Question: Required information Exercise 1 1 - 3 ( Algo ) Depreciation methods; partial periods [ LO 1 1 - 2 ] [ The following information

Required information

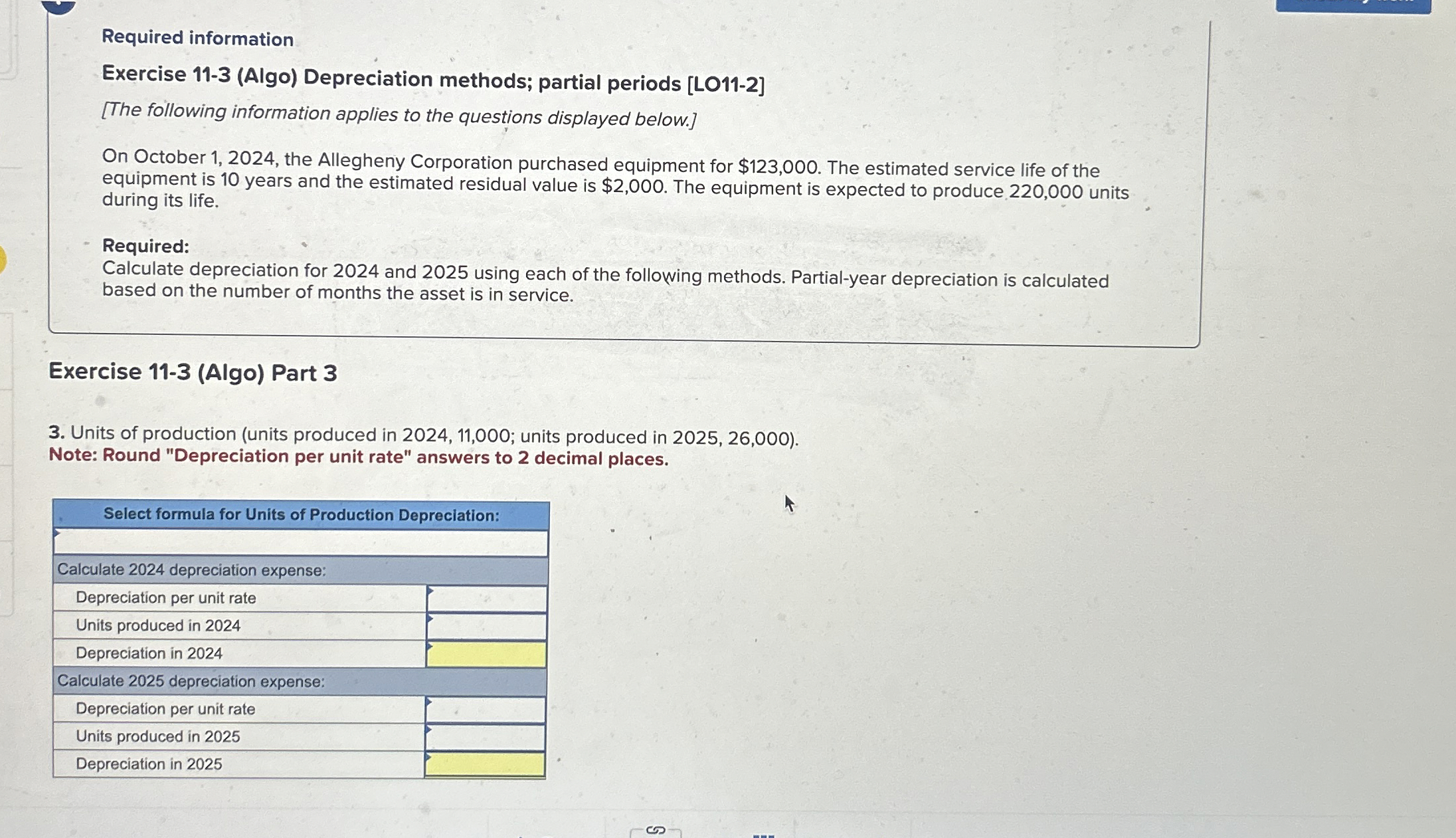

Exercise Algo Depreciation methods; partial periods LO

The following information applies to the questions displayed below.

On October the Allegheny Corporation purchased equipment for $ The estimated service life of the equipment is years and the estimated residual value is $ The equipment is expected to produce units during its life.

Required:

Calculate depreciation for and using each of the following methods. Partialyear depreciation is calculated based on the number of months the asset is in service.

Exercise Algo Part

Units of production units produced in ; units produced in

Note: Round "Depreciation per unit rate" answers to decimal places.

tableSelect formula for Units of Production Depreciation:Calculate depreciation expense:Depreciation per unit rateUnits produced in Depreciation in Calculate depreciation expense:Depreciation per unit rateUnits produced in Depreciation in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock