Question: Required information E4-5 (Static) Recording Adjusting Entries and Reporting Balances in Financial Statements LO4-1, 4-2 [The following information applies to the questions displayed below.] A+T

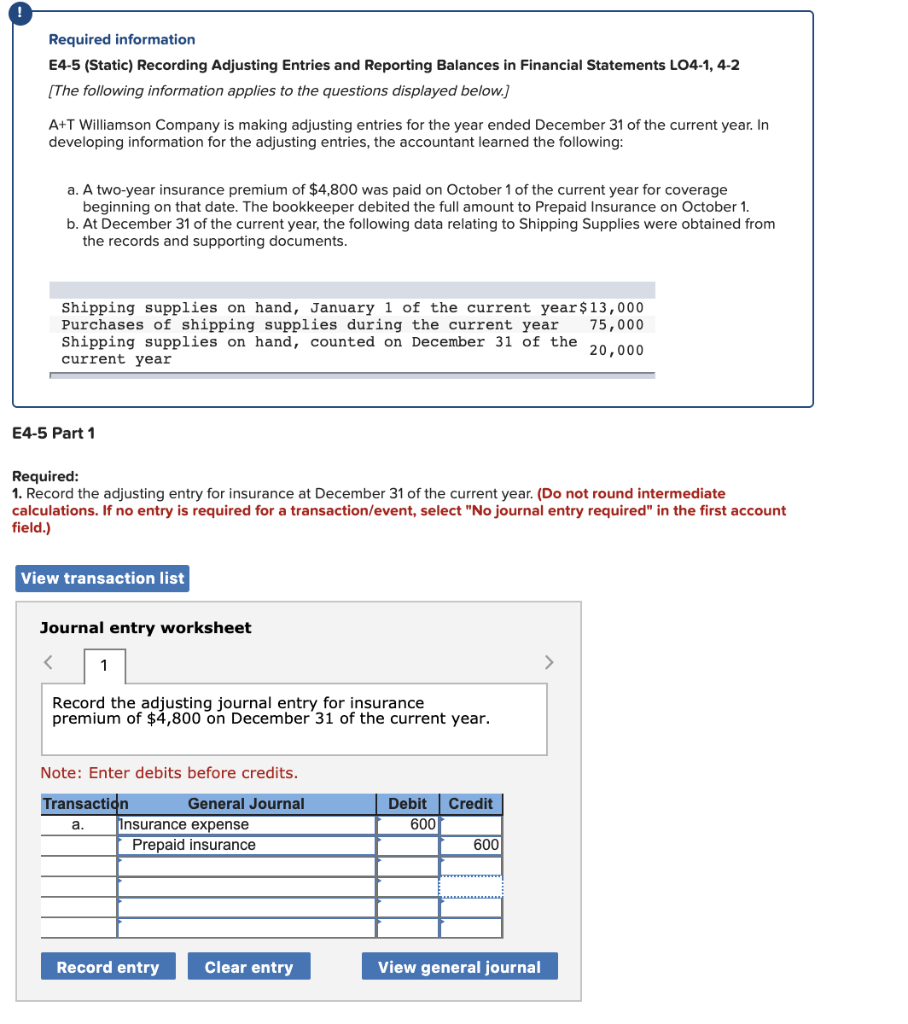

Required information E4-5 (Static) Recording Adjusting Entries and Reporting Balances in Financial Statements LO4-1, 4-2 [The following information applies to the questions displayed below.] A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $ 13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the current year 20,000

Required information E4-5 (Static) Recording Adjusting Entries and Reporting Balances in Financial Statements LO4-1, 4-2 [The following information applies to the questions displayed below.] A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $ 13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the current year 20,000

Required information E4-5 (Static) Recording Adjusting Entries and Reporting Balances in Financial Statements LO4-1, 4-2 (The following information applies to the questions displayed below.) A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: a. A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. b. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the 20.000 current year E4-5 Part 1 Required: 1. Record the adjusting entry for insurance at December 31 of the current year. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the adjusting journal entry for insurance premium of $4,800 on December 31 of the current year. Note: Enter debits before credits. Transaction General Journal Insurance expense Prepaid insurance a Debit Credit 600 1 600 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts