Question: Required information Exercise 13-34 General Transfer-Pricing Rule (LO 13-6) Skip to question [The following information applies to the questions displayed below.] Required information Exercise 13-34

Required information Exercise 13-34 General Transfer-Pricing Rule (LO 13-6) Skip to question [The following information applies to the questions displayed below.]

Required information Exercise 13-34 General Transfer-Pricing Rule (LO 13-6) Skip to question [The following information applies to the questions displayed below.]

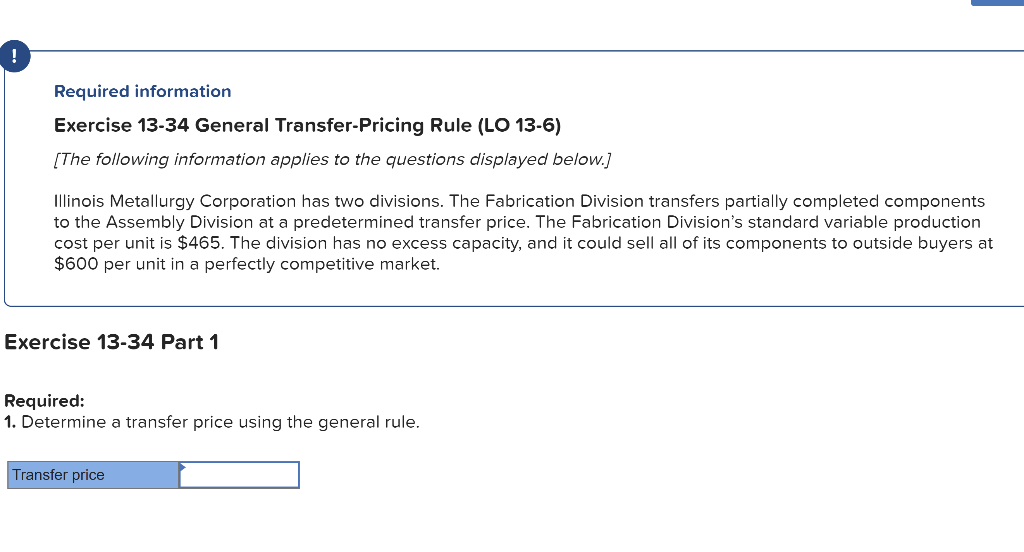

Required information Exercise 13-34 General Transfer-Pricing Rule (LO 13-6) [The following information applies to the questions displayed below.] Illinois Metallurgy Corporation has two divisions. The Fabrication Division transfers partially completed components to the Assembly Division at a predetermined transfer price. The Fabrication Division's standard variable production cost per unit is $465. The division has no excess capacity, and it could sell all of its components to outside buyers at $600 per unit in a perfectly competitive market. Exercise 13-34 Part 1 Required: 1. Determine a transfer price using the general rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts