Question: Required information Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 1 9

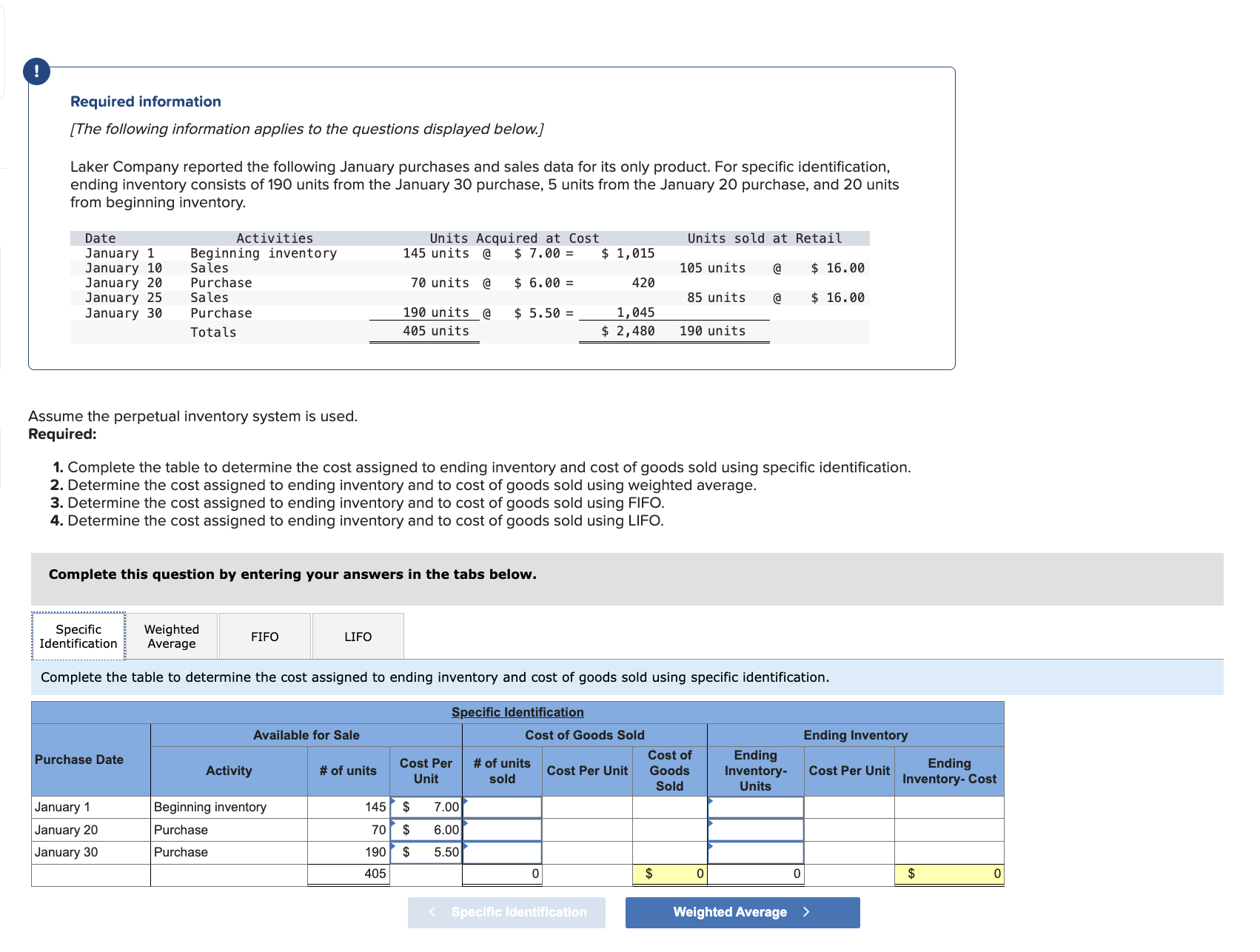

Required information Laker Company reported the following January purchases and sales data for its only product. For specific identification,

ending inventory consists of units from the January purchase, units from the January purchase, and units

from beginning inventory.

Assume the perpetual inventory system is used.

Required:

Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification.

Determine the cost assigned to ending inventory and to cost of goods sold using weighted average.

Determine the cost assigned to ending inventory and to cost of goods sold using FIFO.

Determine the cost assigned to ending inventory and to cost of goods sold using LIFO.

Complete this question by entering your answers in the tabs below.

Specific

Weighted

Average

FIFO

LIFO

Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. Required information

The following information applies to the questions displayed below.

Laker Company reported the following January purchases and sales data for its only product. For specific identification,

ending inventory consists of units from the January purchase, units from the January purchase, and units

from beginning inventory.

Assume the perpetual inventory system is used.

Required:

Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification.

Determine the cost assigned to ending inventory and to cost of goods sold using weighted average.

Determine the cost assigned to ending inventory and to cost of goods sold using FIFO.

Determine the cost assigned to ending inventory and to cost of goods sold using LIFO.

Complete this question by entering your answers in the tabs below.

Specific

Identification

Weighted

Average

FIFO

LIFO

Determine the cost assigned to ending inventory and to cost of goods sold using LIFO.

The following information applies to the questions displayed below.

Laker Company reported the following January purchases and sales data for its only product. For specific identification,

ending inventory consists of units from the January purchase, units from the January purchase, and units

from beginning inventory.

Assume the perpetual inventory system is used.

Required:

Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification.

Determine the cost assigned to ending inventory and to cost of goods sold using weighted average.

Determine the cost assigned to ending inventory and to cost of goods sold using FIFO.

Determine the cost assigned to ending inventory and to cost of goods sold using LIFO.

Complete this question by entering your answers in the tabs below.

Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock