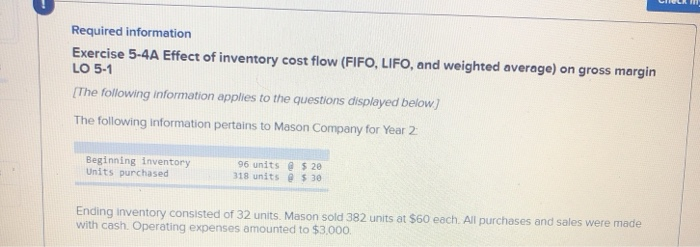

Question: Required information Exercise 5-4A Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1 [The following information applies to the

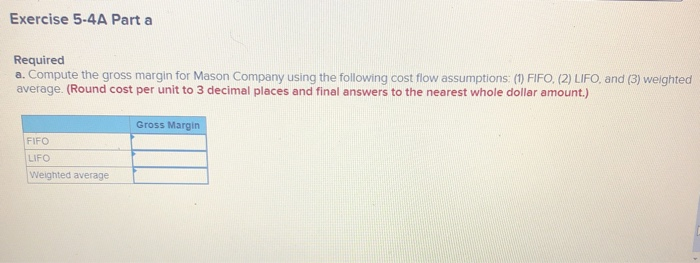

Required information Exercise 5-4A Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1 [The following information applies to the questions displayed below) The following information pertains to Mason Company for Year 2 Beginning inventory Units purchased 96 units 20 318 units @ $30 Ending inventory consisted of 32 units. Mason sold 382 units at $60 each. All purchases and sales were made with cash Operating expenses amounted to $3.000. Exercise 5-4A Part a Required a. Compute the gross margin for Mason Company using the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. (Round cost per unit to 3 decimal places and final answers to the nearest whole dollar amount.) Gross Margin FIFO LIFO Weighted average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts