Question: Required information E9-11 (Static) Demonstrating the Effect of Book Value on Reporting an Asset Disposal [LO 9-5] [The following information applies to the questions displayed

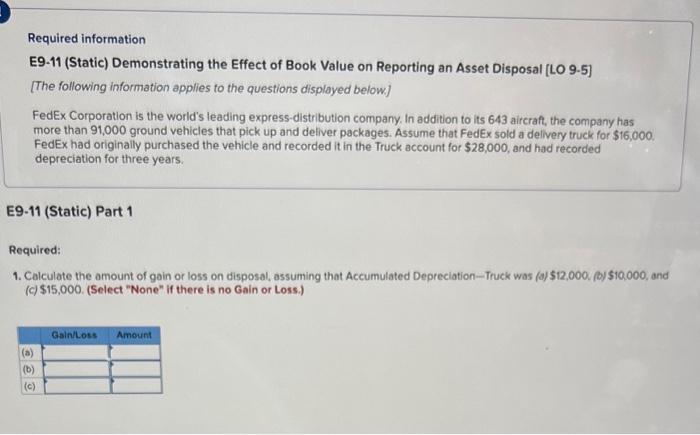

Required information E9-11 (Static) Demonstrating the Effect of Book Value on Reporting an Asset Disposal [LO 9-5] [The following information applies to the questions displayed below] FedEx Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 91,000 ground vehicles that pick up and deliver packages. Assume that FedEx sold a delivery truck for $16,000. FedEx had originally purchased the vehicle and recorded it in the Truck account for $28,000, and had recorded depreciation for three years. e9-11 (Static) Part 1 Required: 1. Calculate the amount of gain or loss on disposal, assuming that Accumulated Depreciation-Truck was (a)$12,000,(0)$10,000, and (c) $15,000. (Select "None" if there is no Gain or Loss.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts