Question: - Required information Exercise 7-10A Determine depreciation for the first year under three methods (L07-4) [The following information applies to the questions displayed below.) Super

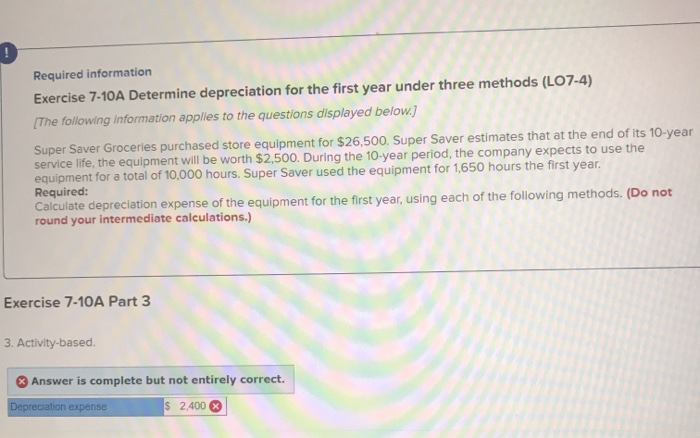

- Required information Exercise 7-10A Determine depreciation for the first year under three methods (L07-4) [The following information applies to the questions displayed below.) Super Saver Groceries purchased store equipment for $26,500. Super Saver estimates that at the end of its 10-year service life, the equipment will be worth $2,500. During the 10-year period, the company expects to use the equipment for a total of 10,000 hours. Super Saver used the equipment for 1,650 hours the first year. Required: Calculate depreciation expense of the equipment for the first year, using each of the following methods. (Do not round your intermediate calculations.) Exercise 7-10A Part 3 3. Activity-based Answer is complete but not entirely correct. Depreciation expense $ 2,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts