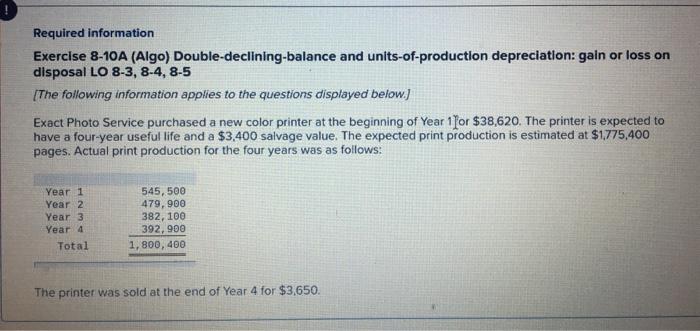

Question: Required information Exercise 8-10A (Algo) Double-declining-balance and units-of-production depreciation: gain or loss on disposal LO 8-3, 8-4, 8-5 (The following information applies to the questions

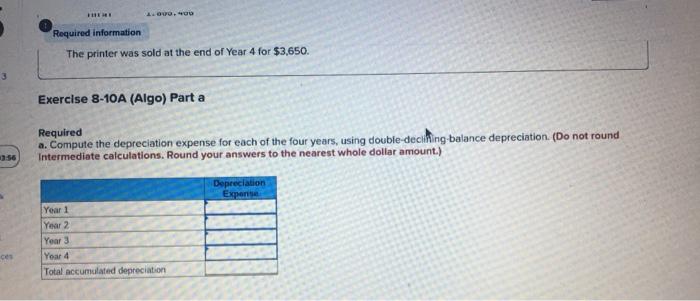

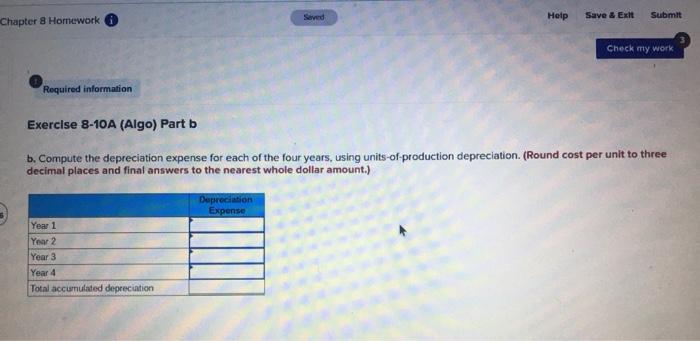

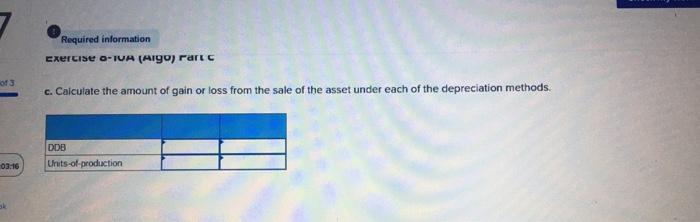

Required information Exercise 8-10A (Algo) Double-declining-balance and units-of-production depreciation: gain or loss on disposal LO 8-3, 8-4, 8-5 (The following information applies to the questions displayed below.) Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,620. The printer is expected to have a four-year useful life and a $3,400 salvage value. The expected print production is estimated at $1775,400 pages. Actual print production for the four years was as follows: Year 1 Year 2 Year 3 Year 4 Total 545,500 479,900 382, 100 392, 900 1,800, 400 The printer was sold at the end of Year 4 for $3,650. HEH! 1.0.900 Required information The printer was sold at the end of Year 4 for $3,650. Exercise 8-10A (Algo) Part a Required a. Compute the depreciation expense for each of the four years, using double-declining balance depreciation. (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount.) Depreciation Expense Year 1 [Year 2 Year 3 Year 4 Total accumulated depreciation Help Save & Exit Submit Chapter 8 Homework Check my work Required information Exercise 8-10A (Algo) Part b b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. (Round cost per unit to three decimal places and final answers to the nearest whole dollar amount.) Depreciation Expense Year 1 Year 2 Year 3 Year 4 Total accumulated depreciation Required information Exercise O-TUA (Aigo) rart c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. DDB Units-of-production 03.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts