Question: Required information Exercise 11-37 (Static) IFRS; amortization; cost to defend a patent [LO11-4, 11-9, 11-10] [The following information applies to the questions displayed below.] On

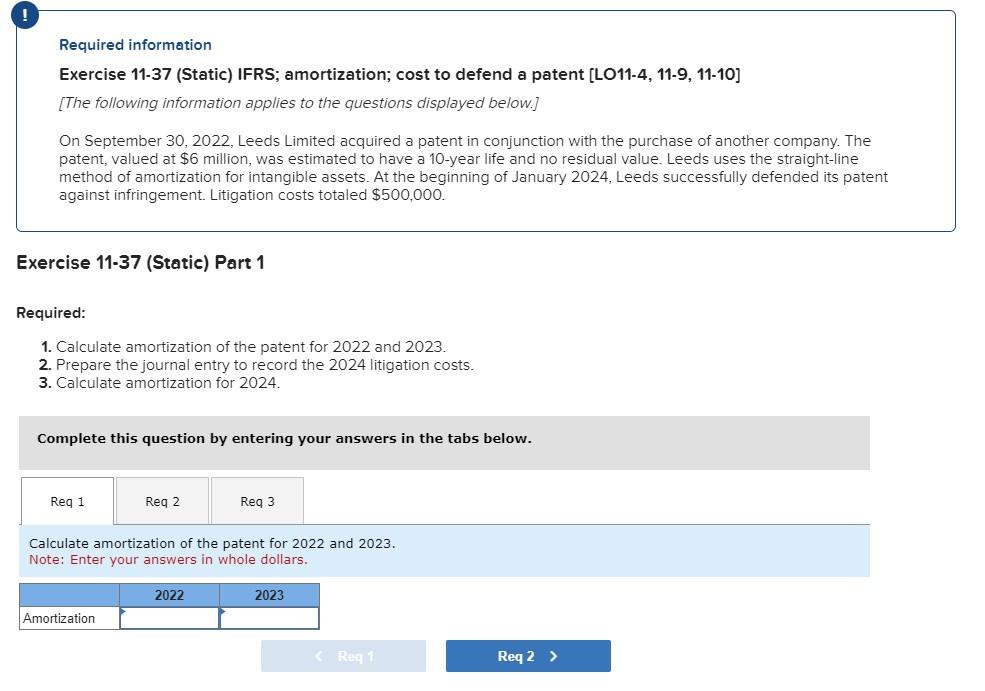

Required information Exercise 11-37 (Static) IFRS; amortization; cost to defend a patent [LO11-4, 11-9, 11-10] [The following information applies to the questions displayed below.] On September 30, 2022, Leeds Limited acquired a patent in conjunction with the purchase of another company. The patent, valued at $6 million, was estimated to have a 10 -year life and no residual value. Leeds uses the straight-line method of amortization for intangible assets. At the beginning of January 2024, Leeds successfully defended its patent against infringement. Litigation costs totaled $500,000. Exercise 11-37 (Static) Part 1 Required: 1. Calculate amortization of the patent for 2022 and 2023. 2. Prepare the journal entry to record the 2024 litigation costs. 3. Calculate amortization for 2024. Complete this question by entering your answers in the tabs below. Calculate amortization of the patent for 2022 and 2023. Note: Enter your answers in whole dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts