Question: Required information Exercise 12-48 (Algo) Comparing Mutually Exclusive Projects; Uneven Cash Flows; Strategy [LO 12-4, 12- 9] [The following information applies to the questions

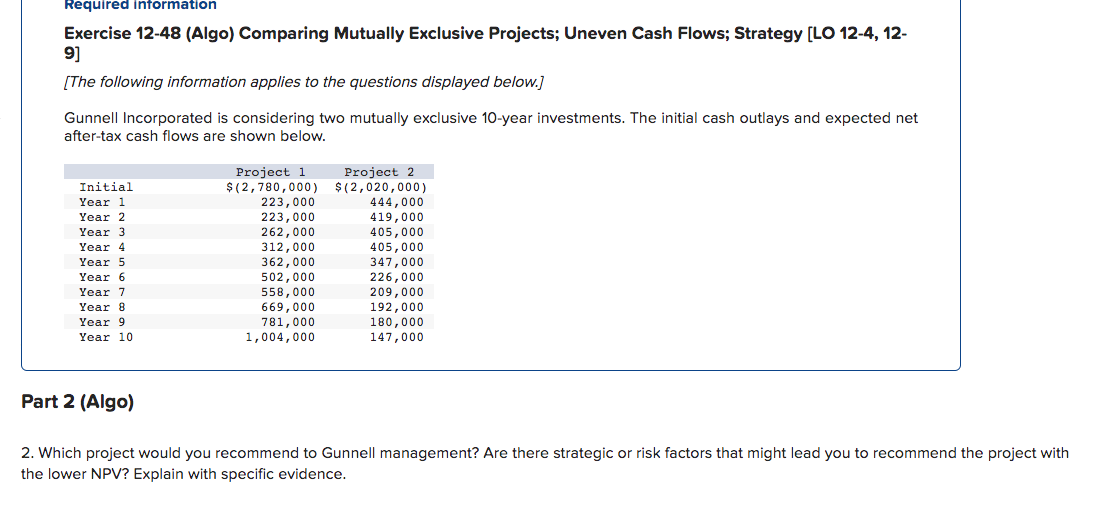

Required information Exercise 12-48 (Algo) Comparing Mutually Exclusive Projects; Uneven Cash Flows; Strategy [LO 12-4, 12- 9] [The following information applies to the questions displayed below.] Gunnell Incorporated is considering two mutually exclusive 10-year investments. The initial cash outlays and expected net after-tax cash flows are shown below. Project 1 Project 2 Initial Year 1 $(2,780,000) $(2,020,000) 223,000 444,000 Year 2 223,000 419,000 Year 3 262,000 405,000 Year 4 312,000 405,000 Year 5 362,000 347,000 Year 6 502,000 226,000 Year 7 558,000 209,000 Year 8 669,000 192,000 Year 9 781,000 180,000 Year 10. 1,004,000 147,000 Part 2 (Algo) 2. Which project would you recommend to Gunnell management? Are there strategic or risk factors that might lead you to recommend the project with the lower NPV? Explain with specific evidence.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts