Question: Required information Exercise 6-11 (Algo) Absorption costing and variable costing income statements LO P2 Skip to question [The following information applies to the questions displayed

Required information

Exercise 6-11 (Algo) Absorption costing and variable costing income statements LO P2

Skip to question

[The following information applies to the questions displayed below.]

Oak Mart, a producer of solid oak tables, reports the following data from its first year of business.

| Sales price per unit | $ 375 | per unit |

|---|---|---|

| Units produced this year | 127,000 | units |

| Units sold this year | 127,000 | units |

| Variable selling and administrative expenses | $ 23 | per unit |

| Fixed selling and administrative expenses | $ 4,655,000 | per year |

| Direct materials | $ 51 | per unit |

| Direct labor | $ 73 | per unit |

| Variable overhead | $ 39 | per unit |

| Fixed overhead | $ 8,890,000 | per year |

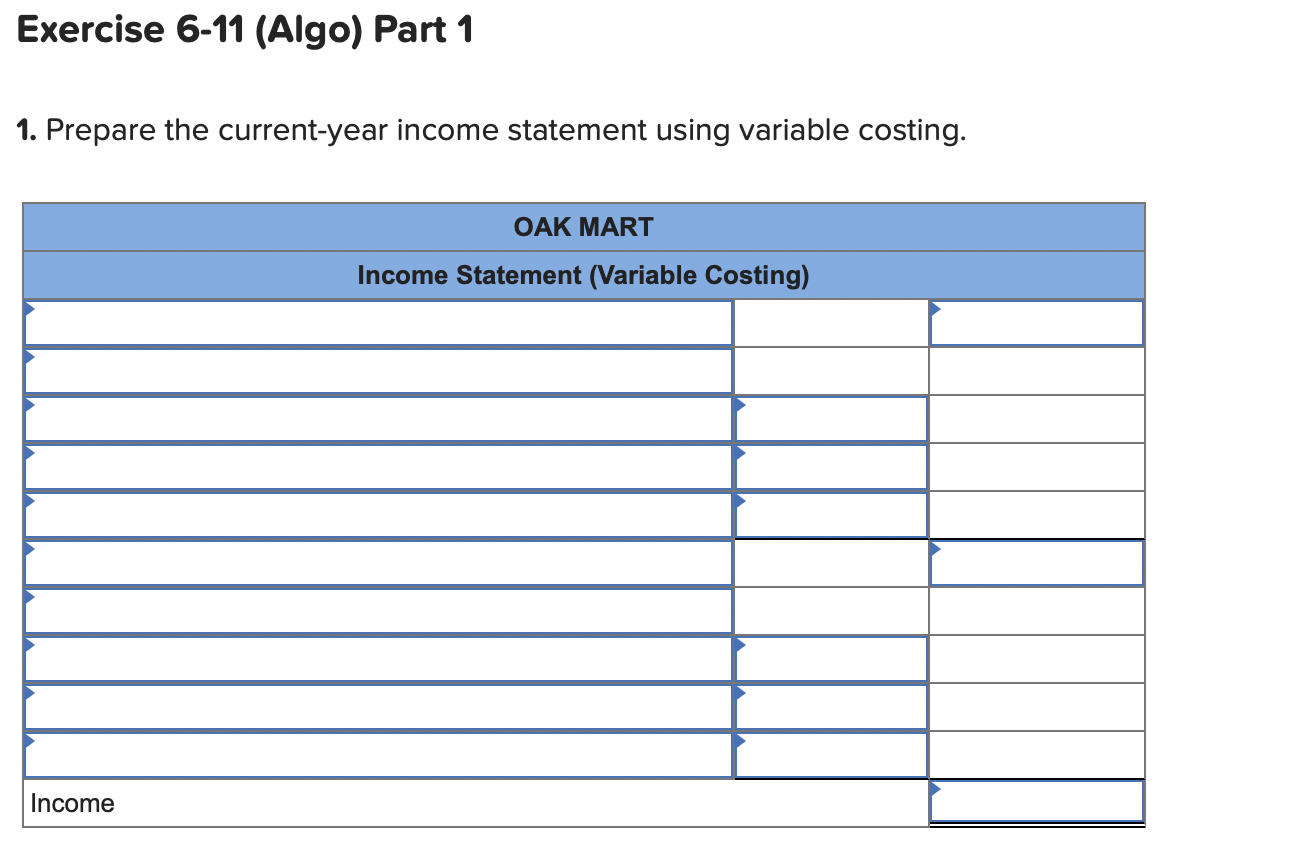

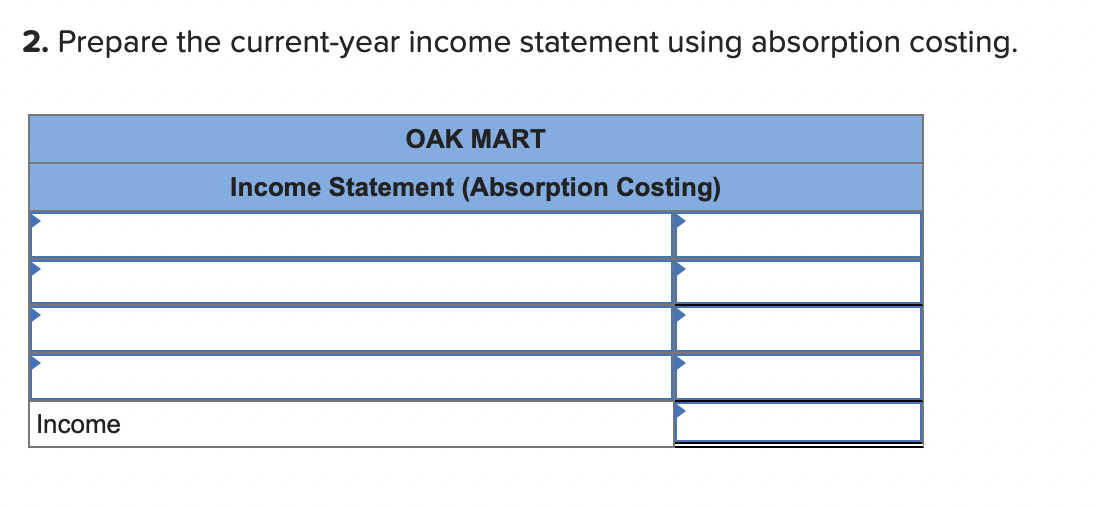

1. Prepare the current-year income statement using variable costing. 2. Prepare the current-year income statement using absorption costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts