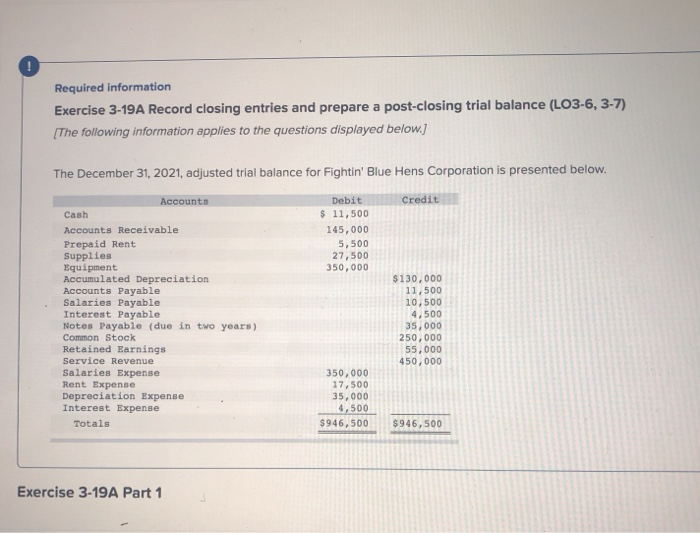

Question: Required information Exercise 3-19A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) The following information applies to the questions displayed below.] The

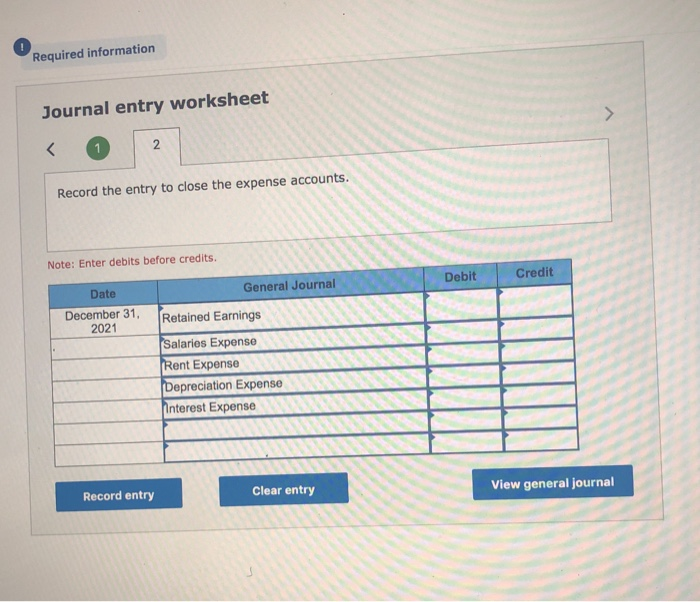

Required information Exercise 3-19A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) The following information applies to the questions displayed below.] The December 31, 2021, adjusted trial balance for Fightin' Blue Hens Corporation is presented below. Credit Debit $ 11,500 145,000 5,500 27,500 350,000 Accounts Cash Accounts Receivable Prepaid Rent Supplies Equipment Accumulated Depreciation Accounts Payable Salaries Payable Interest Payable Notes Payable (due in two years) Common Stock Retained Earnings Service Revenue Salaries Expense Rent Expense Depreciation Expense Interest Expense Totals $130,000 11,500 10,500 4,500 35,000 250,000 55,000 450,000 350,000 17,500 35,000 4,500 $946,500 $946,500 Exercise 3-19A Part 1 Required information Journal entry worksheet Record the entry to close the expense accounts. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2021 Retained Earnings Salaries Expense Rent Expense Depreciation Expense Interest Expense Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts