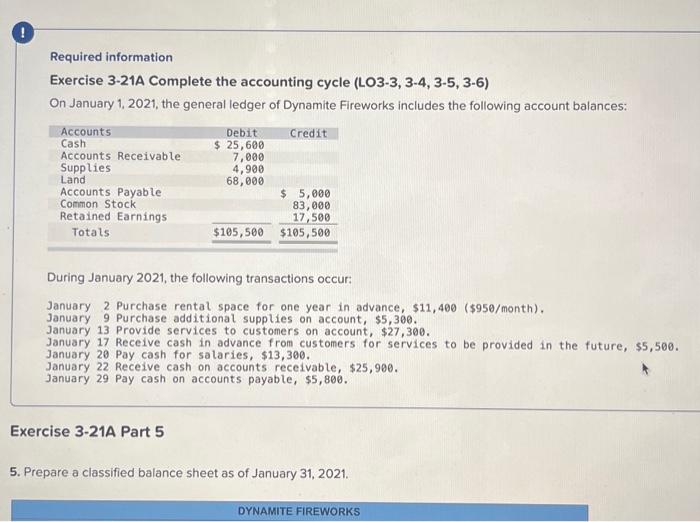

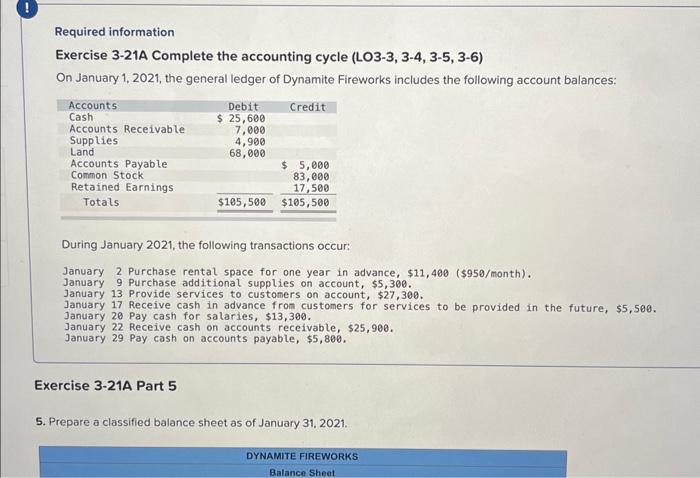

Question: Required information Exercise 3-21A Complete the accounting cycle (LO3-3, 3-4, 3-5, 3-6) On January 1, 2021, the general ledger of Dynamite Fireworks includes the following

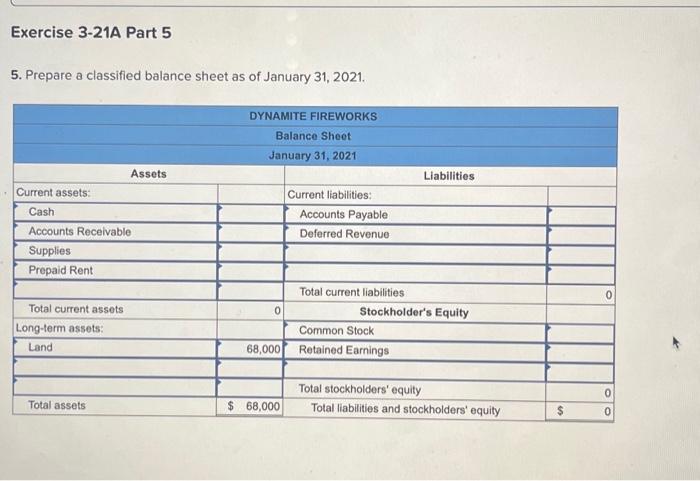

Required information Exercise 3-21A Complete the accounting cycle (LO3-3, 3-4, 3-5, 3-6) On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 Purchase rental space for one year in advance, $11,400 ( $950/ month), January 9 Purchase additional supplies on account, $5,300. January 13 Provide services to customers on account, $27,300. January 17 Receive cash in advance from customers for services to be provided in the future, $5,500. January 20 Pay cash for salaries, $13,300. January 22 Receive cash on accounts receivable, $25,900. January 29 Pay cash on accounts payable, $5,800. January 2 Purchase rental space for one year in advance, $11,400 ( $950/ month). January 9 Purchase additional supplies on account, $5,300. January 13 Provide services to customers on account, $27,300. January 17 Receive cash in advance from customers for services to be provided in the future, $5,500. January 20 Pay cash for salaries, $13,300. January 22 Receive cash on accounts receivable, $25,900. January 29 Pay cash on accounts payable, $5,800. Exercise 3-21A Part 5 5. Prepare a classified balance sheet as of January 31, 2021. 5. Prepare a classified balance sheet as of January 31,2021. Required information Exercise 3-21A Complete the accounting cycle (LO3-3, 3-4, 3-5, 3-6) On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 Purchase rental space for one year in advance, $11,400 ( $950/ month). January 9 Purchase additional supplies on account, $5,300. January 13 Provide services to customers on account, $27,300. January 17 Receive cash in advance from customers for services to be provided in the future, $5,500. January 20 Pay cash for salaries, $13,300. January 22 Receive cash on accounts receivable, $25,900. January 29 Pay cash on accounts payable, $5,800. January 2 Purchase rental space for one year in advance, $11,400 ( $950/ month). January 9 Purchase additional supplies on account, $5,300. January 13 Provide services to customers on account, $27,300. January 17 Receive cash in advance from customers for services to be provided in the future, $5,500. January 20 Pay cash for salaries, $13,300. January 22 Receive cash on accounts receivable, $25,900. January 29 Pay cash on accounts payable, $5,800. Exercise 3-21A Part 5 5. Prepare a classified balance sheet as of January 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts