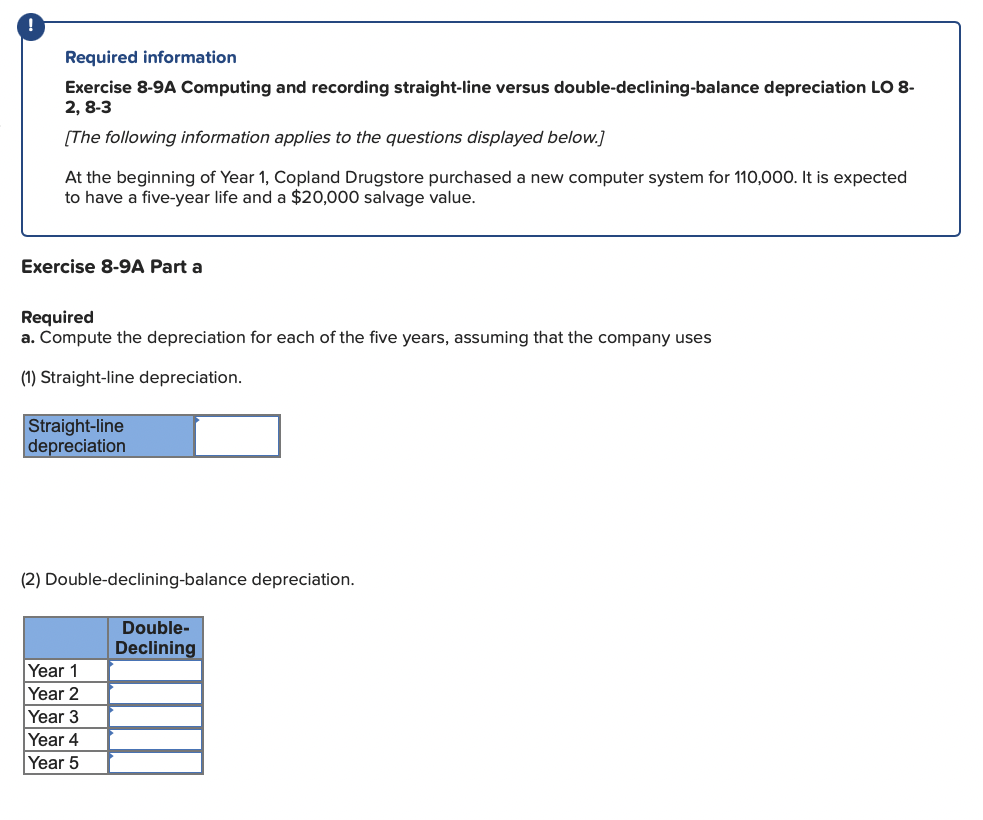

Question: Required information Exercise 8-9 A Computing and recording straight-line versus double-declining-balance depreciation LO 8- 2, 8-3 [The following information applies to the questions displayed below.)

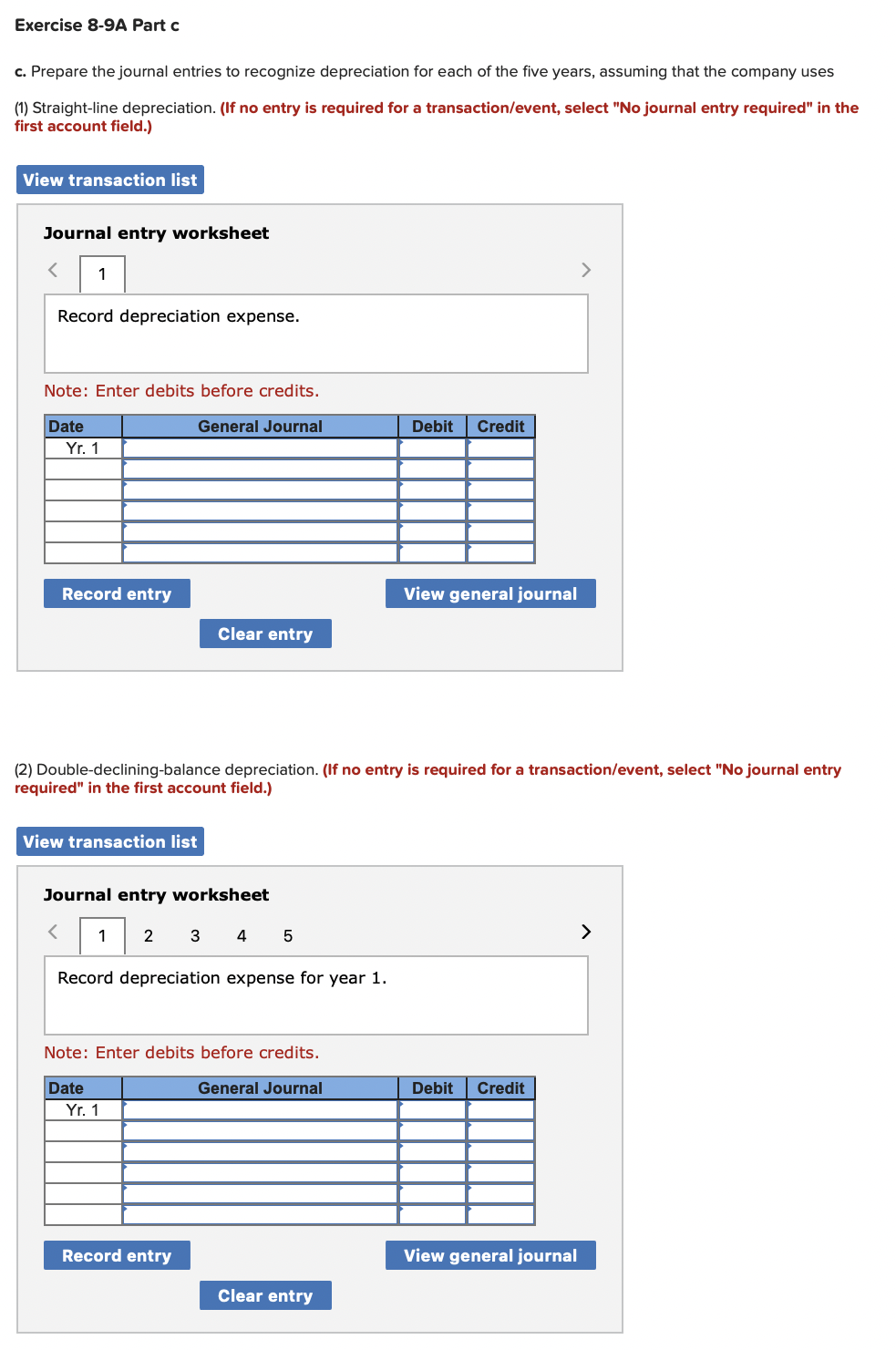

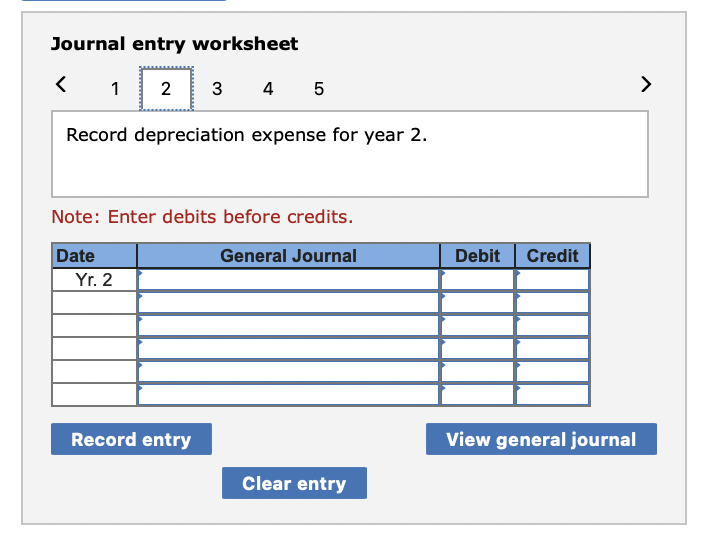

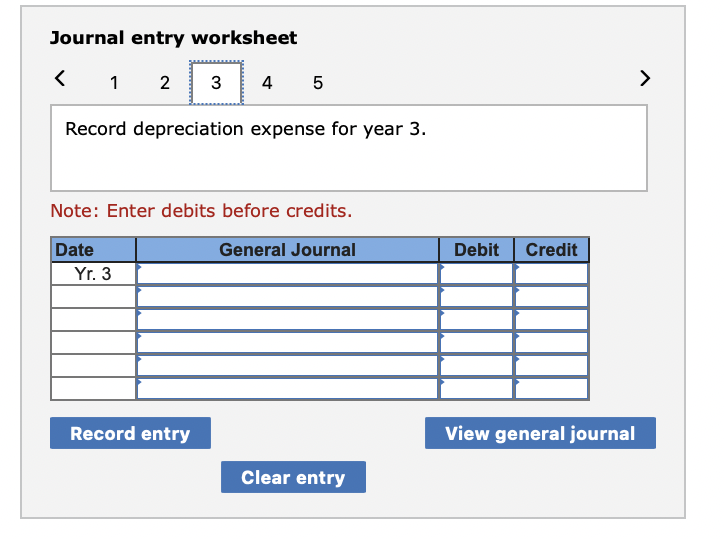

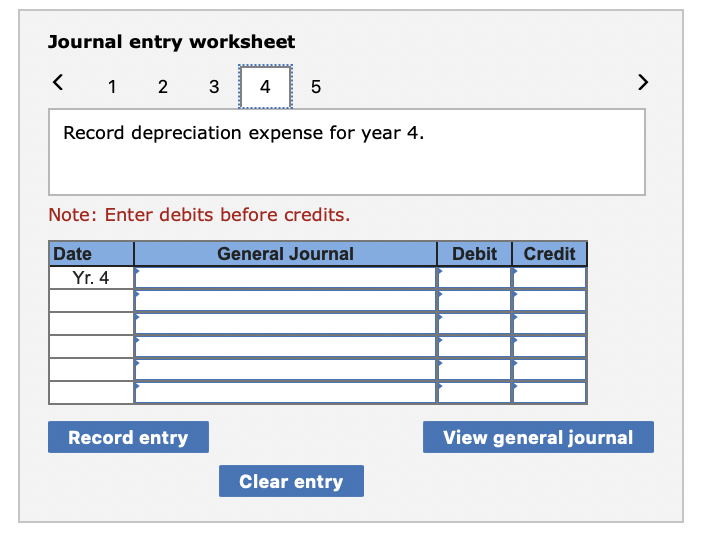

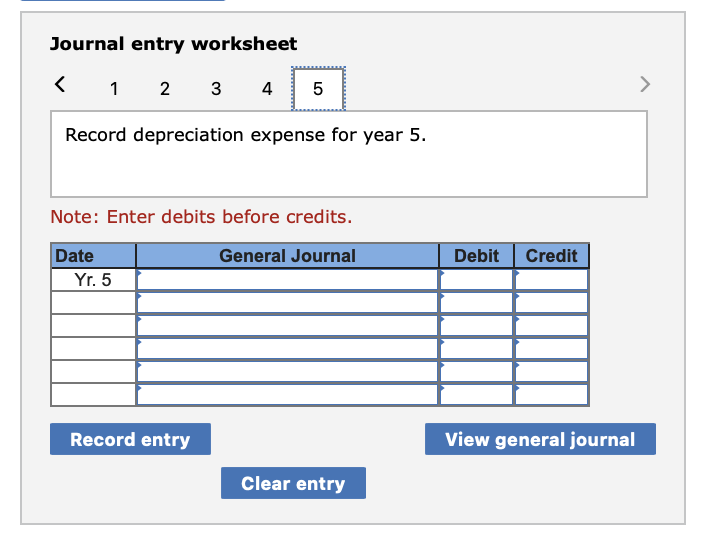

Required information Exercise 8-9 A Computing and recording straight-line versus double-declining-balance depreciation LO 8- 2, 8-3 [The following information applies to the questions displayed below.) At the beginning of Year 1, Copland Drugstore purchased a new computer system for 110,000. It is expected to have a five-year life and a $20,000 salvage value. Exercise 8-9A Part a Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. Straight-line depreciation (2) Double-declining-balance depreciation. Double- Declining Year 1 Year 2 Year 3 Year 4 Year 5 Exercise 8-9A Part c c. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record depreciation expense. Note: Enter debits before credits. General Journal Debit Credit Date Yr. 1 Record entry View general journal Clear entry (2) Double-declining-balance depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record depreciation expense for year 1. Note: Enter debits before credits. General Journal Debit Credit Date Yr. 1 Record entry View general journal Clear entry Journal entry worksheet Record depreciation expense for year 2. Note: Enter debits before credits. General Journal Debit Credit Date Yr. 2 Record entry View general journal Clear entry Journal entry worksheet Record depreciation expense for year 3. Note: Enter debits before credits. General Journal Debit Credit Date Yr. 3 Record entry View general journal Clear entry Journal entry worksheet Record depreciation expense for year 4. Note: Enter debits before credits. General Journal Debit Credit Date Yr. 4 Record entry View general journal Clear entry Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts