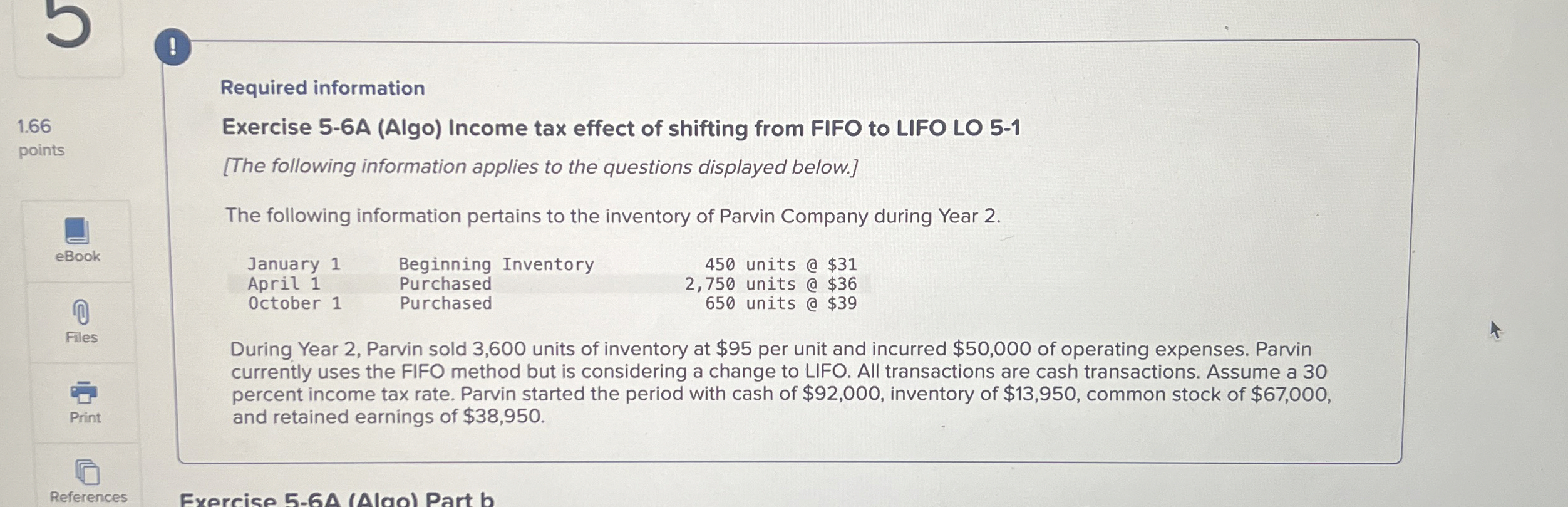

Question: Required information Exercise 5 - 6 A ( Algo ) Income tax effect of shifting from FIFO to LIFO LO 5 - 1 [ The

Required information

Exercise A Algo Income tax effect of shifting from FIFO to LIFO LO

The following information applies to the questions displayed below.

The following information pertains to the inventory of Parvin Company during Year

During, Year Parvin sold units of inventory at $ per unit and incurred $ of operating expenses. Parvin

currently uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a

percent income tax rate. Parvin started the period with cash of $ inventory of $ common stock of $

and retained earnings of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock