Question: Required information Exercise 1 1 - 2 3 ( Algo ) Change in estimate; useful life and residual value of equipment [ LO 1 1

Required information

Exercise Algo Change in estimate; useful life and residual value of equipment LO

The following information applies to the questions displayed below.

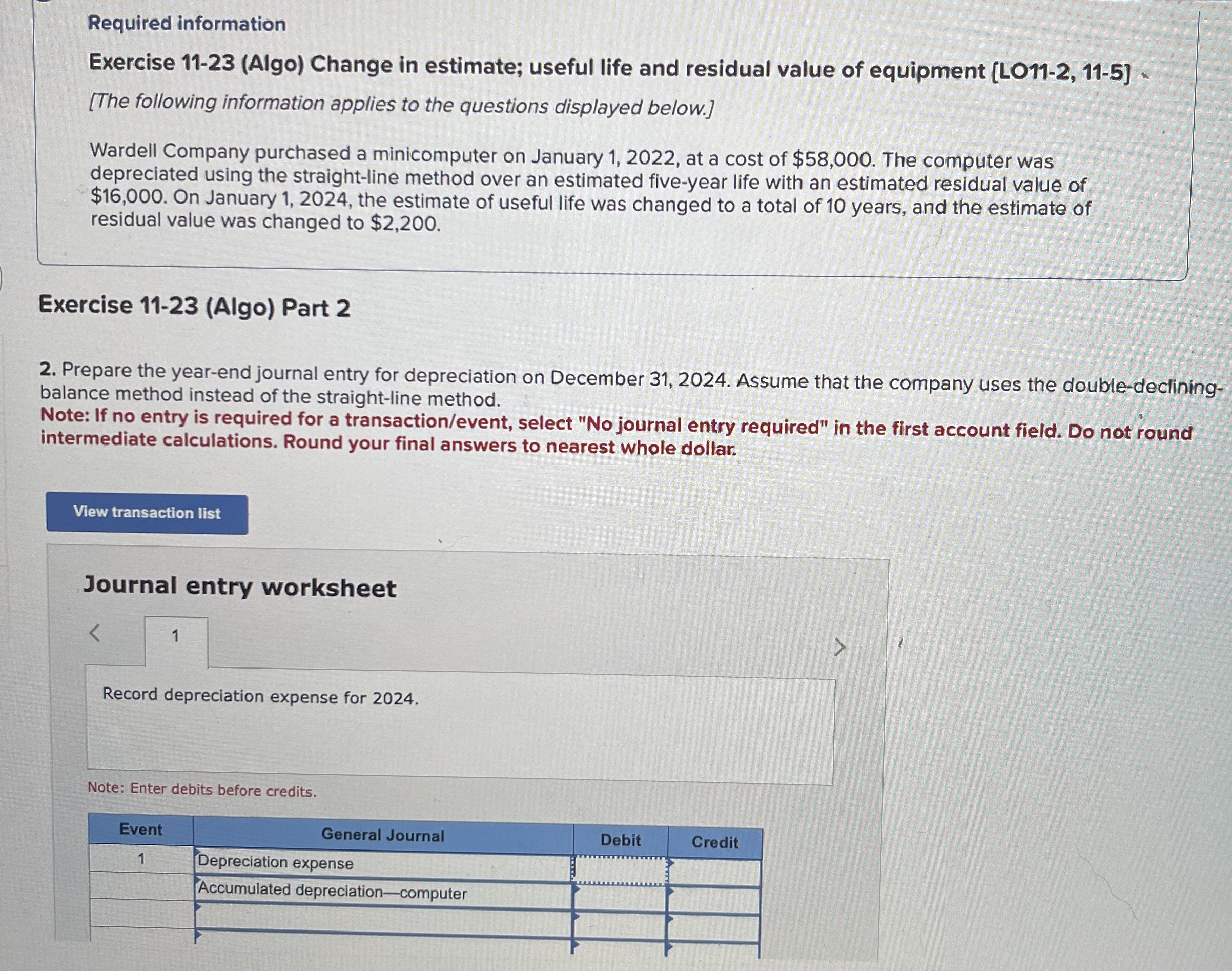

Wardell Company purchased a minicomputer on January at a cost of $ The computer was

depreciated using the straightline method over an estimated fiveyear life with an estimated residual value of

$ On January the estimate of useful life was changed to a total of years, and the estimate of

residual value was changed to $

Exercise Algo Part

Prepare the yearend journal entry for depreciation on December Assume that the company uses the doubledeclining

balance method instead of the straightline method.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Do not round

intermediate calculations. Round your final answers to nearest whole dollar.

Journal entry worksheet

Record depreciation expense for

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock