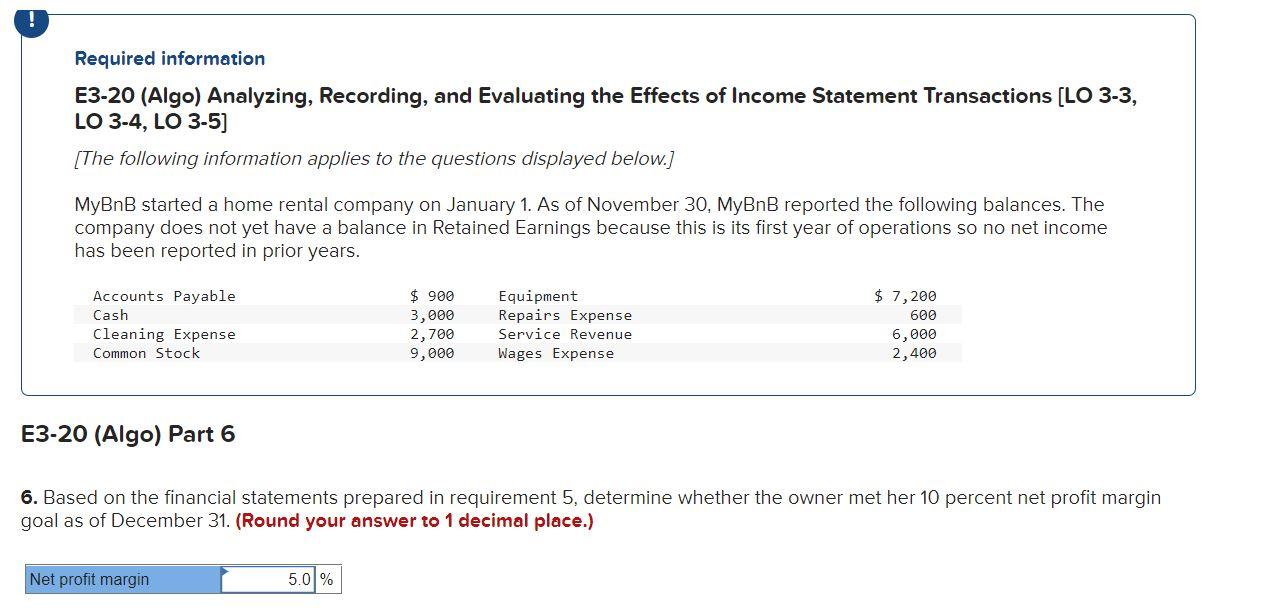

Question: Required information E3-20 (Algo) Analyzing, Recording, and Evaluating the Effects of Income Statement Transactions [LO 3-3, LO 3-4, LO 3-5] (The following information applies to

Required information E3-20 (Algo) Analyzing, Recording, and Evaluating the Effects of Income Statement Transactions [LO 3-3, LO 3-4, LO 3-5] (The following information applies to the questions displayed below.) MyBnB started a home rental company on January 1. As of November 30, MyBnB reported the following balances. The company does not yet have a balance in Retained Earnings because this is its first year of operations so no net income has been reported in prior years. $ 7,200 Accounts Payable Cash Cleaning Expense Common Stock $ 900 3,000 2,700 9,000 Equipment Repairs Expense Service Revenue Wages Expense 600 6,000 2,400 E3-20 (Algo) Part 6 6. Based on the financial statements prepared in requirement 5, determine whether the owner met her 10 percent net profit margin goal as of December 31. (Round your answer to 1 decimal place.) Net profit margin 5.01%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts