Question: Required information Journal entry worksheet 1 2 3 4 5 6 7 8 9 The company purchased supplies for $ 4 5 7 cash. Note:

Required information Journal entry worksheet

The company purchased supplies for $ cash.

Note: Enter debits before credits.

Journal entry worksheet

The company purchased $ of equipment on credit.

Note: Enter debits before credits. Journal entry worksheet

The company received $ cash for services provided to a customer.

Note: Enter debits before credits.

The company paid $ cash to settle the payable for the equipment

purchased in transaction c

ote: Enter debits before credits. The company billed a customer $ for services provided.

Note: Enter debits before credits.

The company paid $ cash for the monthly rent.

Note: Enter debits before credits.The company collected $ cash as partial payment for the account

receivable created in transaction f

Note: Enter debits before credits.

The company paid a $ cash dividend to the owner sole shareholder

Note: Enter debits before credits.

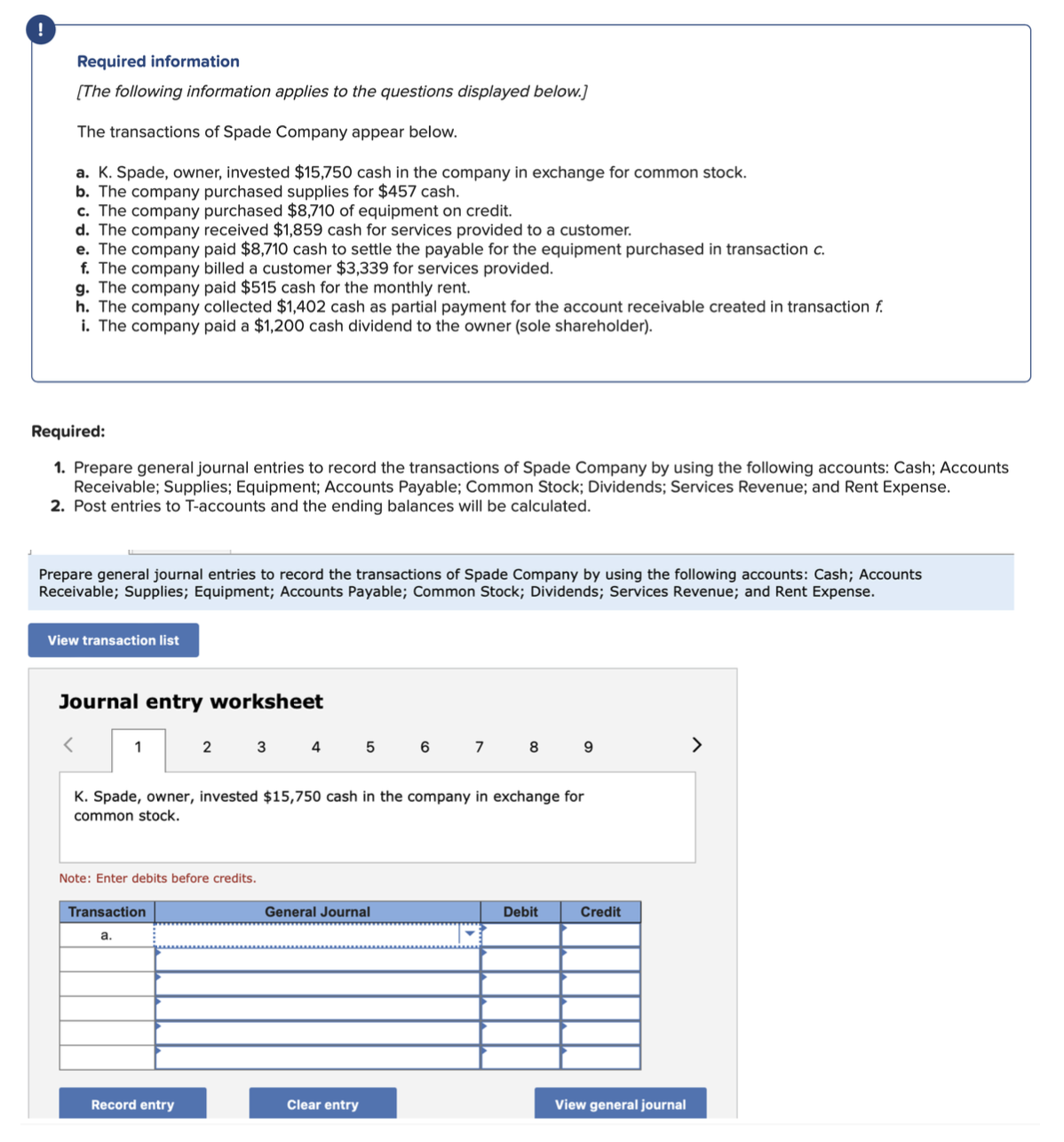

The following information applies to the questions displayed below.

The transactions of Spade Company appear below.

a K Spade, owner, invested $ cash in the company in exchange for common stock.

b The company purchased supplies for $ cash.

c The company purchased $ of equipment on credit.

d The company received $ cash for services provided to a customer.

e The company paid $ cash to settle the payable for the equipment purchased in transaction

f The company billed a customer $ for services provided.

g The company paid $ cash for the monthly rent.

h The company collected $ cash as partial payment for the account receivable created in transaction

i The company paid a $ cash dividend to the owner sole shareholder

Required:

Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Accounts

Receivable; Supplies; Equipment; Accounts Payable; Common Stock; Dividends; Services Revenue; and Rent Expense.

Post entries to T accounts and the ending balances will be calculated.

Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Accounts

Receivable; Supplies; Equipment; Accounts Payable; Common Stock; Dividends; Services Revenue; and Rent Expense.

Journal entry worksheet

K Spade, owner, invested $ cash in the company in exchange for

common stock.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock