Question: -. Required information Exercise 9-9B Record bonds issued at a premium and related semiannual interest (LO9-5) (The following information applies to the questions displayed below.]

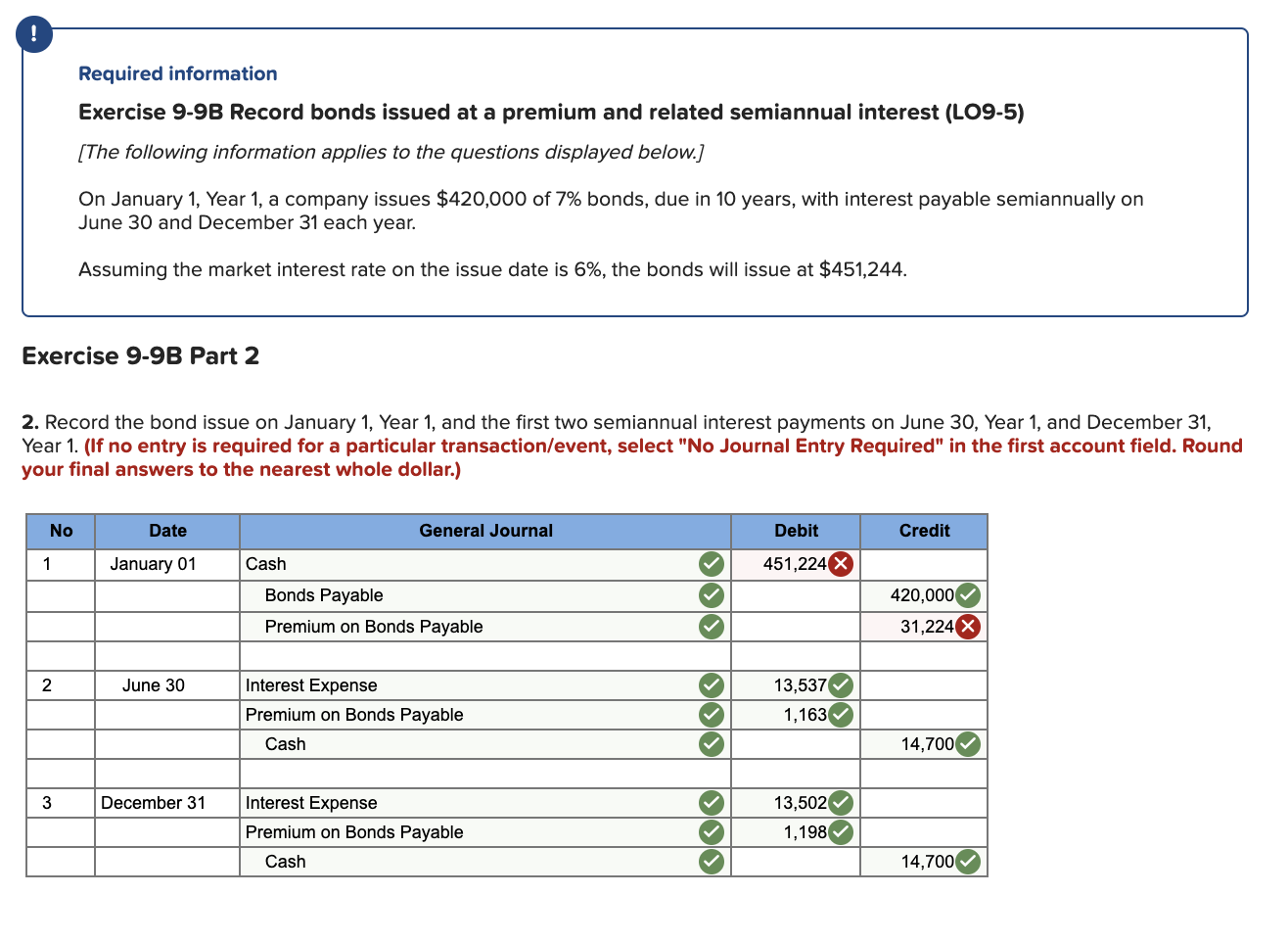

-. Required information Exercise 9-9B Record bonds issued at a premium and related semiannual interest (LO9-5) (The following information applies to the questions displayed below.] On January 1, Year 1, a company issues $420,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 6%, the bonds will issue at $451,244. Exercise 9-9B Part 2 2. Record the bond issue on January 1, Year 1, and the first two semiannual interest payments on June 30, Year 1, and December 31, Year 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar.) No Date General Journal Debit Credit 1 January 01 Cash 451,224 X Bonds Payable Premium on Bonds Payable 420,000 31,224 X 2 June 30 Interest Expense Premium on Bonds Payable Cash OOO OOO 13,537 1,163 14,700 3 December 31 13,502 Interest Expense Premium on Bonds Payable Cash 1,198 14,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts