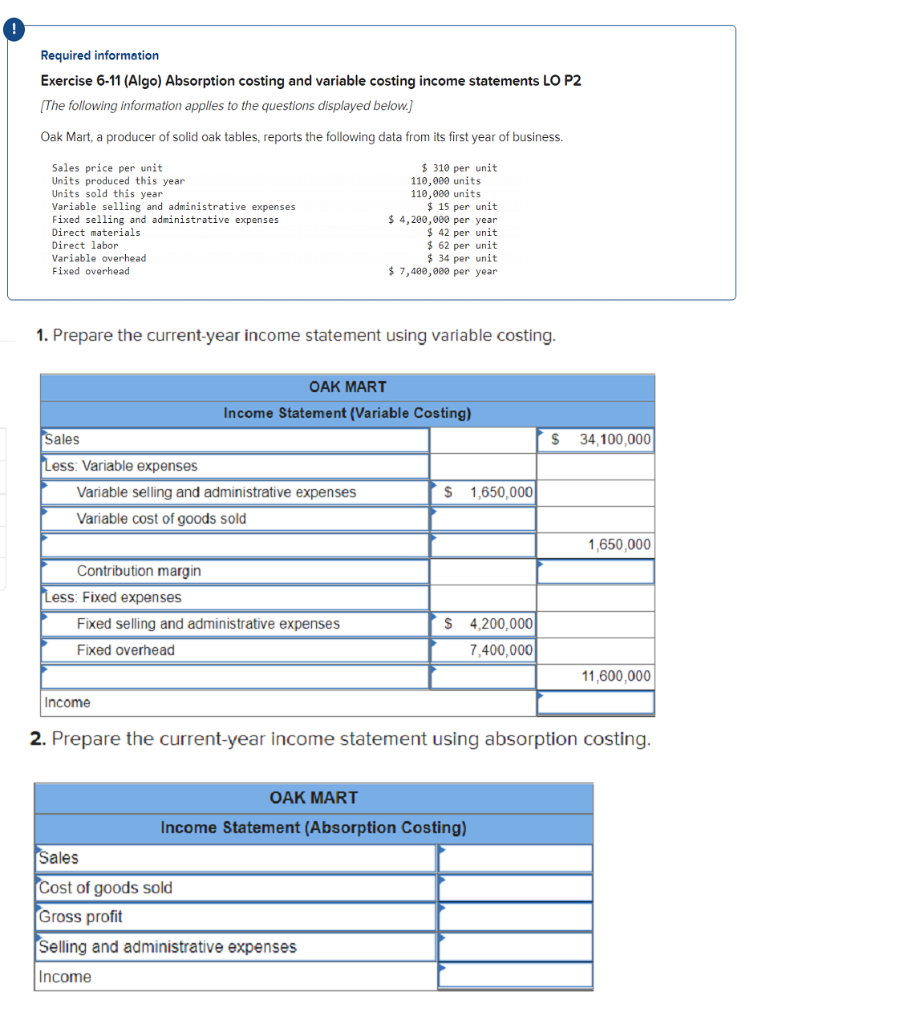

Question: Required information Exercise 6-11 (Algo) Absorption costing and variable costing income statements LO P2 (The following information applies to the questions displayed below.) Oak Mart,

Required information Exercise 6-11 (Algo) Absorption costing and variable costing income statements LO P2 (The following information applies to the questions displayed below.) Oak Mart, a producer of solid oak tables, reports the following data from its first year of business. Sales price per unit Units produced this year Units sold this year Variable selling and administrative expenses Fixed selling and administrative expenses Direct materials Direct labor Variable overhead Fixed overhead $ 310 per unit 110,000 units 110,000 units $ 15 per unit $ 4,200,000 per year $ 42 per unit $ 62 per unit $ 34 per unit $ 7,400,988 per year 1. Prepare the current-year income statement using variable costing. OAK MART Income Statement (Variable Costing) Sales $ 34,100,000 Less: Variable expenses Variable selling and administrative expenses Variable cost of goods sold $ 1,650,000 1,650,000 Contribution margin Less: Fixed expenses Fixed selling and administrative expenses $ 4,200,000 7,400,000 Fixed overhead 11,600,000 Income 2. Prepare the current-year income statement using absorption costing. OAK MART Income Statement (Absorption Costing) Sales Cost of goods sold Gross profit Selling and administrative expenses Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts