Question: Required information Matthew (48 at year-end) develops cutting-edge technology for SV Inc., located in Silicon Valley. In 2019, Matthew participates in SV's money purchase pension

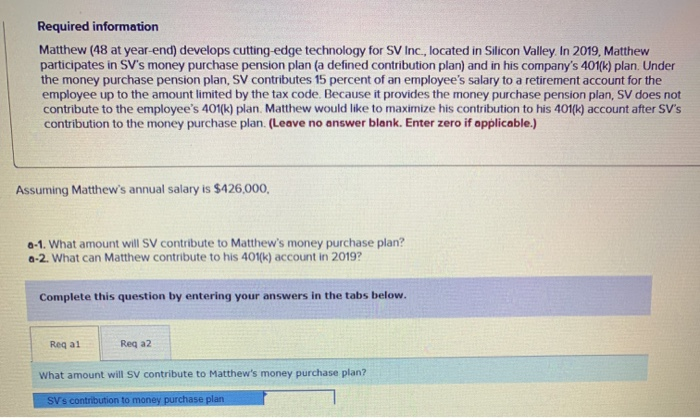

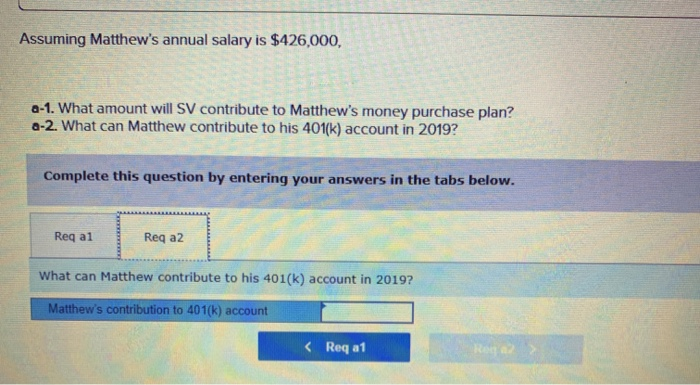

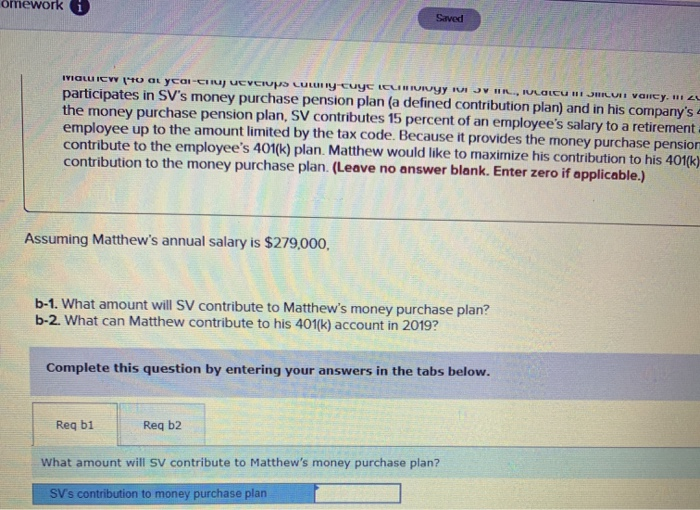

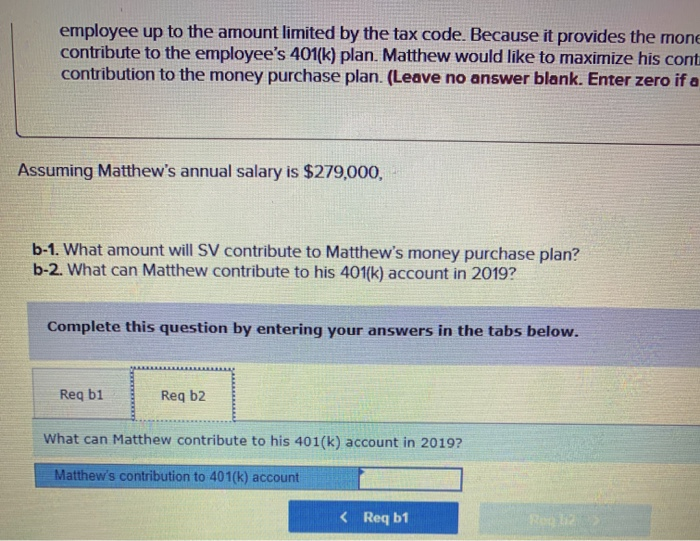

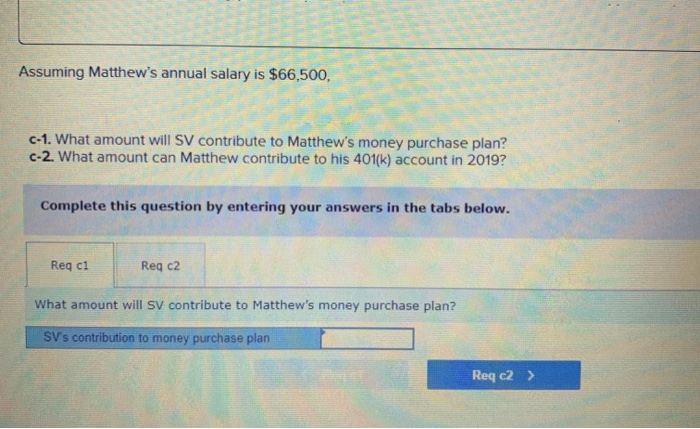

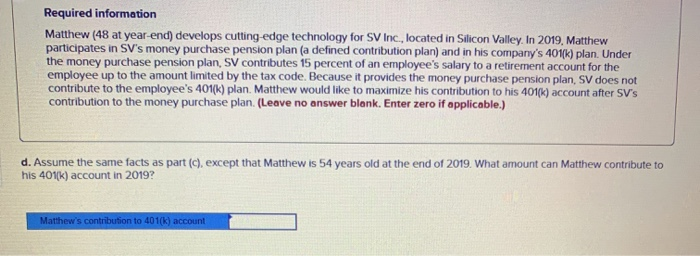

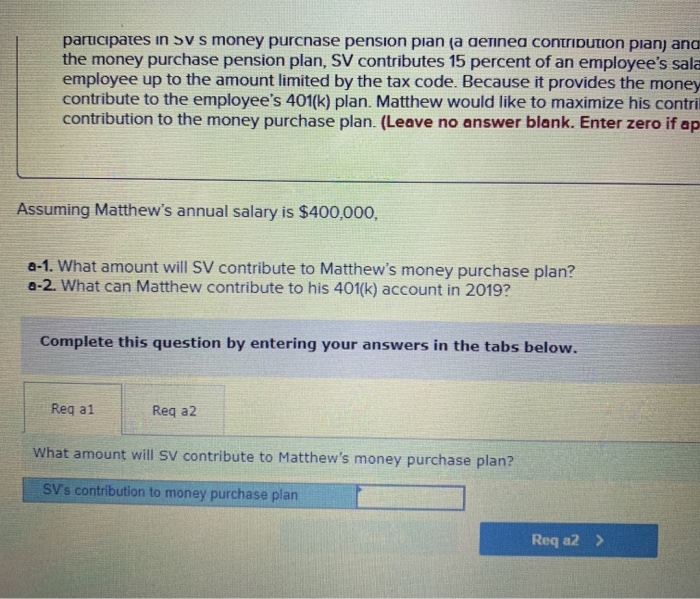

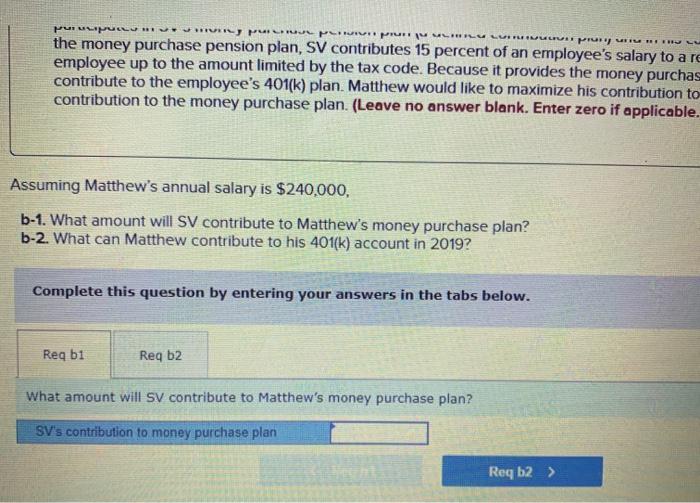

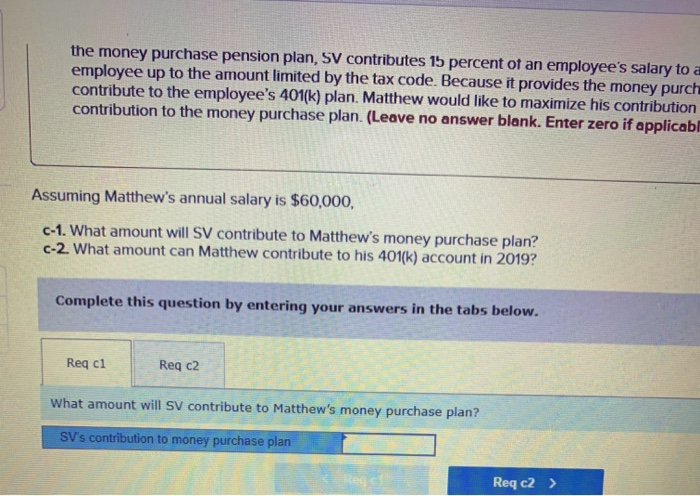

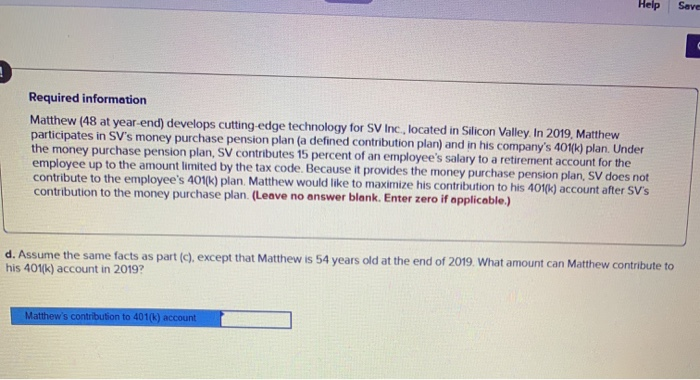

Required information Matthew (48 at year-end) develops cutting-edge technology for SV Inc., located in Silicon Valley. In 2019, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. (Leave no answer blank. Enter zero if applicable.) Assuming Matthew's annual salary is $426,000, 0-1. What amount will SV contribute to Matthew's money purchase plan? a-2. What can Matthew contribute to his 401(k) account in 2019? Complete this question by entering your answers in the tabs below. Regal Reg a2 What amount will SV contribute to Matthew's money purchase plan? SV's contribution to money purchase plan Assuming Matthew's annual salary is $426,000, 0-1. What amount will SV contribute to Matthew's money purchase plan? a-2. What can Matthew contribute to his 401(k) account in 2019? Complete this question by entering your answers in the tabs below. Req ai Req al Reqa2 Req a2 What can Matthew contribute to his 401(k) account in 20197 Matthew's contribution to 401(k) account Required information Matthew (48 at year-end) develops cutting-edge technology for SV Inc., located in Silicon Valley. In 2019, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. (Leave no answer blank. Enter zero if applicable.) d. Assume the same facts as part (c), except that Matthew is 54 years old at the end of 2019. What amount can Matthew contribute to his 401(k) account in 2019? Matthew's contribution to 401(k) account partcipates in Sy s money purcnase pension pian (a detinea contribution plans and the money purchase pension plan, SV contributes 15 percent of an employee's sala employee up to the amount limited by the tax code. Because it provides the money contribute to the employee's 401(k) plan. Matthew would like to maximize his contri contribution to the money purchase plan. (Leave no answer blank. Enter zero if ap Assuming Matthew's annual salary is $400,000, a-1. What amount will SV contribute to Matthew's money purchase plan? a-2. What can Matthew contribute to his 401(k) account in 2019? Complete this question by entering your answers in the tabs below. Req a1 Reg az What amount will SV contribute to Matthew's money purchase plan? SV's contribution to money purchase plan Req a2 > PUMUPUULUH PLUULUU UUUUUU the money purchase pension plan, SV contributes 15 percent of an employee's salary to ar employee up to the amount limited by the tax code. Because it provides the money purchas contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to contribution to the money purchase plan. (Leave no answer blank. Enter zero if applicable. Assuming Matthew's annual salary is $240.000, b-1. What amount will SV contribute to Matthew's money purchase plan? b-2. What can Matthew contribute to his 401(k) account in 2019? Complete this question by entering your answers in the tabs below. Req bi Req b2 What amount will SV contribute to Matthew's money purchase plan? SV's contribution to money purchase plan Req b2 > the money purchase pension plan, SV contributes 15 percent of an employee's salary to a employee up to the amount limited by the tax code. Because it provides the money purch contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution contribution to the money purchase plan. (Leave no answer blank. Enter zero if applicabl Assuming Matthew's annual salary is $60,000, c-1. What amount will SV contribute to Matthew's money purchase plan? c-2. What amount can Matthew contribute to his 401(k) account in 2019? Complete this question by entering your answers in the tabs below. Req ci Req c2 What amount will SV contribute to Matthew's money purchase plan? SV's contribution to money purchase plan Req c2 > Reqc2 , Required information Matthew (48 at year-end) develops cutting edge technology for SV Inc., located in Silicon Valley. In 2019, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. (Leave no answer blank. Enter zero if applicable) d. Assume the same facts as part (c), except that Matthew is 54 years old at the end of 2019. What amount can Matthew contribute to his 401(k) account in 2019? Matthew's contribution to 401(k) account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts