Question: Required information Exercise 8-35 & 8-36 (Algo) (LO 8-5) [The following information applies to the questions displayed below.] The Matsui Lubricants plant uses the FIFO

![information applies to the questions displayed below.] The Matsui Lubricants plant uses](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea53c356b61_89866ea53c2e9ab6.jpg)

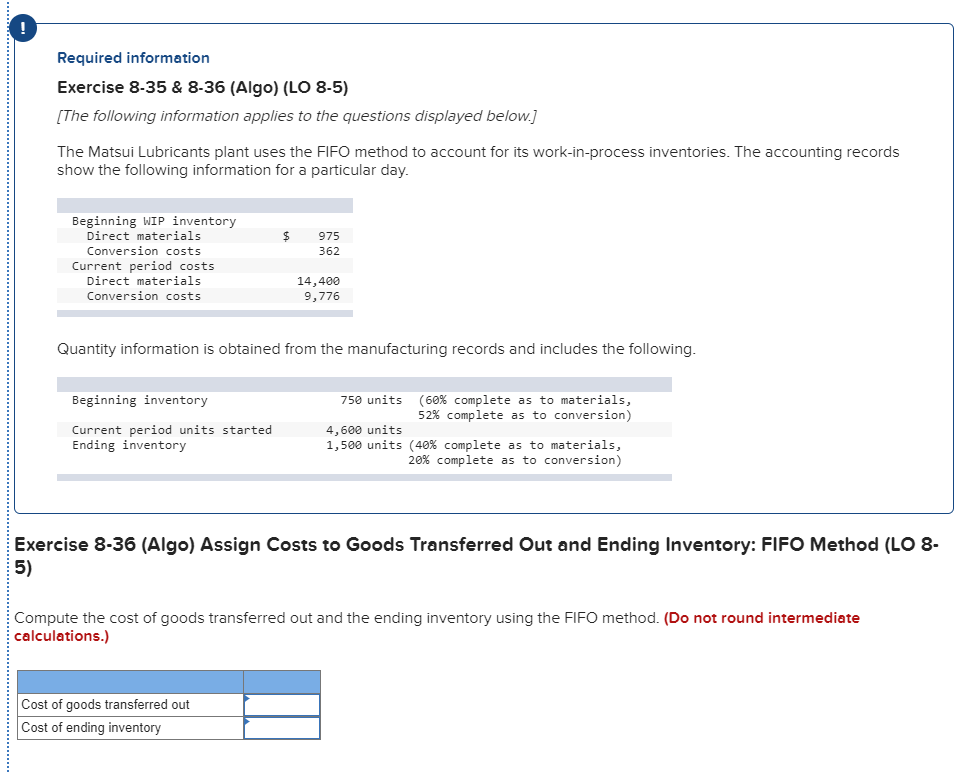

Required information Exercise 8-35 & 8-36 (Algo) (LO 8-5) [The following information applies to the questions displayed below.] The Matsui Lubricants plant uses the FIFO method to account for its work-in-process inventories. The accounting records show the following information for a particular day. $ 975 362 Beginning WIP inventory Direct materials Conversion costs Current period costs Direct materials Conversion costs 14,400 9,776 Quantity information is obtained from the manufacturing records and includes the following. Beginning inventory Current period units started Ending inventory 750 units (60% complete as to materials, 52% complete as to conversion) 4,600 units 1,500 units (40% complete as to materials, 20% complete as to conversion) Exercise 8-36 (Algo) Assign Costs to Goods Transferred Out and Ending Inventory: FIFO Method (LO 8- Compute the cost of goods transferred out and the ending inventory using the FIFO method. (Do not round intermediate calculations.) Cost of goods transferred out Cost of ending inventory Required information Exercise 8-35 & 8-36 (Algo) (LO 8-5) [The following information applies to the questions displayed below.] The Matsui Lubricants plant uses the FIFO method to account for its work-in-process inventories. The accounting records show the following information for a particular day. $ 975 362 Beginning WIP inventory Direct materials Conversion costs Current period costs Direct materials Conversion costs 14,400 9,776 Quantity information is obtained from the manufacturing records and includes the following. Beginning inventory Current period units started Ending inventory 750 units (60% complete as to materials, 52% complete as to conversion) 4,600 units 1,500 units (40% complete as to materials, 20% complete as to conversion) Exercise 8-36 (Algo) Assign Costs to Goods Transferred Out and Ending Inventory: FIFO Method (LO 8- Compute the cost of goods transferred out and the ending inventory using the FIFO method. (Do not round intermediate calculations.) Cost of goods transferred out Cost of ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts