Question: Required information In this mini - case you will perform some procedures required as a part of audit planning. For ease your audit manager has

Required information

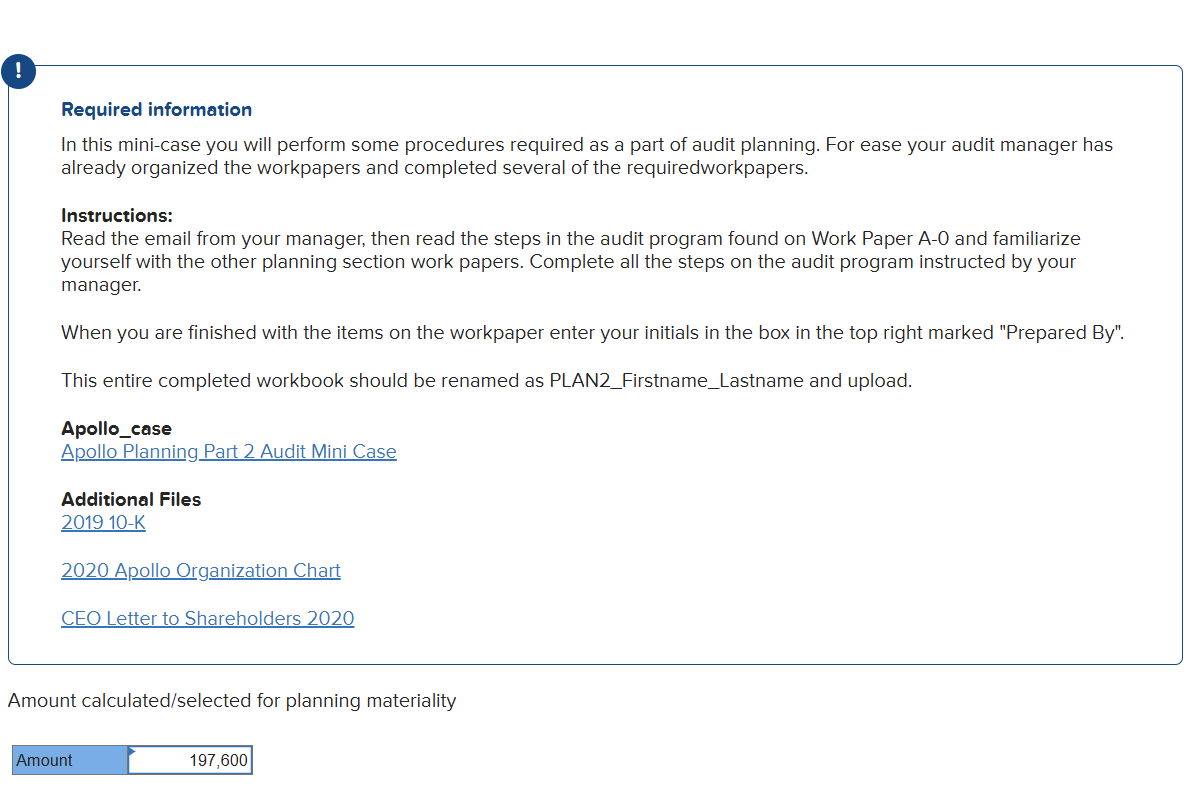

In this minicase you will perform some procedures required as a part of audit planning. For ease your audit manager has already organized the workpapers and completed several of the requiredworkpapers.

Instructions:

Read the email from your manager, then read the steps in the audit program found on Work Paper A and familiarize yourself with the other planning section work papers. Complete all the steps on the audit program instructed by your manager.

When you are finished with the items on the workpaper enter your initials in the box in the top right marked "Prepared By

This entire completed workbook should be renamed as PLANFirstnameLastname and upload.

Apollocase

Apollo Planning Part Audit Mini Case

Additional Files

K

Apollo Organization Chart

CEO Letter to Shareholders

What is the Amount calculatedselected for planning materiality?

Plus minus unusual, nonrecurring revenues and

expenses, and extraordinary items.

TOTAL ASSETS

Current Year

TOTAL REVENUES

Plus minus unusual, nonrecurring revenues

Plus minus unusual, nonrecurring revenues and

expenses, and extraordinary items.

TOTAL ASSETS

Current Year

TOTAL REVENUES

Plus minus unusual, nonrecurring revenues

This completed form must be provided to the engagement quality control reviewer in the planning stage of every

audit. Please complete all the cells highlighted in yellow.

PLANNING MATERIALITY CALCULATION

Only if the current year net income lossor other measure is significantly different from the entity's

historical results would year averaging to obtain normalized net income lossor other measure be

appropriate.

Plus minus unusual, nonrecurring revenues and

expenses, and extraordinary items.

TOTAL ASSETS

Current Year

TOTAL REVENUES

Plus minus unusual, nonrecurring revenues

JUSTIFICATION OF PLANNING MATERIALITY

Financial data source ie actual, budget,

projection:

Basis ie normalized net income, revenue,

total assets, other:

Adjusted net income

USE THIS BOX TO DOCUMENT AND JUSTIFY WHICH BASIS YOU'VE

SELECTED

Percentage of financial data source used:

Standard used.

Amount selected planning materiality

My calculations are not correct, can I get help completing the yellow areas?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock