Question: Required information E7-8 (Static) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 [The following information applies to the questions displayed

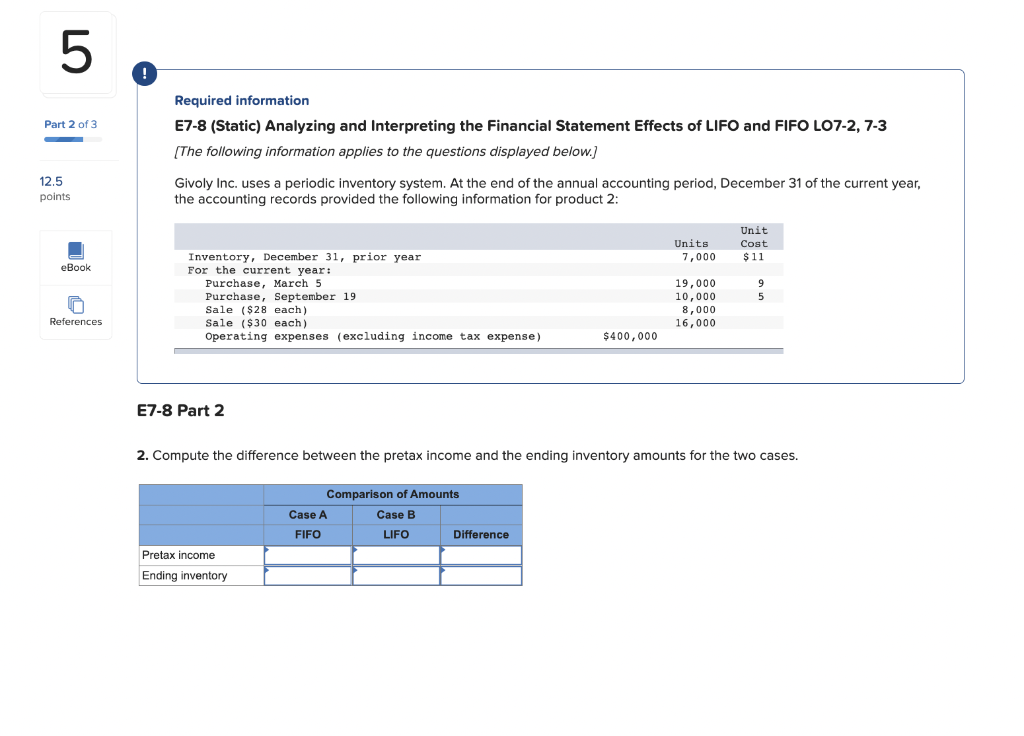

Required information E7-8 (Static) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 [The following information applies to the questions displayed below.] Givoly Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2 : E7-8 Part 2 2. Compute the difference between the pretax income and the ending inventory amounts for the two cases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts