Question: Required Information E9-2 Computing and Recording a Basket Purchase and Straight-Line Depreciation (LO 9-2, LO 9-3) {The following Information applies to the questions displayed below)

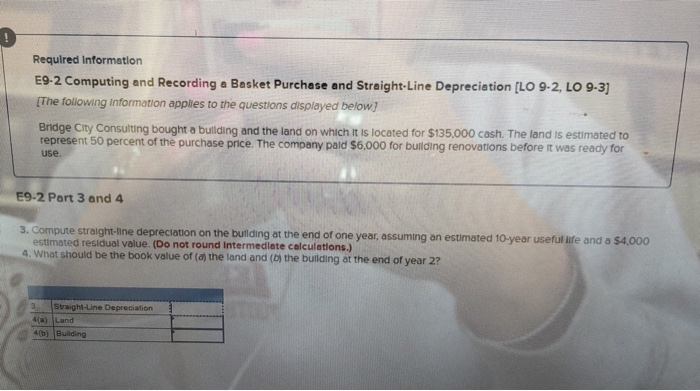

Required Information E9-2 Computing and Recording a Basket Purchase and Straight-Line Depreciation (LO 9-2, LO 9-3) {The following Information applies to the questions displayed below) Bridge City Consulting bought a building and the land on which it is located for $135,000 cash. The land is estimated to represent 50 percent of the purchase price. The company paid $6.000 for building renovations before it was ready for use E9-2 Part 3 and 4 3. Compute straight-line depreciation on the building at the end of one year, assuming an estimated 10-year useful life and a $4,000 estimated residual value. (Do not round Intermediate calculations.) 4. What should be the book value of (a) the land and (b) the building at the end of year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts