Question: Required information Exercise 6.9 Income statement under absorption costing and variable costing LO 1, P2 The following information applies to the questions displayed below Cool

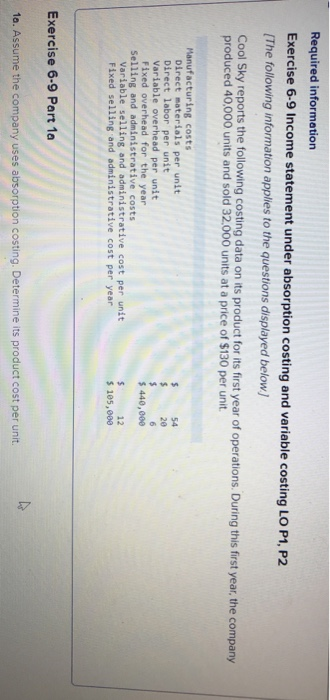

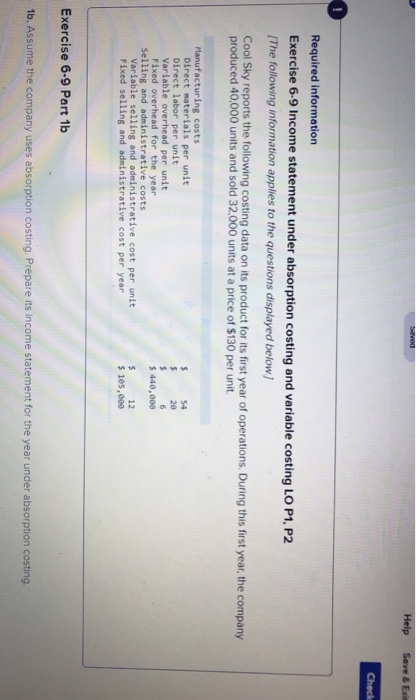

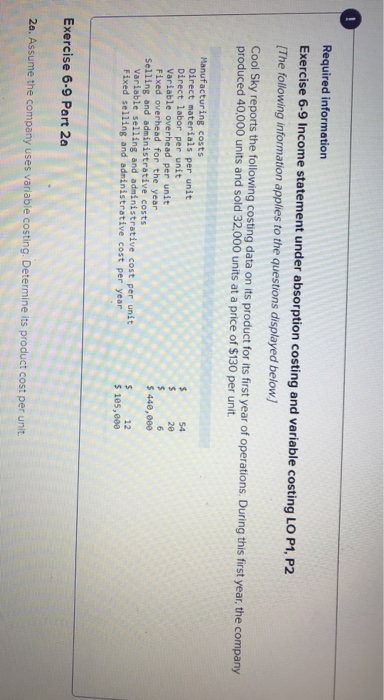

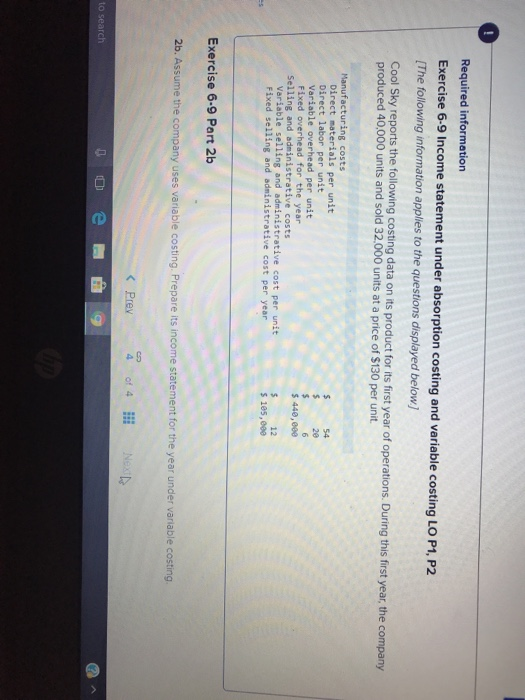

Required information Exercise 6.9 Income statement under absorption costing and variable costing LO 1, P2 The following information applies to the questions displayed below Cool Sky reports the following costing data on its product for its first year of operations. During this first year, the company produced 40,000 units and sold 32.000 units at a price of $130 per unit Manufacturing costs Direct materials per unit Direct labor per unit Variable overhead per unit Fixed overhead for the year 20 440,000 12 Selling and administrative costs Variable selling and administrative cost per unit Fixed selling and administrative cost per year 5 105,088 Exercise 6-9 Part 1a 1a. Assume the company uses absorption costing. Determine its product cost per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts