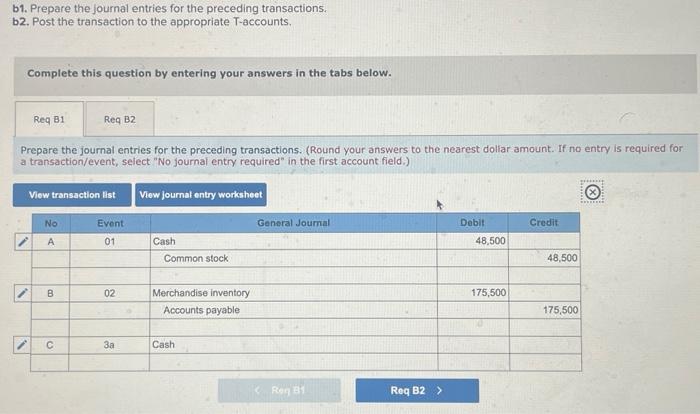

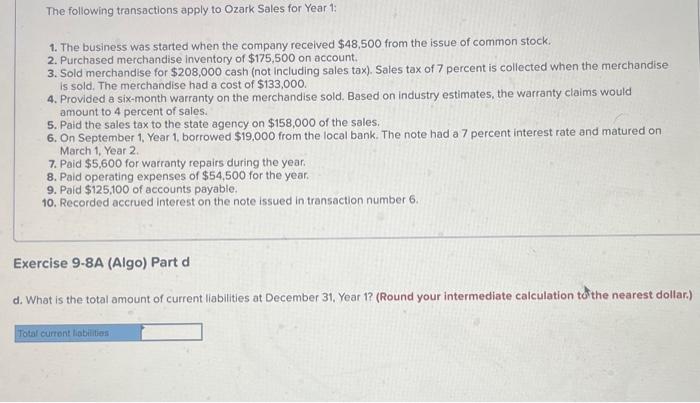

Question: Required information Exercise 9-8A (Algo) Current liabilities LO 9-1, 9-2, 9-4 [The following information applies to the questions displayed below.] The following transactions apply to

![[The following information applies to the questions displayed below.] The following transactions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1eb014ff95_36866f1eb00e27ef.jpg)

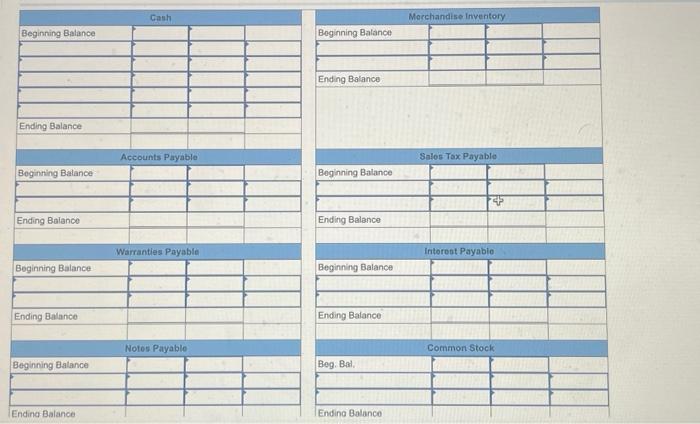

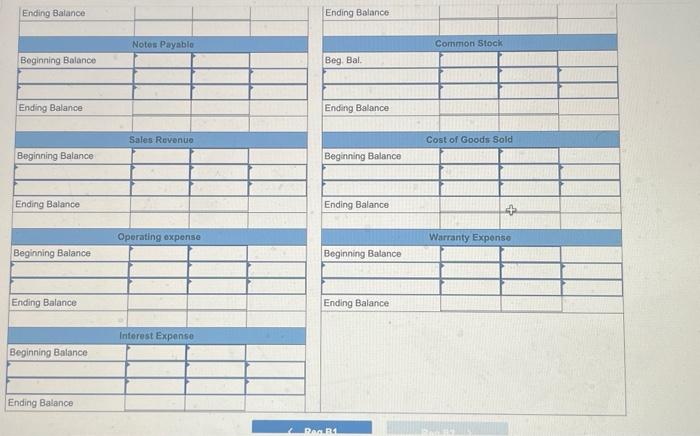

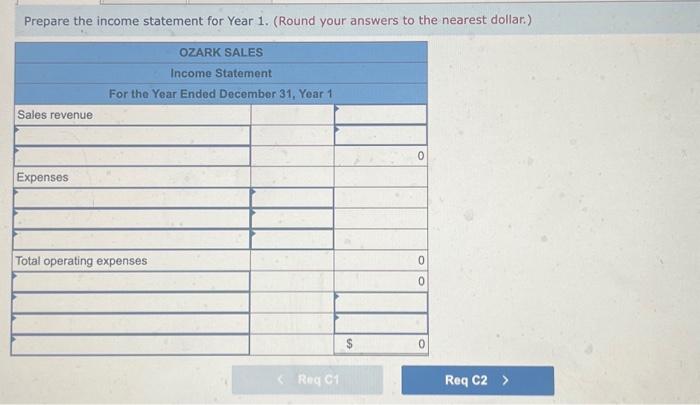

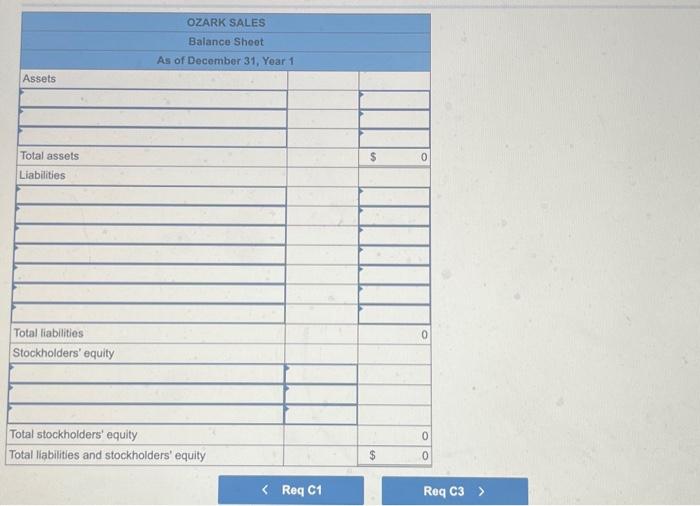

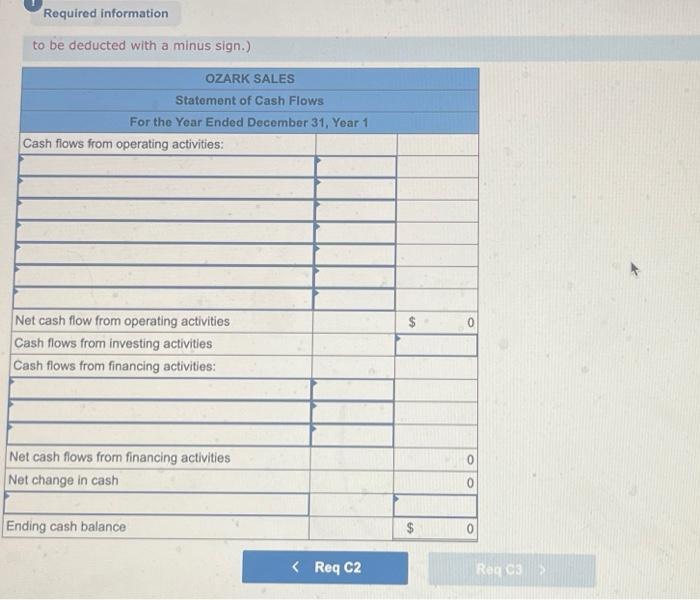

Required information Exercise 9-8A (Algo) Current liabilities LO 9-1, 9-2, 9-4 [The following information applies to the questions displayed below.] The following transactions apply to Ozark Sales for Year 1 : 1. The business was started when the company recelved $48,500 from the issue of common stock. 2. Purchased merchandise inventory of $175,500 on account. 3. Sold merchandise for $208,000 cash (not including sales tax). Sales tax of 7 percent is collected when the merchandise is sold. The merchandise had a cost of $133,000. 4. Provided a six-month warranty on the merchandise sold. Based on industry estimates, the warranty claims would amount to 4 percent of sales. 5. Paid the sales tax to the state agency on $158,000 of the sales. 6. On September 1, Year 1, borrowed $19,000 from the local bank. The note had a 7 percent interest rate and matured on March 1, Year 2. 7. Paid $5,600 for warranty repairs during the year. 8. Pald operating expenses of $54,500 for the year. 9. Paid $125,100 of accounts payable. 10. Recorded accrued interest on the note issued in transaction number 6 . blank).) b1. Prepare the journal entries for the preceding transactions. b2. Post the transaction to the appropriate T-accounts. Complete this question by entering your answers in the tabs below. Prepare the journal entries for the preceding transactions. (Round your answers to the nearest doliar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) \begin{tabular}{|l|l|l|l|} \hline Beginning Balance & Cash & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Boginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Salos Tox Payable } \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Prepare the income statement for Year 1. (Round your answers to the nearest dollar.) \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ OZARK SALES } & \\ \hline As of Decomber 31, Year 1 & & \\ \hline Assets & & \\ \hline & & \\ \hline & & \\ \hline Total assets & & \\ \hline Liabilities & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total liabilities & & \\ \hline Stockholders' equity & & \\ \hline & & \\ \hline \end{tabular} Req C1 Req C3 to be deducted with a minus sign.) The following transactions apply to Ozark Sales for Year 1: 1. The business was started when the company recelved $48,500 from the issue of common stock. 2. Purchased merchandise inventory of $175,500 on account. 3. Sold merchandise for $208,000 cash (not including sales tax). Sales tax of 7 percent is collected when the merchandise is sold. The merchandise had a cost of $133,000. 4. Provided a six-month warranty on the merchandise sold. Based on industry estimates, the warranty claims would amount to 4 percent of sales. 5. Paid the sales tax to the state agency on $158,000 of the sales. 6. On September 1, Year 1, borrowed $19,000 from the local bank. The note had a 7 percent interest rate and matured on March 1, Year 2. 7. Paid $5,600 for warranty repairs during the year. 8. Paid operating expenses of $54,500 for the year. 9. Paid $125,100 of accounts payable. 10. Recorded accrued interest on the note issued in transaction number 6. Exercise 9-8A (Algo) Part d d. What is the total amount of current liabilities at December 31, Year 1? (Round your intermediate calculation tothe nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

To solve this we need to first prepare the journal entries for Ozark Sales transactions and then ide... View full answer

Get step-by-step solutions from verified subject matter experts