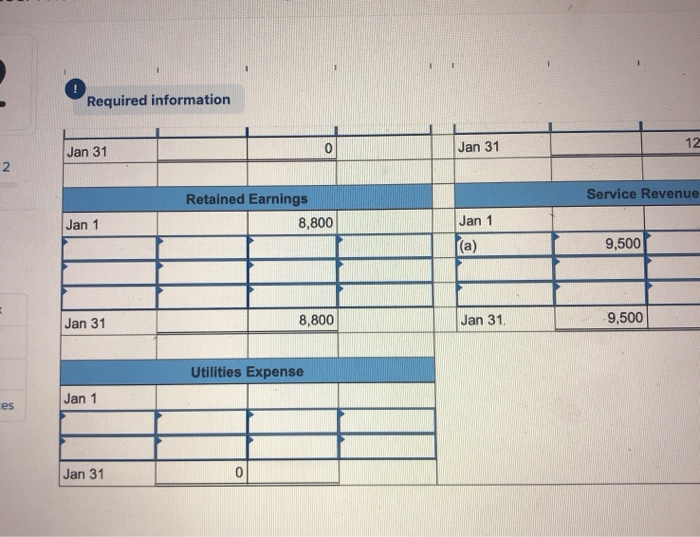

Required information E3-18 and E3-19 Posting to T-Accounts and Creating an Unadjusted Trial Balance (LO 3. 3, LO 3-4) (The following information applies to the questions displayed below.) In January, Tongo, Inc., a branding consultant, had the following transactions. a. Received $9,500 cash for consulting services rendered in January. b. Issued common stock to investors for $10,000 cash. c. Purchased $12,000 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years. d. Received $7,500 cash for consulting services to be performed in February. e. Bought and received $1,000 of supplies on account. f Received utility bill for January for $1,250, due February 15. 9. Consulted for customers in January for fees totaling $15,900, due in February h. Received $12.000 cash for consulting services rendered in December 1. Paid $500 toward supplies purchased in (e). Post the effects to the appropriate T-accounts. Account Receivable 12,500 Jan 1 Cash 0,000 9,500 1 Jan 31 19,500 Jan 31 12,500 nces Supplies 800 Equipment 5,000 Jan 1 Jan 1 Jan 31 B001 Jan 31 5,000 Accounts Payable 5,000 Deferred Revenue 2,500 Jan 1 Required information 1 of 2 Accounts Payable ts Payable 5,000 Deferred Revenue Deferred Re 2,500 Jan 1 TTT 5,000 Jan 31 Jan 31 L 2,500 Book Notes Payable Hint Jan 1 Common Stock 12,000 / Print / ferences AS . / 12,000 Service Revenue Retained Earnings 8,800 / 9,500 N / / Jan 31 8,800 9.500 Required information Jan 31 Jan 31 Service Revenue Retained Earnings 8,800 Jan 1 Jan 1 Ila) 9,500 Jan 31 8,800 Jan 31 9,500 Utilities Expense Jan 1 Jan 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts