Question: Required information Exercise 9 - 8 A ( Algo ) Current liabilities LO 9 - 1 , 9 - 2 , 9 - 4 Skip

Required information

Exercise A Algo Current liabilities LO

Skip to question

The following information applies to the questions displayed below.

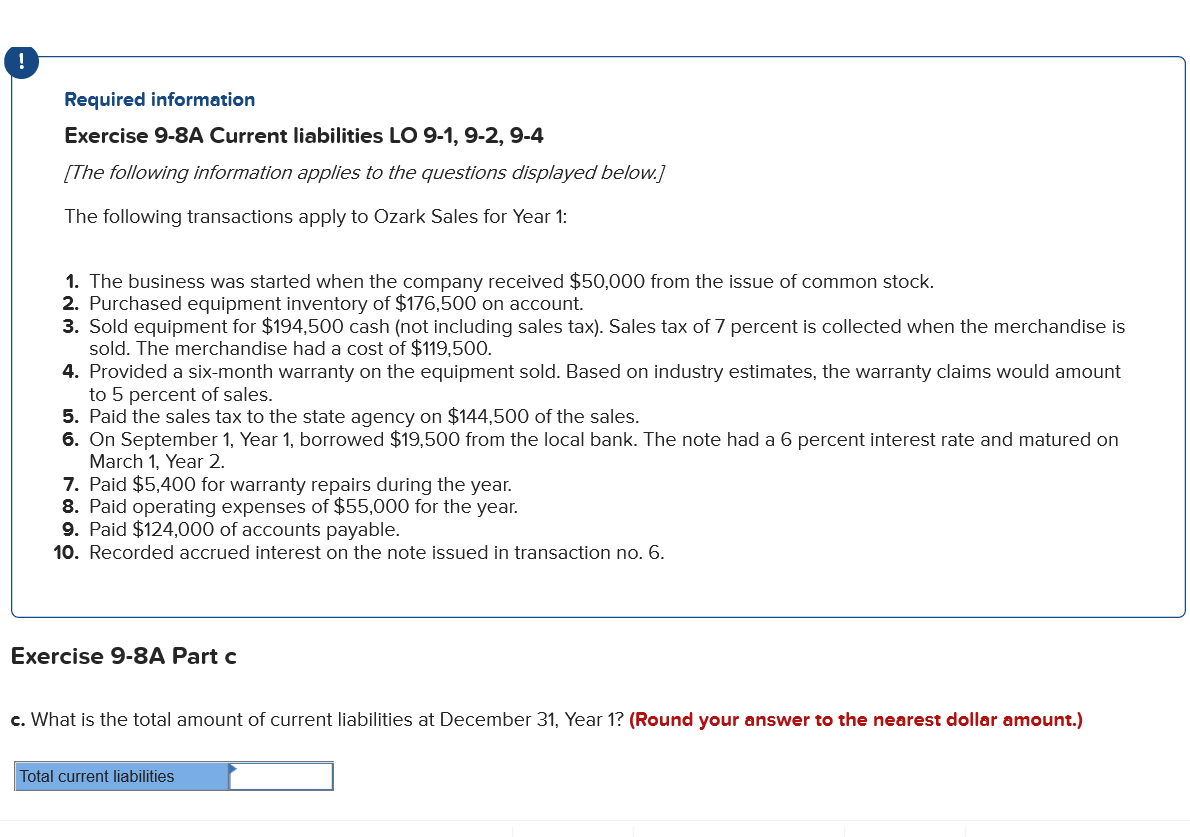

The following transactions apply to Ozark Sales for Year :

The business was started when the company received $ from the issue of common stock.

Purchased equipment inventory of $ on account.

Sold equipment for $ cash not including sales tax Sales tax of percent is collected when the merchandise is sold. The merchandise had a cost of $

Provided a sixmonth warranty on the equipment sold. Based on industry estimates, the warranty claims would amount to percent of sales.

Paid the sales tax to the state agency on $ of the sales.

On September Year borrowed $ from the local bank. The note had a percent interest rate and matured on March Year

Paid $ for warranty repairs during the year.

Paid operating expenses of $ for the year.

Paid $ of accounts payable.

Recorded accrued interest on the note issued in transaction no

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock