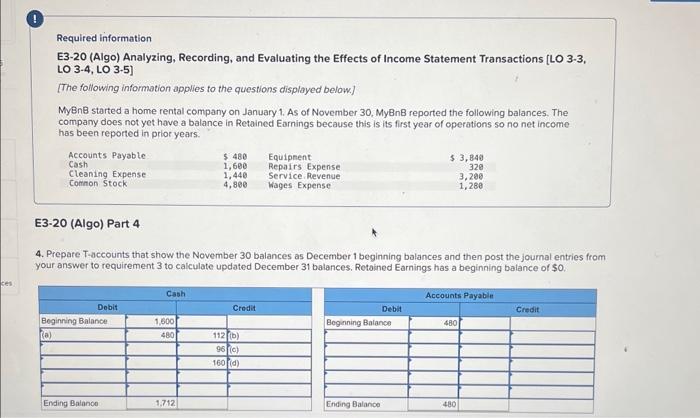

Question: Required information E3-20 (Algo) Analyzing, Recording, and Evaluating the Effects of Income Statement Transactions [LO 3-3, LO 3-4, LO 3-5] [The following information applies to

![Income Statement Transactions [LO 3-3, LO 3-4, LO 3-5] [The following information](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66b8c6f60f2ad_58966b8c6f5acc5f.jpg)

Required information E3-20 (Algo) Analyzing, Recording, and Evaluating the Effects of Income Statement Transactions [LO 3-3, LO 3-4, LO 3-5] [The following information applies to the questions displayed below.] MyBnB started a home rental company on January 1. As of November 30, MyBnB reported the following balances. The company does not yet have a balance in Retained Earnings because this is its first year of operations so no net income has been reported in prior years. E3-20 (Algo) Part 4 4. Prepare T-accounts that show the November 30 balances as December 1 beginning balances and then post the joumal entries from your answer to requirement 3 to calculate updated December 31 balances. Retained Earnings has a beginning balance of $0. Required information \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Equipment } & \\ \hline \multicolumn{2}{|c|}{ Debit } & & \\ \hline Beginning Balance & 3,840 & & \\ \hline & & & \\ \hline & & & \\ \hline & 3,840 & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Retainod Earnings } \\ \hline \multicolumn{2}{|c|}{ Dobit } & \multicolumn{2}{|c|}{ Credit } \\ \hline & & 160 & \\ \hline & & & \\ \hline Enginning Balance & & & \\ \hline & & 160 & \\ \hline & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts