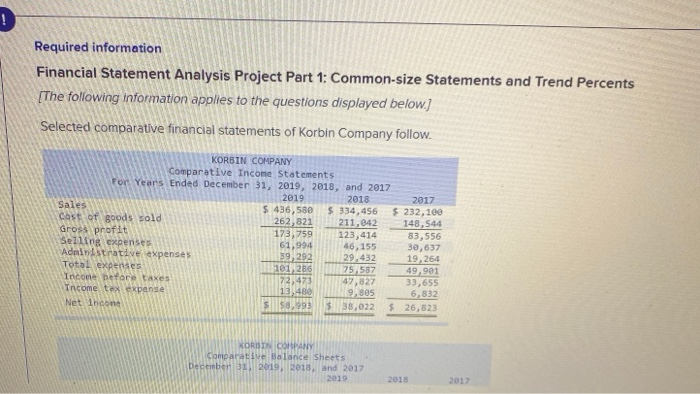

Question: Required information Financial Statement Analysis Project Part 1: Common-size Statements and Trend Percents [The following information applies to the questions displayed below.) Selected comparative financial

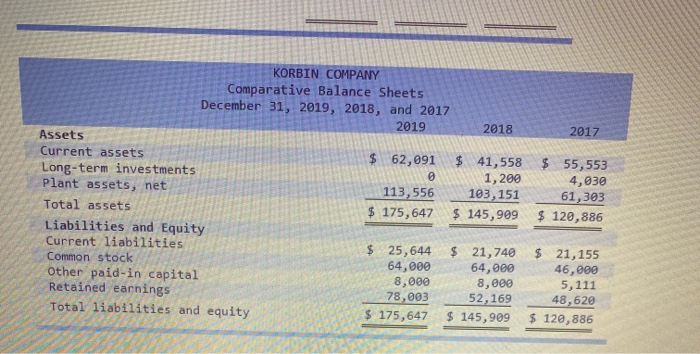

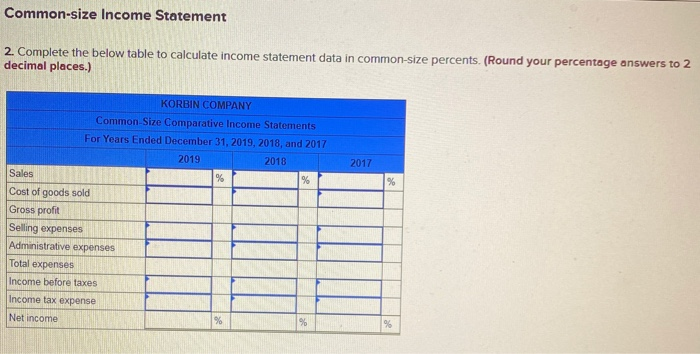

Required information Financial Statement Analysis Project Part 1: Common-size Statements and Trend Percents [The following information applies to the questions displayed below.) Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales $ 436,580 $ 334,456 $ 232,100 Cost of goods sold 262,821 211,042 148,544 Gross profit 173,759 123,414 83,556 Selling expenses 61,994 46, 155 30,637 Administrative expenses 39,292 29,432 19, 264 Total expenses 101,286 75,587 49,901 Incone before taxes 72,473 47,827 33,655 Income tax expense 13,480 9,805 6,832 Net Income S58,993 $ 38,022 $ 26,823 KORISTN COMPANY Comparative Balance Sheets December 31, 2019, 2013, and 2017 2019 2018 2017 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 2017 Assets Current assets $ 62,091 $ 41,558 $ 55,553 Long-term investments 1,200 4,030 Plant assets, net 113,556 103, 151 61,303 Total assets $ 175,647 $ 145,999 $ 120,886 Liabilities and Equity Current liabilities $ 25,644 $ 21,740 $ 21,155 Common stock 64,000 64,000 46,000 Other paid-in capital 8,000 8,000 5,111 Retained earnings 78,003 52,169 48,620 Total liabilities and equity $ 175,647 $ 145,909 $ 120,886 Common-size Income Statement 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2017 % KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 Sales % % Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts