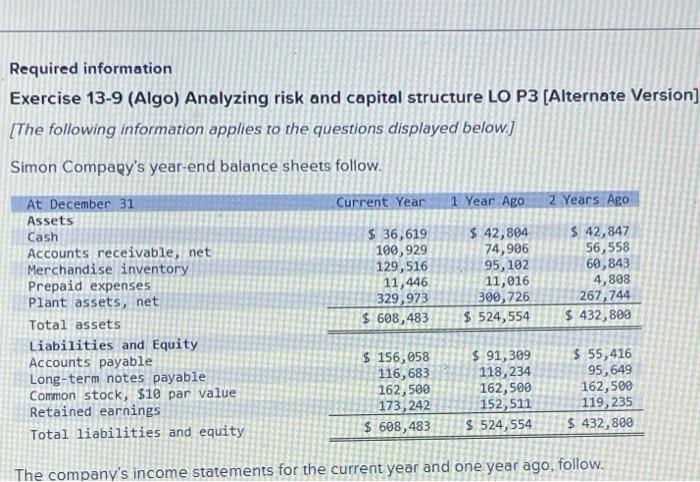

Question: Required information Exercise 13-9 (Algo) Analyzing risk and capital structure LO P3 [Alternate Version] [The following information applies to the questions displayed below.) Simon Company's

![P3 [Alternate Version] [The following information applies to the questions displayed below.)](https://s3.amazonaws.com/si.experts.images/answers/2024/07/668e27849d79a_260668e27844087d.jpg)

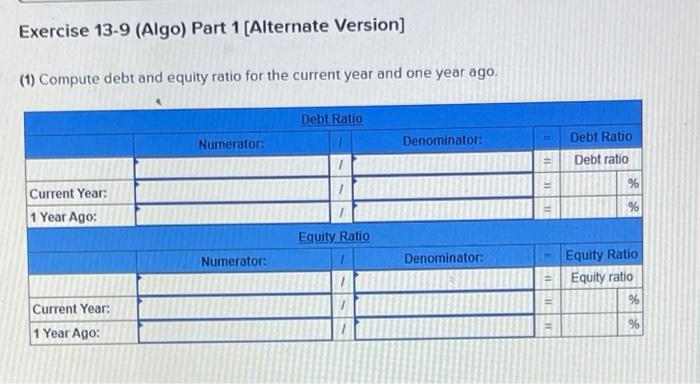

Required information Exercise 13-9 (Algo) Analyzing risk and capital structure LO P3 [Alternate Version] [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash $ 36,619 100,929 129,516 11,446 329,973 $ 608,483 $ 42,804 74,906 95, 102 11,016 300,726 $ 524,554 $ 42,847 56,558 60,843 4,808 267, 744 $ 432,800 Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 156,058 116,683 162,500 173, 242 $ 608,483 $ 91,309 118,234 162,500 152,511 $ 524,554 $ 55,416 95,649 162,500 119, 235 $ 432,800 The company's income statements for the current year and one year ago, follow. The company's income statements for the current year and one year ago, follow For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Year $ 791,028 $482,527 245,219 13,447 10,283 751,476 $ 39,552 $ 2.43 1 Year Ago S 624,219 $ 405,742 157,927 14,357 9.363 587,389 $ 36,830 $ 2.27 Exercise 13-9 (Algo) Part 1 (Alternate Version] (1) Compute debt and equity ratio for the current year and one year ago. Debt Ratio Numerator: Denominator Debt Ratio Debt ratio III % Current Year: 1 Year Ago: % Equity Ratio Numerator: Denominator: Equity Ratio Equity ratio % 11 Current Year: 11 % 1 Year Ago

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts