Question: Required information Exercise 8-18 (Static) FIFO, LIFO, and average cost methods [LO8-1, 8-4] [The following information applies to the questions displayed below.) Causwell Company began

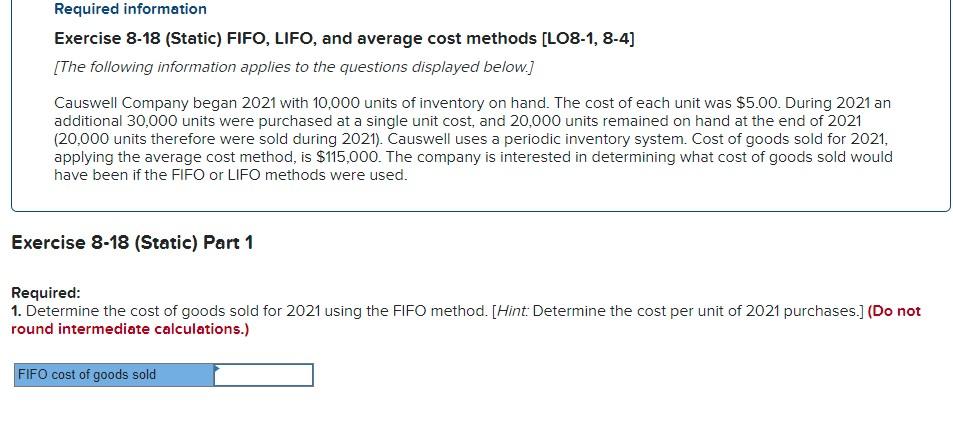

Required information Exercise 8-18 (Static) FIFO, LIFO, and average cost methods [LO8-1, 8-4] [The following information applies to the questions displayed below.) Causwell Company began 2021 with 10,000 units of inventory on hand. The cost of each unit was $5.00. During 2021 an additional 30,000 units were purchased at a single unit cost, and 20,000 units remained on hand at the end of 2021 (20,000 units therefore were sold during 2021). Causwell uses a periodic inventory system. Cost of goods sold for 2021, applying the average cost method, is $115,000. The company is interested in determining what cost of goods sold would have been if the FIFO or LIFO methods were used. Exercise 8-18 (Static) Part 1 Required: 1. Determine the cost of goods sold for 2021 using the FIFO method. (Hint: Determine the cost per unit of 2021 purchases.] (Do not round intermediate calculations.) FIFO cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts