Question: Required information Exercise 7-11A Determine depreciation under three methods (L07-4) [The following information applies to the questions displayed below.] Speedy Delivery Company purchases a delivery

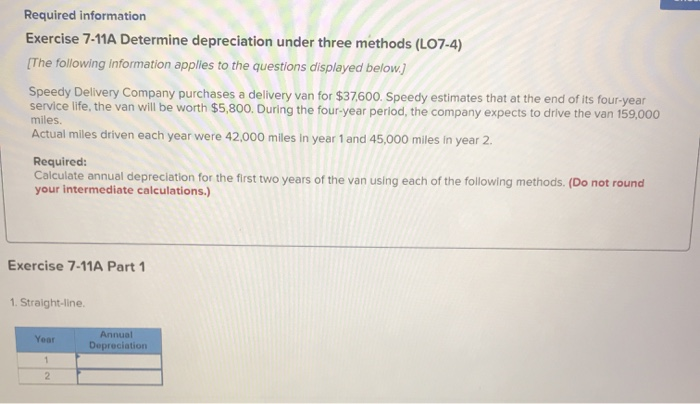

Required information Exercise 7-11A Determine depreciation under three methods (L07-4) [The following information applies to the questions displayed below.] Speedy Delivery Company purchases a delivery van for $37,600. Speedy estimates that at the end of its four-year service life, the van will be worth $5,800. During the four-year period, the company expects to drive the van 159,000 miles. Actual miles driven each year were 42,000 miles in year 1 and 45,000 miles in year 2. Required: Calculate annual depreciation for the first two years of the van using each of the following methods. (Do not round your intermediate calculations.) Exercise 7-11A Part 1 1. Straight-line. Year Annual Depreciation 1 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts